The U.S.–China trade alignment and the Federal Reserve’s recent rate cut have eased macroeconomic pressures, creating favorable conditions for risk assets. Yet, Bitcoin’s next move will depend on whether it can confirm a breakout above the 100-day MA or hold the 200-day MA as structural support.

Until one side of this equilibrium breaks, the market remains in accumulation and consolidation mode, with volatility compression likely preceding the next major impulse move.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, Bitcoin has been oscillating between the 100-day MA near $114K and the 200-day MA around $109K, creating a well-defined equilibrium zone. The repeated rebounds from the 200-day MA signal that the $108K–$109K area continues to attract institutional demand, while the $114K–$116K range serves as a strong distribution zone.

This structure highlights the market’s current state of balance between buyers and sellers. The ongoing stabilization phase could represent an accumulation pattern, as shown by the clustered price action between the two key moving averages.

A confirmed daily close above the 100-day MA would likely trigger a breakout toward $120K–$122K, while a breakdown below $108K could expose the $102K–$104K institutional demand zone once again.

Improving macro sentiment from the FOMC’s dovish policy pivot and the U.S.–China cooperation framework could support a bullish continuation if on-chain and volume metrics confirm accumulation.

The 4-Hour Chart

The 4-hour timeframe reinforces the range-bound nature of Bitcoin’s recent behavior. The price has repeatedly reacted from the $108K–$109K support zone, forming higher lows and attempting to reclaim short-term structure. However, the $115K–$116K resistance band remains a ceiling that has capped multiple upward attempts.

This setup outlines a symmetrical consolidation within an ascending structure, suggesting that volatility is tightening before a potential breakout.

A bullish breakout above $116K could mark a structural shift toward $120K–$122K, while a failure to hold the $108K area would confirm a deeper retest toward the $102K liquidity pocket.

Until either side of the range is breached, the market is expected to oscillate between these levels, with low volatility preceding the next expansion.

On-Chain Analysis

By Shayan

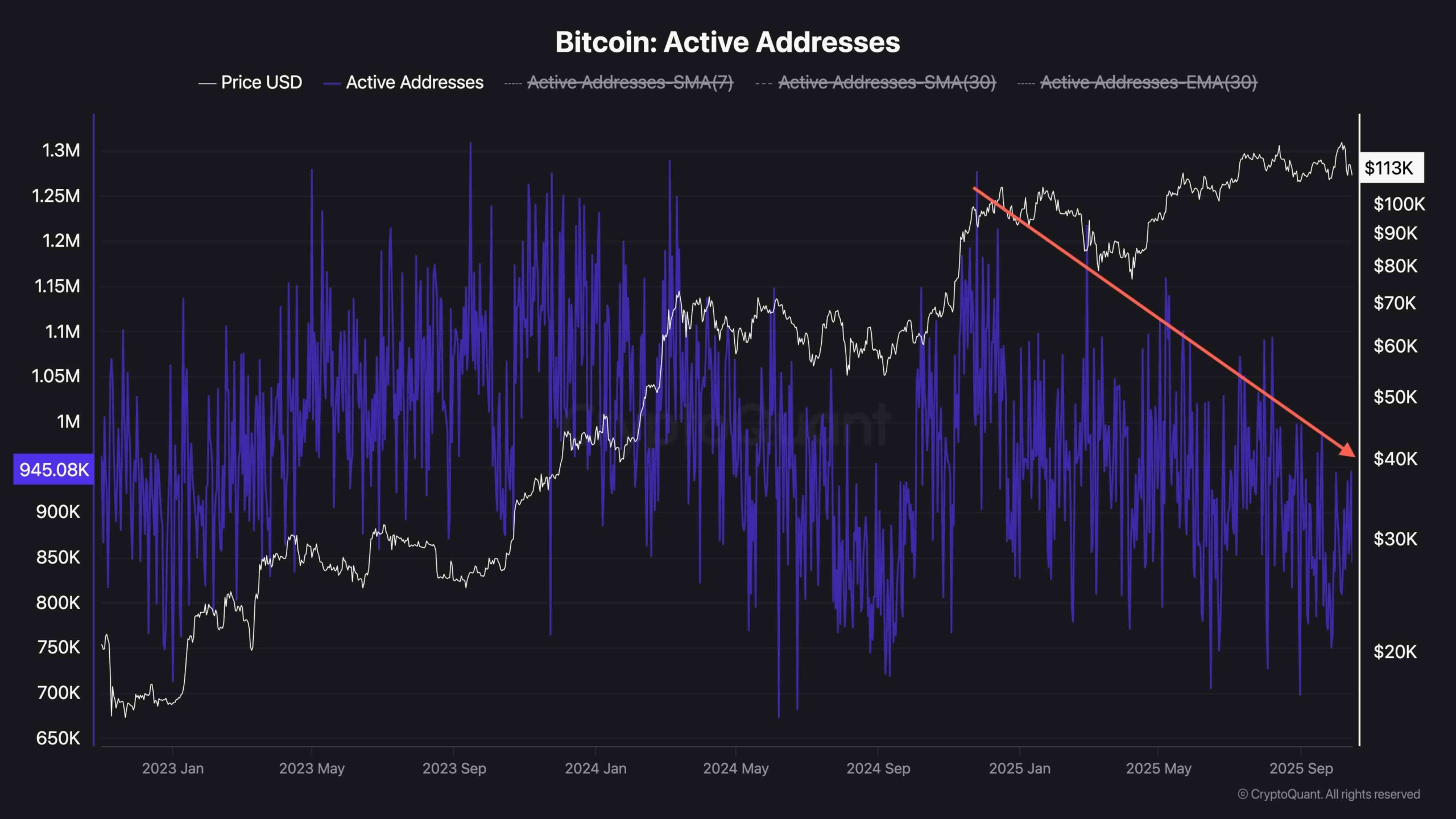

Bitcoin Active Addresses offers an important signal about market participation and network health. Over recent months, the number of active addresses has gradually declined, even as Bitcoin’s price maintained its position near record highs. Historically, such a decline in on-chain activity often reflects market fatigue or short-term distribution, particularly following extended rallies.

However, the current level of activity, while subdued, remains above the 2024 accumulation baseline, implying that the market is not experiencing full capitulation.

Periods of reduced address activity near key support levels have often preceded large-scale accumulation and trend reversals, as seen in late 2023 and mid-2024.

If active address growth stabilizes while price holds the $108K–$110K support range, it would strengthen the case for an accumulation-driven bottom formation, aligning with the macro environment of increased global liquidity and improving investor sentiment after the Fed’s rate cut.

The post Bitcoin Price Analysis: BTC’s Next Move Will Depend on This Key Level appeared first on CryptoPotato.

The U.S.–China trade alignment and the Federal Reserve’s recent rate cut have eased macroeconomic pressures, creating favorable conditions for risk assets. Yet, Bitcoin’s next move will depend on whether it can confirm a breakout above the 100-day MA or hold the 200-day MA as structural support. Until one side of this equilibrium breaks, the market BTC Analysis, BTCEUR, BTCGBP, BTCUSD, BTCUSDT, Crypto News, Bitcoin (BTC) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.