The landscape around bitcoin after the last FOMC meeting for 2024 in the US turned upside down, with local investors pulling funds out of the ETFs and the Coinbase Premium Index declining to yearly lows.

However, on-chain data shows that US investors are back on the BTC front, with massive accumulations.

ETFs Demand Returns

During the aforementioned meeting at the highest levels in the US central bank, Fed Chair Jerome Powell warned that there might be fewer or even no rate cuts in 2025 due to rising inflation. US investors reacted immediately and started pulling funds out of riskier assets like BTC and crypto.

Within the next four trading days, they withdrew more than $1.5 billion out of the US-based Bitcoin exchange-traded funds. December 26 was the only day well in the green, as December 27, 30, and January 2 saw more net outflows. Even BlackRock’s IBIT, the world’s largest Bitcoin ETF, was posting negative records.

However, this changed on Friday, January 3. The total net inflows for the day shot up to $908.1 million, according to FarSide data. IBIT was actually second with $253.1 million, trailing behind Fidelity’s FBTC with $357 million. Ark Invest’s ARKB also had a strong presence, attracting $222.6 million. This became the best day in terms of net inflows since November 21.

Coinbase Premium Index

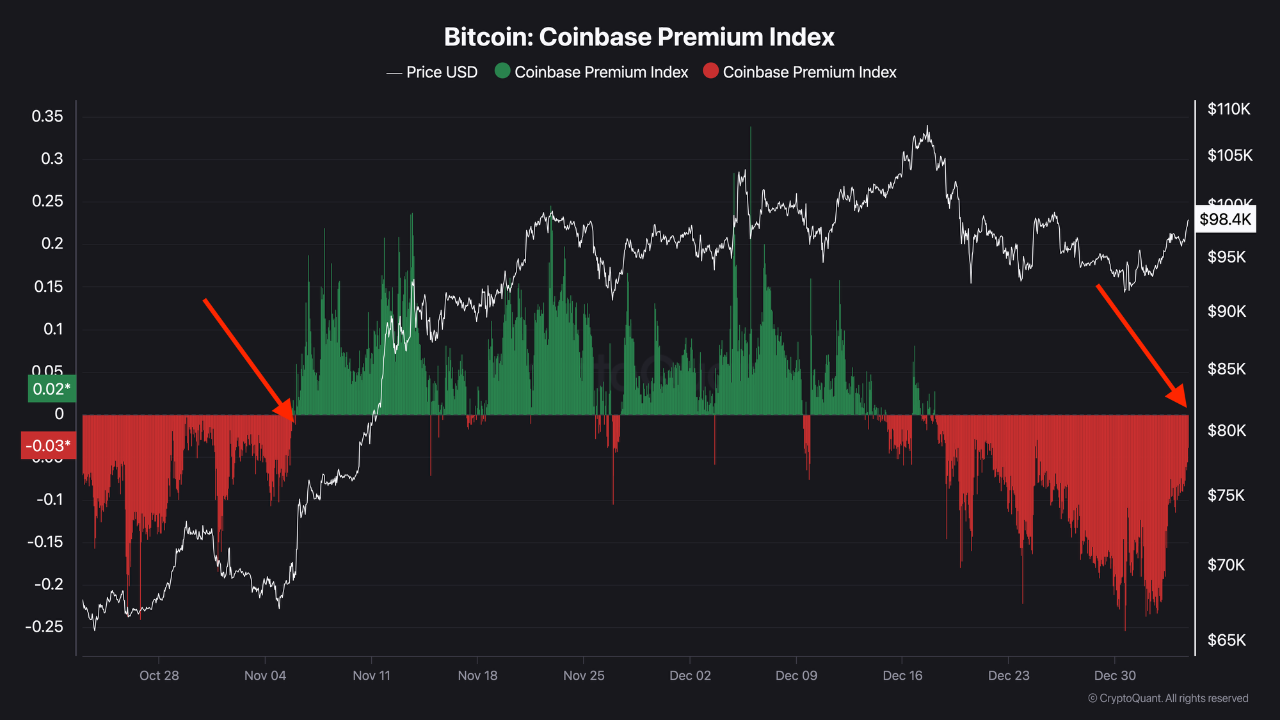

The other metric that showcases US investors’ overall behavior toward bitcoin and crypto is the Coinbase Premium Index, which measures the BTC price difference between Coinbase and Binance. When it shoots up into positive territory, this means that US-based investors are accumulating heavily, and vice versa.

The metric recently plunged to a yearly low, as reported, which coincided with the growing ETF outflows after the FOMC meeting. Now, though, CryptoQuant data shows that it has returned to neutral territory almost immediately after posting that low. This shows that “sentiment by the US and institutional investors is back.”

The post 2 Strong Indicators US Investors Are Flocking Back to Bitcoin appeared first on CryptoPotato.

The BTC ETFs saw their best day in over a month on Friday. BTCEUR, BTCGBP, BTCUSD, BTCUSDT, Crypto News, featured1, Bitcoin (BTC) Price, Bitcoin ETF, Coinbase, United States

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.