TLDR:

Binance Labs invested in OpenEden, a real-world asset tokenization platform

OpenEden’s tokenized U.S. T-Bill Fund received an “A” rating from Moody’s

OpenEden achieved over $100 million in Total Value Locked for tokenized T-Bills

The investment aims to expand access to RWA-backed yields in DeFi

Tokenized real-world assets have grown to $8 billion in total value locked

Binance Labs, the venture capital arm of Binance, has made a strategic investment in OpenEden, a platform focused on tokenizing real-world assets (RWAs). This move aims to bridge traditional finance with the growing world of decentralized finance (DeFi).

OpenEden is a company that includes a fund management firm licensed by the Monetary Authority of Singapore and a technology company specializing in tokenization.

Their main product is a tokenized U.S. Treasury Bill Fund called TBILL. This fund has received an “A” rating from Moody’s, making it the first of its kind to achieve such a high rating. It’s also the largest fund of its type outside the United States.

The goal of OpenEden is to bring real-world financial products into the blockchain space. They believe that by making these assets available on the blockchain, more people can access them. This could lead to a financial system that includes more people and is less centralized.

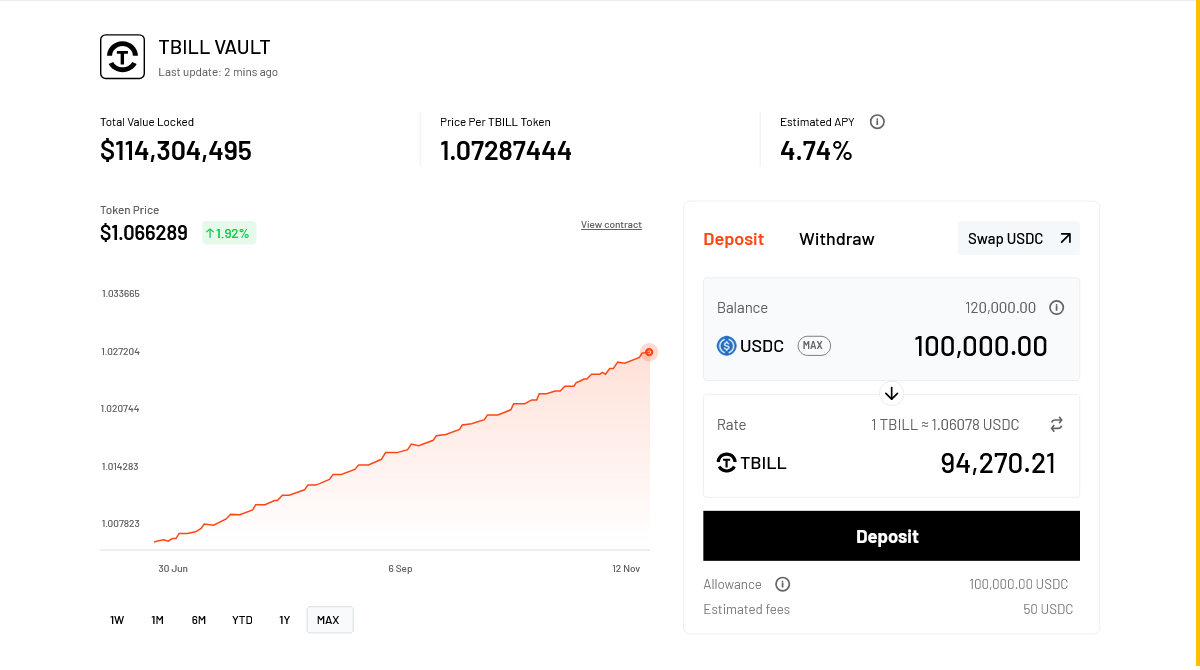

Recently, OpenEden announced that they had reached over $100 million in Total Value Locked (TVL) for their tokenized T-Bills. This means that investors have put more than $100 million worth of assets into their platform.

$TBILL is The Best-Performing Tokenized Treasury Product over 180 days

OpenEden allows investors who have passed Know Your Customer (KYC) checks, as well as Decentralized Autonomous Organizations (DAOs) and crypto treasury managers, to use their own wallets to create TBILL tokens. This gives them a way to earn money on their unused stablecoins.

OpenEden manages the entire process of tokenization themselves. This helps them work more efficiently and offer higher returns to people who hold their tokens. So far, they have signed up more than 100 institutional clients.

With the new funding from Binance Labs, OpenEden plans to do several things. They want to create new products, form partnerships with other companies, and look into new markets. All of these efforts are aimed at making it easier for more people to access yields backed by real-world assets in the DeFi ecosystem.

Andy Chang, who works at Binance Labs, said they support projects that are creating new opportunities in Web3 with useful and lasting technologies. He believes OpenEden is in a good position to take advantage of the growing use of stablecoins and real-world assets.

Jeremy Ng, who helped start OpenEden, said they’re happy to have Binance Labs’ support. He explained that this support will help them work faster to combine yields from both crypto and real-world assets. This could help make returns in DeFi more stable and create ways for institutional investors to put money into decentralized platforms.

The demand for tokenized real-world assets has been growing quickly. T-Bills have become a popular choice for companies that want to issue these types of tokens. According to a company called Messari that analyzes blockchain data, the total value locked in real-world assets has grown a lot over the past year, reaching $8 billion.

Binance Labs, which started in 2018, has invested in over 250 projects from more than 25 countries. They focus on projects that are creating new technology that people actually want to use and that can make money in a sustainable way.

The post Binance Labs Invests in OpenEden to Boost Real-World Asset Tokenization in DeFi appeared first on Blockonomi.