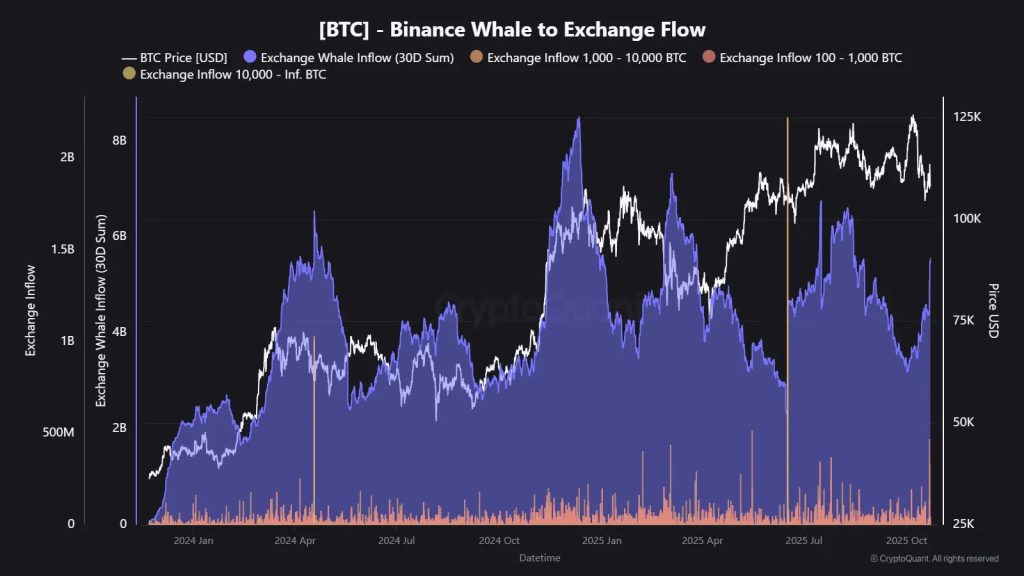

Binance received $5.56 billion in whale transactions exceeding 1,000 BTC over the past 30 days, with $1.07 billion arriving on October 21 alone as Bitcoin surged from $108,000 to $113,000 before retracing.

The massive inflows have raised questions about whether these participants are accumulating positions or depositing coins for liquidation.

At the same time, allegations emerged accusing Binance of coordinating with market maker Wintermute to manipulate crypto prices and cause $19 billion in retail liquidations during the October 10 crash.

October 21 saw concentrated bursts, including $336.95 million at 18:00, $323.43 million at 10:00, and $162.24 million at 08:00.

Bitcoin currently trades around $109,000 after reversing Monday’s pump from $114,000.

The timing coincides with $1.83 billion in Bitcoin movements from wallets linked to Chinese mining pool LuBian, marking the second major transfer in two weeks from the entity connected to the largest confirmed Bitcoin theft.

Exchanges Manipulation? Alleged

Crypto analyst MartyParty accused Binance of manipulating crypto prices through market maker Wintermute, claiming “this manipulation caused the $19b of retail liquidations October 10th yet no action taken.”

X user 941 theorized that the October 10-11 wipeout was “manufactured” through throttled withdrawals and captured spreads via fees and internal profit-and-loss accounting.

The analyst claimed exchanges could “force liquidations, slow withdrawals, book internal P&L, and harvest 8-12 bps on extreme turnover days.“

The geopolitical theory posits that if Washington makes domestic hash rate and mined BTC collateral for Treasuries, “the dollar becomes energy backed again, this time by computation rather than crude.”

This poses a threat to China’s BRICS commodity clearing model, which is based on gold and the digital yuan.

The analyst argued that China cannot easily stop American miners or ETF flows, but “can attack the price discovery layer” through offshore venues like Binance, Bybit, and Hyperliquid, which offer deep liquidity but lack U.S. regulatory oversight.

Accumulation Data Conflicts With Distribution Theories

Binance Bitcoin outflow data from CryptoQuant shows the 30-day moving average has been strongly negative, which means investors are offloading holdings from exchanges and accumulating.

However, the simultaneous $5.56 billion in whale inflows creates a contradiction.

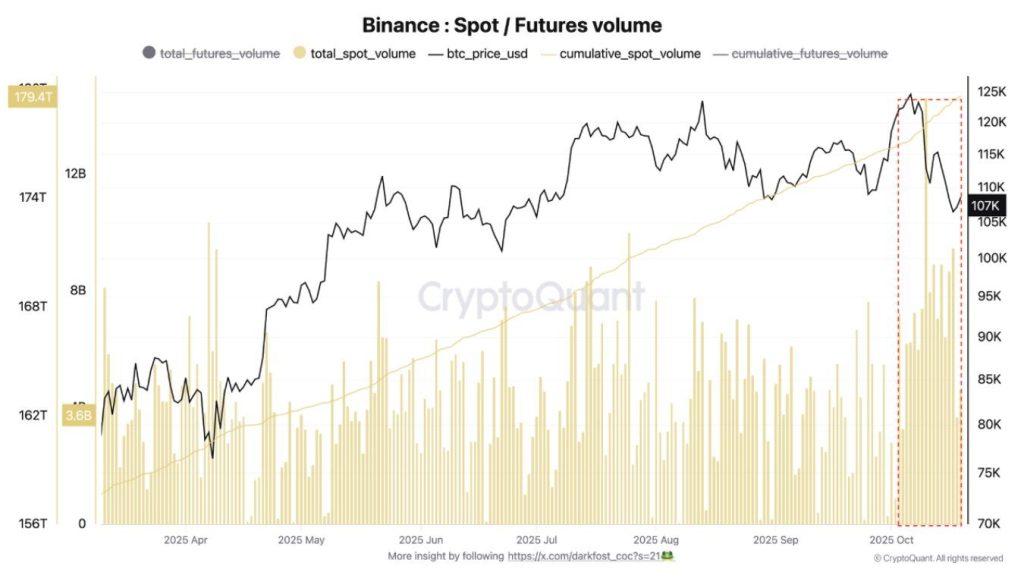

Daily BTC spot volumes on Binance ranged between $3 billion and $5 billion since January 2025, but surged to between $5 billion and $10 billion daily since October 10.

Bitcoin’s MVRV Ratio also slipped below its 365-day average. Previous drops below this threshold in mid-2021, June 2022, and early 2024 all marked local bottoms.

Speaking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, explained that gold’s $2.5 trillion market cap correction “is a recalibatory move after an overheated rally” representing “a natural cooling phase rather than a structural change in investor confidence.”

He noted “this cooling season does open a window for Bitcoin to reassert itself in the safe-haven asset conversation” as “investors who are taking risk off the table in one asset are likely to seek asymmetric upside in another.“

Ehsani stated that “should the U.S CPI print come out soft and trade talks yield a détente, investors may pivot from pure protection to growth participation.”

He projected gold potentially hitting $4,500 in Q1 2026 and BTC reaching $130,000-$132,000, “provided market conditions are not further hampered by macro volatility.”

Asset manager Bitwise also estimates that just 3-4% capital rotation from gold to Bitcoin could push BTC above $240,000.

Technical Analysis: Wyckoff Pattern Suggests Breakout Ahead

Bitcoin’s 8-hour chart displays a Wyckoff reaccumulation phase structure, with a Selling Climax at $106,000 during the liquidation event, Spring representing the drop to $102,000, and the current Test phase consolidation.

This sequence suggests that Bitcoin may be completing Phase C testing and preparing for Phase D markup, leading to higher prices.

CME Bitcoin futures analysis also identifies unfilled gaps at $92,000 and $116,000. Every Bitcoin CME gap since December 2023 has been filled, except for these two zones.

Bitcoin is currently testing support near $112,000, with consolidation between $105,000 and $115,000 positioning the asset equidistant from both unfilled gaps.

If Bitcoin holds above $108,000 and forms a base, the path of least resistance targets $117,000 first, with potential to retest previous highs near $126,000 if bullish momentum returns.

However, a breakdown below $106,000 would invalidate this bullish scenario and trigger downside pressure toward the $92,000 CME gap.

As it stands now, Bitcoin will likely break decisively toward either $92,000 or $126,000 within the coming weeks.

The post $5.56B Whale Money Hits Binance – Is It Bitcoin Topping or Exchange Playing Games? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.