Early-stage investment in Bitcoin-native startups saw a sharp rise in 2024, signaling the growth of a once-niche sector, according to a new research brief by Trammell Venture Partners (TVP).

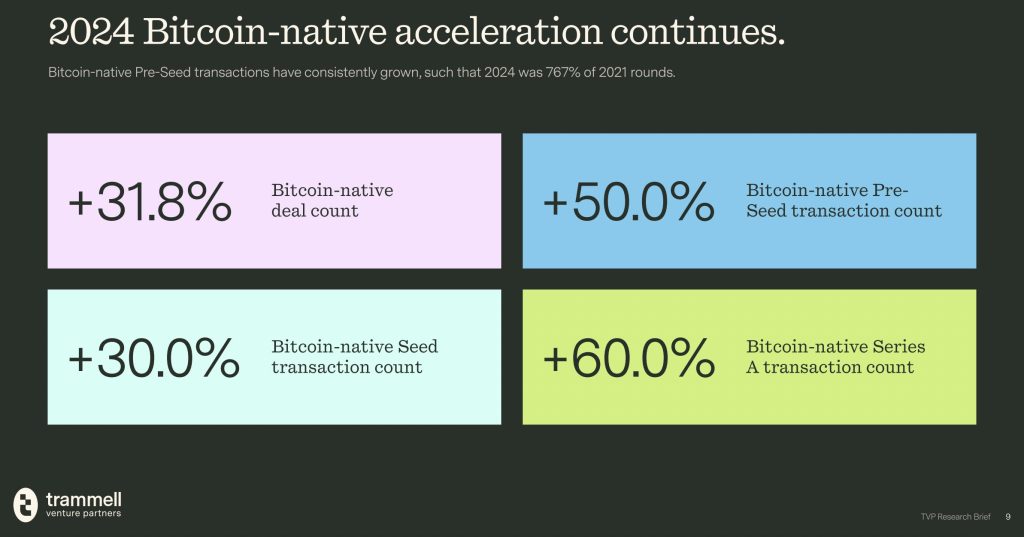

While overall capital raised in 2024 fell 22.1%, the number of Bitcoin startup deals jumped by nearly 32%, with pre-seed activity alone increasing by 50%.

The report defines “Bitcoin-native” companies as those fundamentally aligned with Bitcoin as a monetary asset and protocol stack, building products that directly benefit from Bitcoin’s growth and functionality.

Unlike broader crypto ventures, which often span various blockchain platforms, these startups are committed to the Bitcoin ecosystem from the ground up.

Bitcoin Startups See Consistent Growth Across All Early Stages

The number of Bitcoin-native pre-seed deals in 2024 was more than seven times higher than in 2021, showing a big rise in new startups and ideas.

Seed and Series A deal volumes also saw year-over-year increases of 30% and 60%, respectively.

Image Source: Trammell Venture Partners

Total capital raised may have dropped, but deal count and new company formation continued to rise. This points to growing confidence in Bitcoin-native startups. TVP notes four straight years of growth as a sign these startups could soon capture a bigger share of crypto venture funding.

Big-Name VCs Back Bitcoin as Ecosystem Matures

Backing this momentum is a growing list of institutional investors. In 2024, firms like Founders Fund, Ribbit Capital, Y Combinator and Valor Equity Partners participated in Bitcoin startup rounds. Their involvement points to rising confidence in business models built on Bitcoin’s protocol layers.

Bitcoin holds over half of the crypto market’s total value. Yet in 2024, it received only 2.3% of venture funding, the report notes. Researchers see this gap as an opportunity to rebalance, as the Bitcoin ecosystem expands beyond mining and asset holding.

Backed by simple business models, clear focus and growing investor interest, Bitcoin-native startups are quietly shaping a new path for crypto innovation.

The post Early-Stage Deals for Bitcoin Startups Jumped in 2024, Defying Broader Market Trends appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.