Binance is working hard to improve its ties with Indian regulators and is enforcing stricter Know Your Customer (KYC) requirements.

The crypto exchange previously faced several frictions with Indian regulators, including atemporal service disruptions. Since returning to India, Binance is seeking to rebuild trust and align its operations with local policy demands.

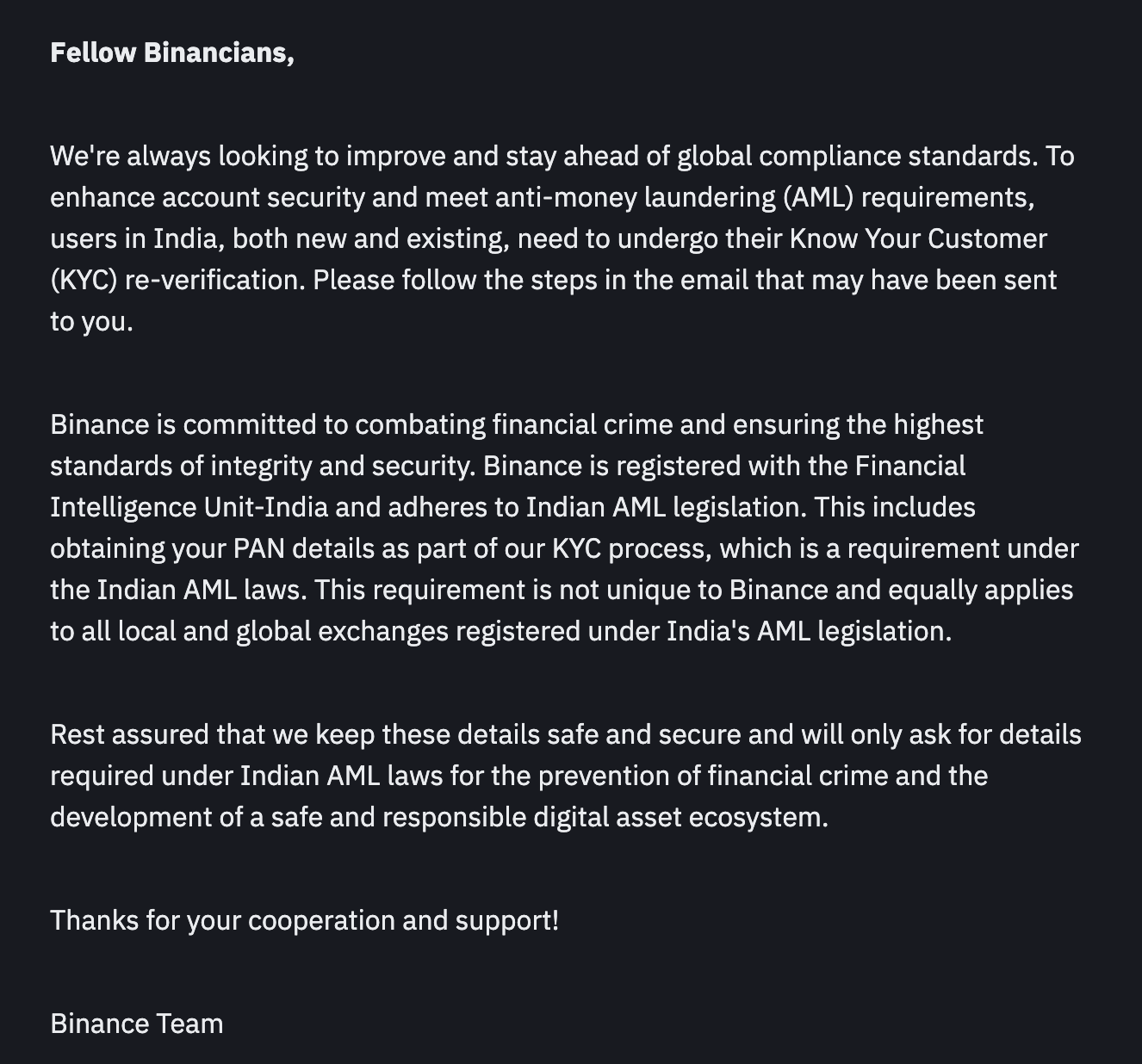

Indian Binance users, both new and old, are required to complete KYC re-verification. This policy aligns Binance with India’s anti-money laundering (AML) framework. In addition, it reflects Binance’s commitment to stay compliant.

Binance is requiring all users in India – both new & existing – to complete KYC re-verification, including PAN details to meet India’s

anti-money laundering (AML) laws.

Binance is registered with FIU-India & the move supports financial crime prevention & user security.… pic.twitter.com/bGoJ78KBrw

— BITCOIN EXPERT INDIA (@Btcexpertindia) April 18, 2025

Binance also displayed its willingness to cooperate with India’s regulators by getting registered with India’s Financial Intelligence Unit (FIU). As part of the process, users must now provide their Permanent Account Number (PAN). As per reports, this is a standard requirement under Indian AML regulations.

Not an imposed rule

Binance, in its announcement, clarified that the verification process is not unique to its platform. “This requirement is not unique to Binance and equally applies to all local and global exchanges registered under India’s AML legislation,” the crypto exchange said, aiming to clarify that it’s following national standards, not imposing arbitrary rules.

To ease concerns, Binance reassured users that it will only request data mandated by local law, promising safety to all user data. As per local reports, the trading platform has already contacted some users via email, offering reverification tips.

With crypto becoming mainstream, many argue that KYC measures will provide an extra layer of safety. Most industry observers view Binance’s new KYC policy as a positive sign.

#Binance is proud to have received a Virtual Asset Service Provider (VASP) licence from Dubai’s Virtual Assets Regulatory Authority (VARA).

This milestone allows us to extend our services to the retail market alongside qualified and institutional investors.

Read more

— Binance (@binance) April 18, 2024

Binance is rebuilding its global reputation.

Binance’s cooperation with regulators is not limited to India. The exchange is taking clear steps to rebuild trust with regulators globally following several years of legal challenges.

The crypto exchange faced investigations in several countries, including accusations of being used for money laundering. Binance faced further damage after its former CEO, Changpeng Zhao (CZ), pleaded guilty to violating U.S. anti-money laundering laws. The crypto exchange also paid around $4.3 billion in fines to the U.S.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post Binance Tightens KYC Rules in India for AML Compliance appeared first on Altcoin Buzz.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.