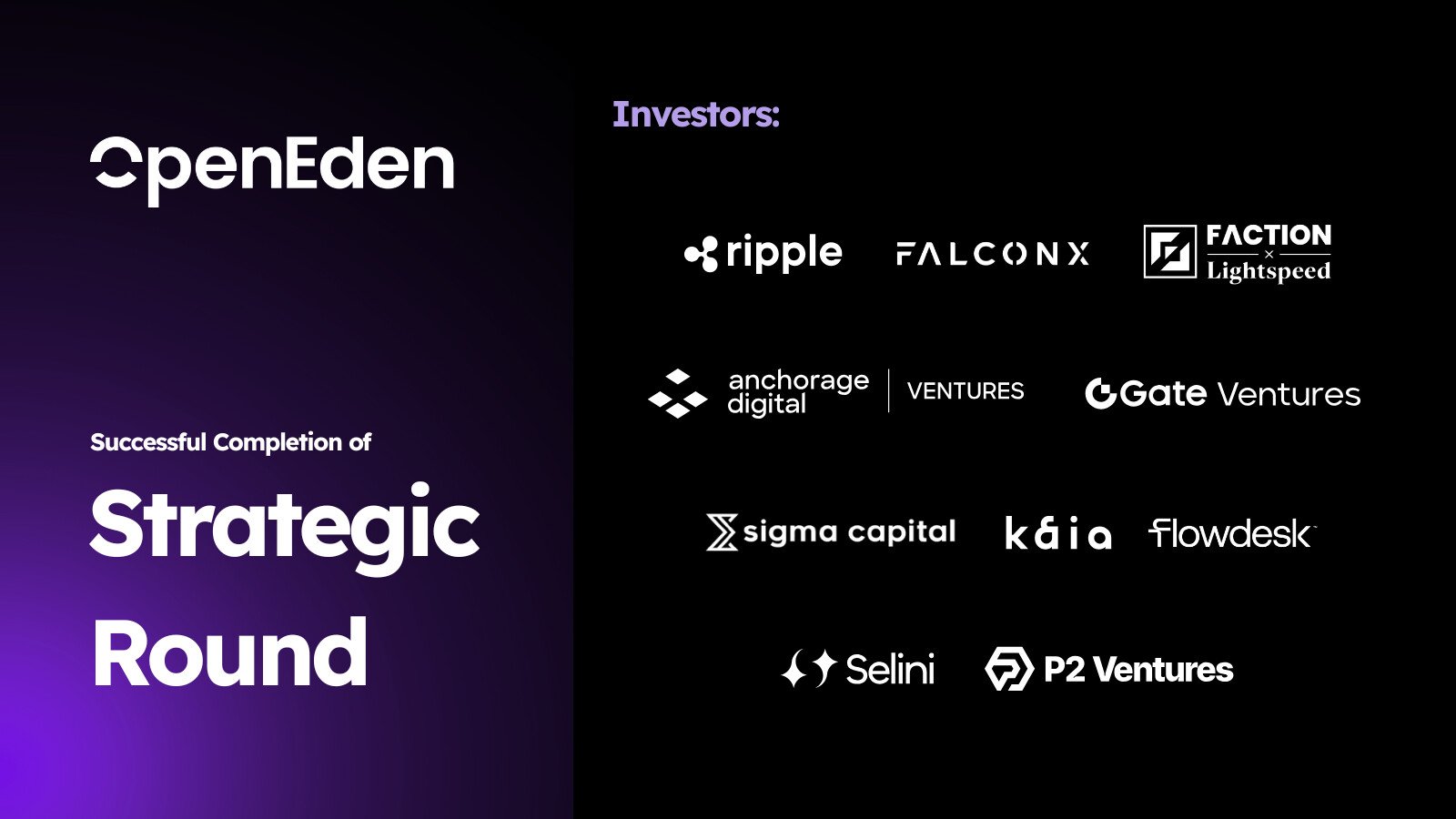

OpenEden, a regulated real-world asset (RWA) tokenization platform, has closed a strategic investment round backed by Ripple, Lightspeed Faction, Gate Ventures, FalconX, Anchorage Digital Ventures, Flowdesk, P2 Ventures, Selini Capital, Kaia Foundation, and Sigma Capital. This global consortium of institutional and crypto-native investors reflects growing conviction in regulated tokenization as the next major phase of digital asset adoption.

The round follows OpenEden’s earlier fundraising with Yzi Labs in 2024 and will support the company’s expansion of its end-to-end tokenization-as-a-service infrastructure, enabling institutions, fintechs, and protocols to issue and manage regulated tokenized financial products.

Institutional Backing for a Growing RWA Leader

OpenEden’s strategic round secured investors spanning blockchain networks, trading firms, venture funds, and institutional infrastructure providers across North America, Europe, and Asia. The diversity of backers highlights OpenEden’s position as one of the most credible players in regulated RWA tokenization.

“The growth of OpenEden mirrors the broader transformation we’re seeing in the RWA sector,” said Jeremy Ng, Founder and CEO of OpenEden. “As tokenization scales in adoption, institutions and protocols are seeking trusted, compliant infrastructure to bring traditional assets on-chain. This funding round boosts our capacity to provide regulated, market-ready products that fit both traditional and decentralized finance standards.”

A Breakout Year for Tokenized Treasuries and Stablecoins

Real-world assets have been one of the fastest-growing segments in crypto. In 2025, both tokenized RWAs and tokenized Treasuries doubled in market size, fueled by institutions seeking greater on-chain exposure.

OpenEden has been a central contributor to this growth. Its flagship TBILL Fund — one of the earliest tokenized U.S. Treasuries products — has seen its peak AUM grow more than tenfold in under two years. The fund also received an investment-grade ‘AA+f/S1+’ rating from S&P Global, adding to its existing ‘A’ rating from Moody’s.

The fund’s institutional profile was further strengthened after The Bank of New York (BNY) was appointed custodian and investment manager for its underlying Treasury assets.

This institutional-grade foundation has directly supported the adoption of USDO, OpenEden’s regulated, yield-bearing stablecoin fully backed by tokenized Treasuries. USDO is now integrated across major DEXs, lending markets, yield protocols, and payment gateways.

Meanwhile, cUSDO, USDO’s wrapped variant, became the first yield-bearing digital asset approved as off-exchange collateral on Binance, enabling institutional users to earn yield through off-exchange custody, while retaining full trading access on the exchange.

Fueling the Next Phase of Tokenized Finance

With its new strategic round, OpenEden plans to accelerate the rollout of several new institutional-grade tokenized products. These include:

- A tokenized Short-Duration Global High-Yield Bond Fund, developed with a leading global asset manager

- A multi-strategy yield token

- Tokenized structured products, replicating traditional payoff profiles on-chain

Additionally, OpenEden will expand USDO’s integration into both consumer and institutional payment networks, and build a multi-currency stablecoin framework, as well as a cross-border stablecoin settlement network.

These initiatives tie into OpenEden’s mission to deliver a regulated and composable infrastructure layer for the global tokenization market, enabling any institution, fintech, or developer to launch, integrate, and distribute tokenized products with regulatory safeguards.

Industry Leaders Weigh In

OpenEden’s focus on compliance and institutional trust has resonated strongly with investors.

Markus Infanger, SVP of RippleX, said, “As regulated financial assets move onchain, institutional investors are looking for products that offer compliance, reliability, and the same controls they expect in traditional markets. OpenEden has shown a disciplined approach to how they operate, and we are pleased to support their growth as assets like tokenized T-bills emerge as practical ways for institutions to begin engaging with onchain markets.”

Nathan McCauley, Co-Founder and CEO of Anchorage Digital, said, “RWAs are gaining strong institutional interest, and OpenEden is building the kind of platform the market needs right now—expanding access to tokenized financial products with a focus on trust and security. We’re excited to support projects like OpenEden that are driving the onchain ecosystem forward and creating pathways for more institutions to participate.”

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.