TLDR

- Bitcoin fell 8% on Monday from $91,000 to $84,000 as concerns about potential Japan interest rate hikes triggered market selloff

- MicroStrategy announced $1.44 billion cash reserve while stock dropped to 52-week low, now holds 650,000 bitcoins after adding 130 last week

- Coinbase down 20%, Circle down 38%, Robinhood down 16%, and MicroStrategy down 40% over past 30 days

- Bitcoin ETFs posted $3.5 billion in outflows during November, marking second-worst month on record

- Analysts say bitcoin would need to fall below $12,700 for MicroStrategy to face serious debt coverage issues

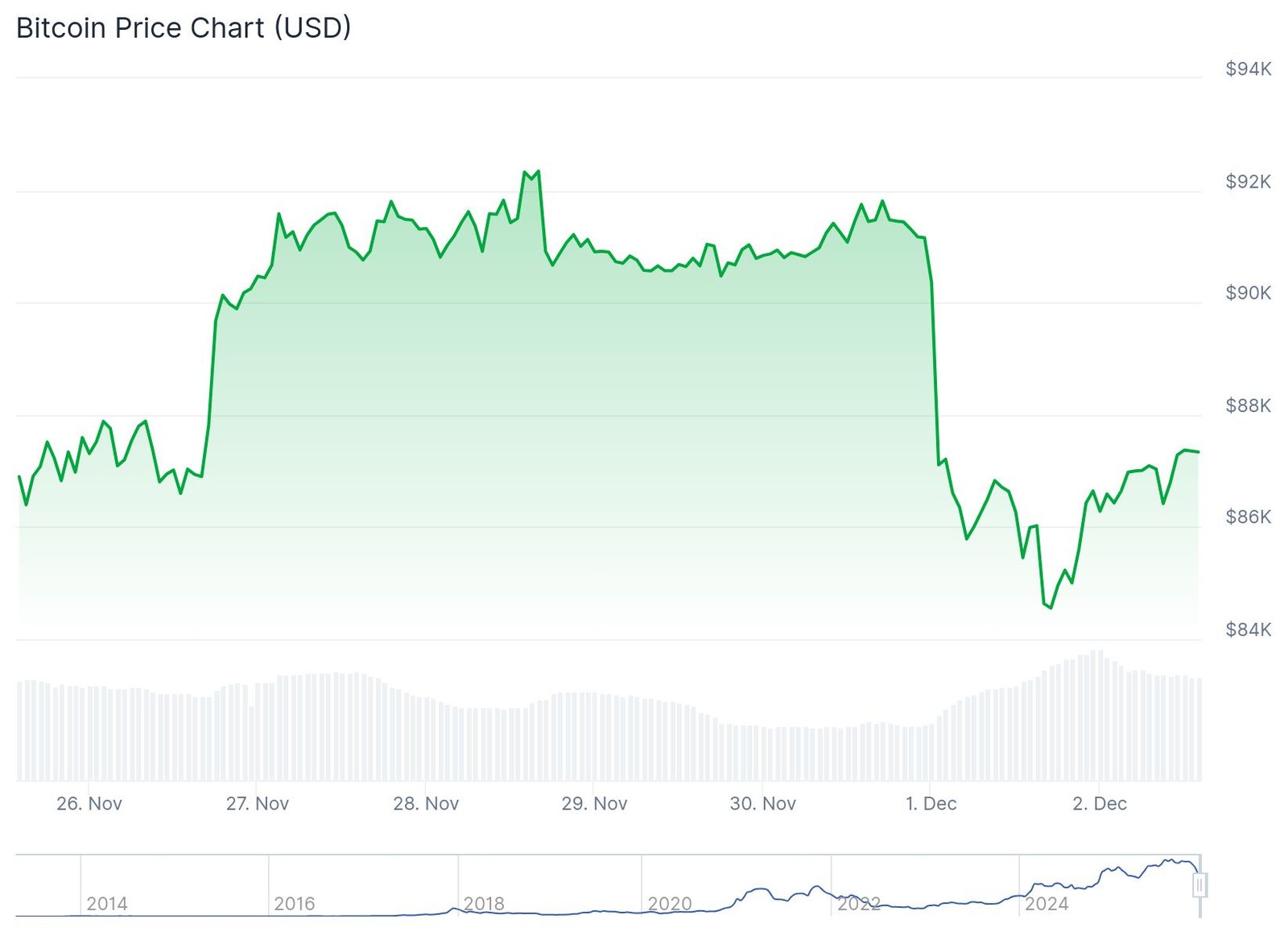

Bitcoin experienced its worst single-day decline since March on Monday, falling 8% from around $91,000 to as low as $84,000. The selloff came as investors worried about potential interest rate increases in Japan.

The drop mirrors a similar event in August 2024. At that time, bitcoin fell from over $66,000 to around $54,000 in just a few days, representing an 18% decline.

The concern centers on yen carry trades. Investors borrow Japanese yen at low interest rates to purchase assets like US stocks and bitcoin. If Japan raises rates, these investors might rush to reverse their trades.

Nic Puckrin from Coin Bureau noted that history appears to be repeating itself. He advised investors to prepare for volatility but said the macro backdrop remains favorable for risk assets.

The Federal Reserve is expected to cut interest rates in December. Futures markets show an 87.6% probability of a rate cut at the Fed’s December 10 meeting.

Bitcoin ETFs See Record Outflows

Bitcoin exchange-traded funds recorded their second-worst month in November. The funds experienced $3.5 billion in outflows during the period.

The cryptocurrency is now down more than 30% from its October all-time high above $126,000. As of Tuesday morning, bitcoin trades around $86,948.

A 10X Research note stated that a sustained rally appears unlikely before year-end. The firm suggested 2026 may present a different setup for crypto markets.

Bernstein analysts said they are still looking for clear signs that bitcoin has bottomed out. The price action indicates weak market sentiment according to analyst Gautam Chhugani.

Crypto Stocks Face Heavy Selling

MicroStrategy stock hit a 52-week low on Monday despite positive company announcements. The stock has declined roughly 40% over the past month.

MicroStrategy Incorporated, MSTR

The company established a $1.44 billion cash reserve through an equity offering. This reserve will support dividend payments on preferred stock and interest on outstanding debt.

MicroStrategy added 130 bitcoins last week, bringing total holdings to 650,000. The company is the largest public holder of bitcoin.

Concerns emerged that lower bitcoin prices could force MicroStrategy to sell holdings. Analysts from Bernstein and Benchmark called these concerns overstated.

Mark Palmer from Benchmark noted the company would only face coverage issues if bitcoin fell below $12,700. That would require an 86% decline from current levels.

Palmer stated that while 80%+ drawdowns have occurred in bitcoin’s history, multiple macro shocks would need to happen simultaneously. Institutional entities have replaced speculative retail investors as the main buyers.

MicroStrategy said yearly net income could range from a loss of $5.5 billion to a profit of $6.3 billion.

Other crypto stocks also suffered losses. Coinbase dropped roughly 20% over the past 30 days while Circle fell 38%. Robinhood declined 16% during the same period.

US stock futures slid early Tuesday morning as investors assessed the start of December trading. Contracts tied to major indexes ticked down 0.2% following a down session that snapped five-day winning streaks.

The post Daily Market Update: Bitcoin and Crypto Stocks Face Heavy Selling Pressure appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.