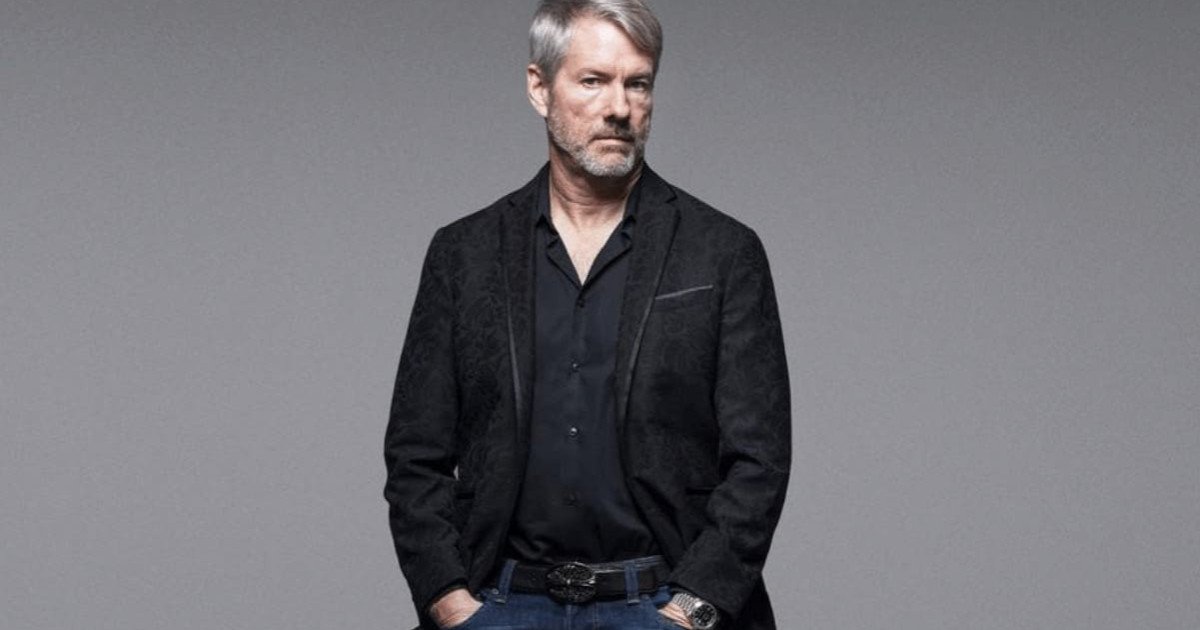

Michael Saylor simplifies complex concepts, and this topic is no exception. When people inquired whether it was important to know whether MicroStrategy had ever been listed on the S&P 500, he said, Not really.

Michael Saylor believes a single index won’t shape the long-term future of Bitcoin and digital assets, whether it accepts them or not.

Why Saylor Isn’t Worried About the S&P 500

In a November 23 CoinDesk interview, Michael Saylor said Bitcoin has already faced tougher challenges than index committees. At one point, credit rating agencies, accountants, and regulators were skeptical. Even the Basel rules once treated Bitcoin as having zero value. Yet today, that’s changing; these same institutions are starting to accept it.

Michael Saylor: in the long run, whether we join the S&P 500 doesn’t really matter

On November 23, MicroStrategy co-founder Michael Saylor said in a CoinDesk podcast interview that whether the S&P 500 includes them doesn’t matter in the long run. In discussing how Bitcoin and… pic.twitter.com/TYK6WZoEPJ

— Wu Blockchain (@WuBlockchain) December 1, 2025

Saylor explained that bankers didn’t want to handle Bitcoin. Accountants disliked how digital assets fit into their frameworks, and regulators weren’t sure how to classify them. Over time, all three groups adjusted. Eventually, he said, they “embraced the asset.” Now, even Basel regulators say they’ll reconsider their harsh treatment of Bitcoin. To him, the situation is proof that hesitation is normal and temporary.

The Free Market Decides, Not Index Committees

Michael Saylor stressed that decisions from index managers like MSCI or the S&P 500 are outside his control. He said they don’t change the long-term trajectory. He believes that if Bitcoin is “digital capital superior to gold,” then the free market will divide capital accordingly.

📢 Michael Saylor fires back at $JPMorgan’s warning over a potential MSTR exclusion from the MSCI index — calling it “a bit alarmist.”

In a fresh interview, @saylor downplays the $2.8B outflow projection tied to MSCI rules and says the fears are exaggerated.

⚡️ “MicroStrategy… pic.twitter.com/JN7n6t81PA

— COACHTY (@TheRealTRTalks) December 1, 2025

If banks, insurers, or index allocators avoid Bitcoin, Saylor sees it as short-term noise. In his words, it creates a bigger opportunity for other investors who do understand the value. The market adjusts, capital moves, and the trend continues.

Conclusion

According to Michael Saylor, long-term forces matter more than short-term decisions. Whether MicroStrategy joins the S&P 500 or not won’t decide Bitcoin’s future or theirs. As acceptance grows across institutions that once rejected it, he believes the market will reward what has real value. If Bitcoin is truly superior capital, no index committee can slow that down.

Disclaimer

The information provided by Altcoin Buzz is not financial advice. It is intended solely for educational, entertainment, and informational purposes. Any opinions or strategies shared are those of the writer/reviewers, and their risk tolerance may differ from yours. We are not liable for any losses you may incur from investments related to the information given. Bitcoin and other cryptocurrencies are high-risk assets; therefore, conduct thorough due diligence. Copyright Altcoin Buzz Pte Ltd.

The post Michael Saylor: S&P 500 Inclusion Doesn’t Matter Long-Term appeared first on Altcoin Buzz.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.