This trading week proved rather turbulent for Bitcoin as the premier cryptocurrency fell to as low as $91,000 on Monday amid concerns of a potential trade war between the US and Canada, Mexico, and China. Though Bitcoin soon made a sharp recovery rising briefly above $102,000, the flagship cryptocurrency currently trades above $96,000 in what appears to be a range-bound market. Meanwhile, blockchain analytics firm Glassnode has provided valuable insights on Bitcoin investor behavior in the last few months.

Bitcoin Retail Investors Stacking 10,627 BTC Daily

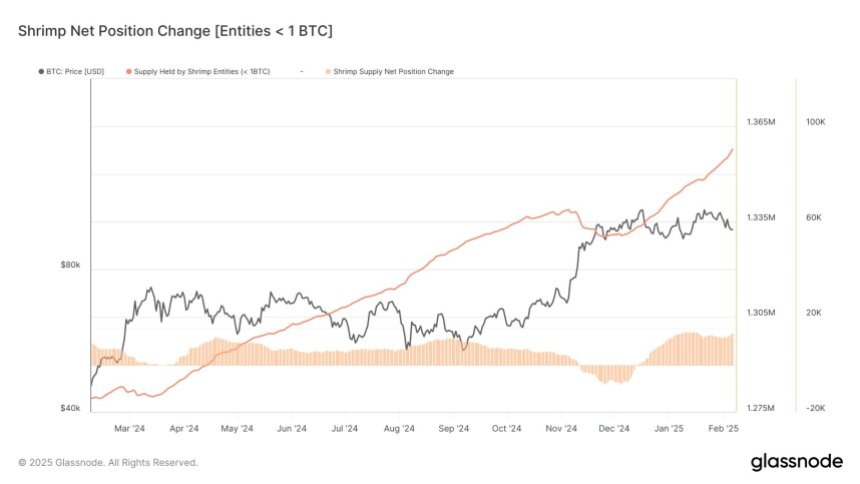

In a new X post, Glassnode dived into the recent activity of Bitcoin holders stating that retail investors i.e. address holding ≤1 BTC, are presently on an accumulation spree stretching to mid-December. Notably, these small investors are purchasing Bitcoin at an accelerated average rate of 10,627 BTC per day, which represents a 72% surge compared to last year’s daily average of 6,177 BTC.

This aggressive buying by retail investors marks a stark contrast to their behavior in November where they opted to take profits as Bitcoin soared past $100,000. However, their renewed accumulation despite Bitcoin’s woes since December suggests a strong confidence in the asset’s long-term profitability.

On the other end, Bitcoin whales i.e. investors holding over 1000 BTC, are offloading their assets at a rather unprecedented rate. Since November 24, these large investors have been moving Bitcoin to exchanges at an alarming average rate of 32,509 per day, suggesting a potential 9x increase in selling pressure compared to BTC’s yearly average.

Generally, a large sell-off by market whales is a bearish signal indicating uncertainty about an asset’s future price. However, the Bitcoin community remains bullish as a significant portion of the offload by the market whales can be attributed to profit-taking rather than loss of confidence.

Furthermore, the recent accumulation surge by retail investors has served as a key absorber of supply, mitigating potential drastic price declines. Albeit, as Bitcoin struggles to find some stability, retail investors must maintain their current demand level which is crucial in sustaining the asset’s bullish structure.

BTC Price Overview

At press time, Bitcoin trades at $96,679 after a 0.84% decline in the past day. This negative performance underlines the asset’s form in the past week in which prices dipped by a cumulative 5.71%. Despite the price decline, trading volume has surged by 17.22%, signaling increased market activity and interest. Bitcoin’s price action indicates consolidation within the $95,000–$100,000 range, setting the stage for a potential breakout. To confirm an uptrend, market bulls must drive a rally beyond the critical $105,000 resistance level.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.