In the world of digital assets, it is easy to get lost in spreadsheets, circulating supply tables, and quantitative projections. Many crypto projects insist that math alone will drive scarcity and price appreciation. Yet the reality is often more nuanced. Numbers are important, but in any market, sentiment and credibility dictate whether a token’s economic design is believable.

FUNToken is a perfect example of this dynamic in action. On paper, its deflationary model is clear. The team executes quarterly burns funded directly by platform revenue. The most recent event removed 25 million FUN from circulation. This supply cut was about 0.23 percent of total tokens. Some observers might argue that such a percentage is too small to impact price. But the market’s response tells a different story.

FUNToken’s deflation model is less about raw mathematics and more about proving to its community that the team will consistently deliver on its commitments. This trust-first strategy has been the driving force behind the project’s sustained growth, steady adoption, and the robust price performance it has recorded over the past quarter.

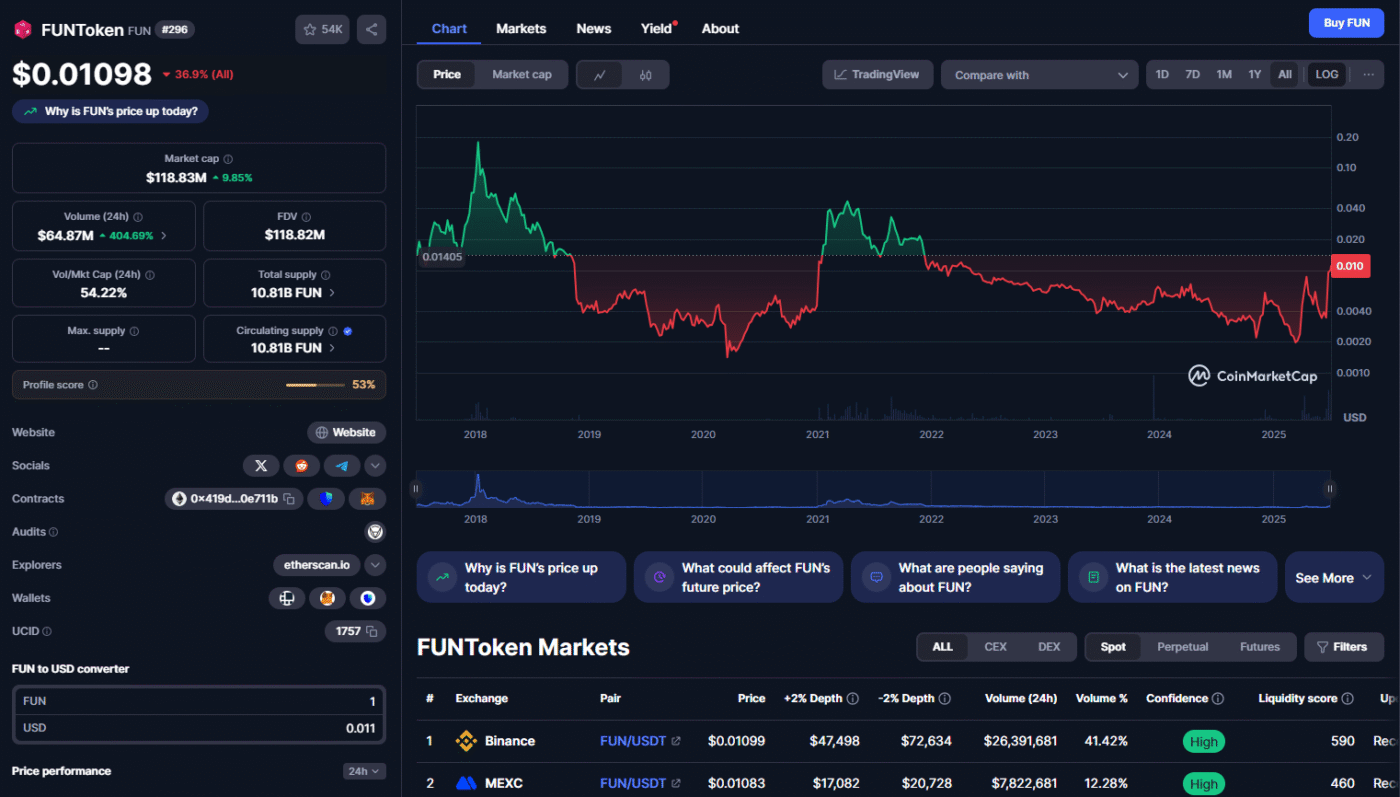

Today, the token trades around $0.0109, with daily volumes exceeding $60 million and market capitalization in the range of $119 million..

Reinforcing Value Through Revenue-Backed Burns

The deflation strategy starts with a simple premise. Every quarter, the FUNToken team allocates some percent of platform revenue to buy back and burn tokens. This practice ensures that supply reductions are not hypothetical or dependent on token reserves. They are a direct consequence of real adoption.

When the most recent burn removed 25 million FUN from circulation, the event was transparent and fully verifiable on-chain. This transparency is essential. Unlike many projects that announce burns without showing evidence, FUNToken published transaction records and made them accessible to the community.

This process is reinforced by the project’s roadmap, which clearly outlines how revenue from the expanding gaming ecosystem and engagement tools will continue to fund future burns. It is a model rooted in consistency, not just theoretical scarcity.

CertiK Verification Supports Credibility

Another critical layer of this trust strategy is the emphasis on independent security validation. In April, FUNToken completed a full audit by CertiK.

The audit confirmed several vital attributes:

- The contract is immutable, so no administrator can mint additional tokens beyond the original supply

- All burns are irreversible once executed

- There are no backdoors or hidden functions that could undermine supply integrity

This assurance is reinforced by CertiK Skynet, which continuously monitors the contract in real time. If any anomalies were to occur, they would be flagged immediately, adding further protection.

For Web2 users and institutional participants, this independent oversight is essential. It demonstrates that even as FUNToken grows, its deflationary promises cannot be quietly reversed.

Price Stability Reflects Investor Confidence

Critics may point out that reducing supply by a fraction of a percent does not mathematically guarantee price appreciation. They are correct on a purely statistical level. But tokens are not stocks, and crypto markets are driven as much by trust and visibility as by linear supply models.

After the burn, FUNToken’s price jumped from roughly $0.0045 to $0.0064 in less than 24 hours. Since then, it has consistently traded above the $0.010 threshold, even in the face of broader market volatility.

This resilience is the result of several converging factors:

- Holders trust that burns will continue, backed by real revenue

- The CertiK audit assures that no hidden dilution will occur

- A clear roadmap demonstrates future milestones that will drive adoption and revenue

- A strong community engages daily, creating liquidity and reinforcing awareness

These conditions illustrate that deflation alone is never the only factor supporting price. It must be combined with credibility, transparency, and ongoing delivery.

The Telegram AI Bot Builds Habitual Engagement

One of the most underappreciated aspects of FUNToken’s strategy is how it leverages its AI-powered $FUN Telegram bot to create daily touchpoints with users. The bot serves as both an onboarding engine and an engagement channel.

- It generates transaction volume that contributes to platform revenue

- It keeps the community active and informed

- It builds trust by showing that rewards are consistently distributed

This habit-forming engagement mirrors the daily check-in mechanics common in Web2 gaming. As users return repeatedly, they grow more confident that the ecosystem is stable and worth further investment.

Roadmap Commitments Sustain Momentum

The project’s roadmap outlines a series of milestones that reinforce the credibility behind its deflationary strategy:

- In Q3 and Q4 of 2025, the team plans to launch a dedicated mobile wallet. This wallet will support staking, seamless swaps, and integration with the Telegram bot.

- By the end of 2025, the roadmap calls for the launch of play-to-earn games that will drive additional user acquisition and transaction volume.

- In Q1 2026, FUNToken targets a base of over 1 million active wallets, a milestone that would significantly expand the ecosystem’s revenue potential.

Each of these deliverables is designed to convert engagement into economic activity. That economic activity feeds the quarterly burns. And the burns reinforce scarcity.

The power of this cycle lies not in any single transaction, but in the visible proof that every phase of the roadmap directly supports the long-term health of the token economy.

Conclusion

FUNToken’s deflationary model is not only an exercise in mathematics. It is a carefully executed trust strategy. Every quarter, the team proves that it will deliver on its commitments, remove supply transparently, and do so in a way that can be verified independently.

Combined with a clear roadmap, an AI-powered engagement platform, and the validation of CertiK’s audit and Skynet monitoring, this approach creates the rare conditions where scarcity is not just theoretical but visible and credible.

Note: The price mentioned was accurate at the time of writing (July 3, 2025) and may have changed since

The post FUNToken’s Deflation Model Isn’t Working on Math but on Trust Strategy appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.