Liquid staking gained popularity in a short timeframe. It allows you to get twice the rewards compared to single staking. You single stake an asset and in turn you receive a liquid staking token (LST). So, now you can use this liquid staking token again in DeFi. So, you get rewards for staking your initial assets and for staking the LSTs. But you can also restake your LSTs.

However, is liquid staking and liquid restaking without risk? Let’s find out.

What Is Liquid Restaking?

Liquid restaking gives a new meaning to liquid staking. It allows you to use your underlying staked $ETH to secure another protocol. You earn more yield with your underlying staked $ETH. This results in increased capital efficiency. In other words, you stake your $ETH and receive an $ETH LST in return. Now you stake this $ETH LST in a different protocol or invest it as you like.

When doing this, AVS and AVS location play an important role. This is of importance for restaking protocols. They need to make sure that their users can use their LSTs in a safe and secure way. So, that also makes it important for us, the users. Let’s take a look at what the AVS and their allocations are.

Actively Validated Services (AVS) are blockchain-based apps. However, they operate outside the EVM or Ethereum Virtual Machine. These services can also utilize restaked $ETH for their security. For example,

Layer-2 chains.

Data availability layers.

Sequencers.

DApps.

Oracle networks.

Cross-chain bridges or

Virtual machines.

AVS allocation refers to the criteria used to assigning staked $ETH across AVSs. This also includes Node Operators (NOs). These AVS allocations play an essential role. That’s because they immediately impact the security and growth of liquid restaking protocols.

When you assign your LSTs effectively, it can reduce various risks. For instance,

Slashing.

Liquidity constraints.

Reliance on specific node operators (NOs).

2/ First, the basics:

What is liquid restaking?

Liquid restaking extends liquid staking by utilizing the underlying staked ETH to secure other decentralized services. This increases the capital efficiency of underlying staked ETH and provides an increased yield for stakers.…

— Chaos Labs (@chaos_labs) August 20, 2024

So, for long term stability, you need to strategically diversify your allocations. You also want to minimize your liquidity and slashing risks. Slashing is when an NO or validator misbehaves in a PoS (Proof of Staking) network. The NO loses rewards, and you as delegator, may also be punished. So, you lose rewards, or in the worst case, your LSTs. Punishments vary by protocol. This brings us to liquid staking risks.

What Are Liquid Staking Risks and Restaking Risks?

Liquid staking and restaking have various risks. I listed a few already above. But that’s not all, there are various other risks as well. So, let’s take a closer look at these. First, here are some liquid staking risks. That’s besides the already mentioned slashing risks.

Liquid Staking Risks

Smart Contract Vulnerabilities

Liquid staking relies on smart contracts. They create and manage LSTs. So, a vulnerability or a bug in smart contract can have disastrous effects. For example, you can lose your funds or bad actors can exploit the smart contract. You may know this abbreviation, DYOR. This stands for ‘Do Your Own Research’. Each platform or project you consider for liquid staking needs your attention. You need to DYOR these platforms and projects. Look for audited smart contracts that are reputable.

Market Volatility

The price fluctuation for LSTs can have high volatility. So, besides staking rewards, there are also potential gains or losses due to price changes. To clarify, these are price changes for the underlying asset. They can also depeg from Ethereum’s price if one or more of these things happen.

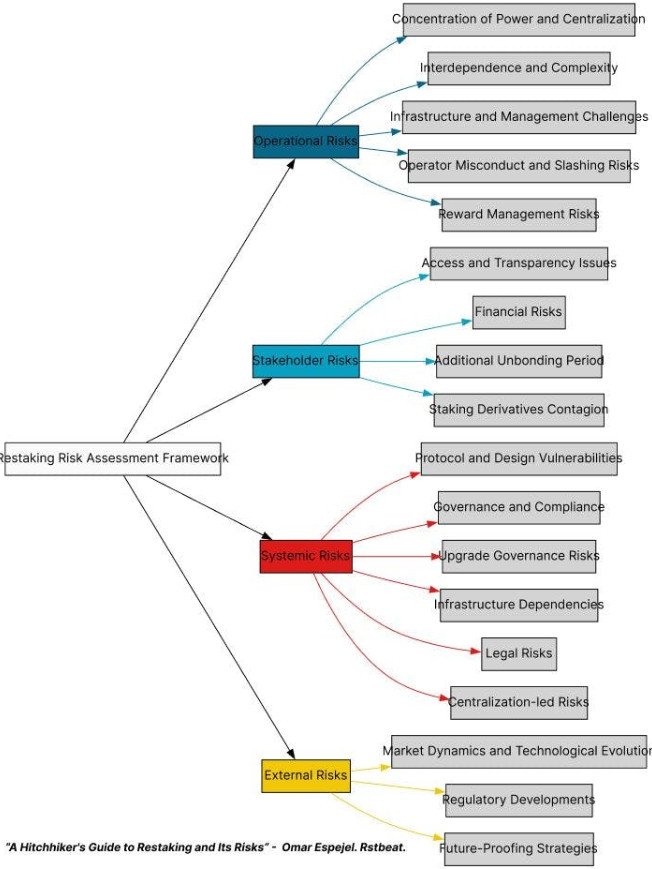

Specific Restaking Risks

For restaking risks, there are other, more specific risks. These include risks for restakers, NOs, and AVSs.

Operational Risks

This concerns NOs and AVSs. For example,

Concentration of power and centralization. — This can happen when a single operator manages various AVSs. Control can now become centralized. As a result, there’s a risk for systemic vulnerabilities. This is a concern for everyone about ETH and how large a holding leading liquid staker Lido has as an ETH validator.

Slashing risks — As explained before.

Infrastructure and management challenges — Like hardware failures or software bugs. This can cause operational downtime or security breaches.

Reward management risks — Manage your rewards from various AVSs. They may pay in different tokens. Hence, it requires plenty of resources and careful planning. You don’t want to miss rewards. Hence, you need to track liquidity on various trading venues.

Stakeholder Risks

This impacts us, the restakers. For instance,

Access and transparency issues. — Withdrawal and reward criteria need to be clear and fair. This ensures trust in the protocol.

Financial risks — Operator errors or AVS failures can lead to loss of funds. That’s why the restaking process should have clear guidelines. There’s should also be a strong control mechanism in place.

Longer unbonding period — $ETH withdrawal duration can increase because of restaking. AVSs can also have unbonding times.

Systemic Risks

Protocol and design vulnerabilities — These can put the system at risk. Hence, systems need constant updates and audits.

Legal risks — You need to follow local laws of your resident country.

Governance risks — Governance changes can collide with operational compliance.

External risks

Market dynamics and technological evolution — Changes can affect adoption and functionality.

Regulatory developments — New regulations can have an impact on compliance requirements. They can also influence operational restrictions.

Source: Hackernoon

Conclusion

Liquid staking and restaking have become popular options. However, they are not completely without risks. So, we look deeper into the risks of liquid staking and restaking. You can avoid many risk factors by doing due diligence and DYOR. Mitigating risks expands to these staking activities. You want to protect your assets.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours.

We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence.

Copyright Altcoin Buzz Pte Ltd.

The post What Are The Risks to Liquid Staking? appeared first on Altcoin Buzz.