TL;DR

- Avalanche processes 10.9M weekly transactions, DEX volume tops $3B, and price trades near $23 today still.

- Grayscale files S-1 for spot AVAX trust; Coinbase Custody and Coinbase serve roles as partners.

- CLS identifies $19–$20 FVG interest zone; targets $27, $28, $31, $34 if momentum holds weekly.

Network Activity Climbs

Avalanche (AVAX) processed 10.9 million transactions over the past week, the highest reading since December 2023. Activity held near 2–4 million for months before rising sharply from mid-2025 as more apps went live.

$AVAX showing 10.9M weekly txns (highest since Dec ’23), $3B+ DEX volume holding strong, and TVL close to $4B after 3 years.

Growth is coming from partnerships, RWA tokenization, and gaming.

With gaming market expected to hit ~$615B by 2030, I feel $AVAX still has big upside.… pic.twitter.com/p1G9qhilsO

— Joe Swanson (@Joe_Swanson057) August 26, 2025

Weekly DEX volume stayed above $3 billion, with trading trending higher since early June 2025. Liquidity across swaps and lending has deepened. Analyst Joe Swanson wrote,

“$AVAX showing 10.9M weekly txns (highest since Dec ’23), $3B+ DEX volume holding strong.”

The price of Avalanche was $23 at the time of writing, with a 24-hour volume of over $711 million. AVAX is down 3% on the day and up 1% over seven days. The move tracks broader crypto softness while on-chain activity stays firm.

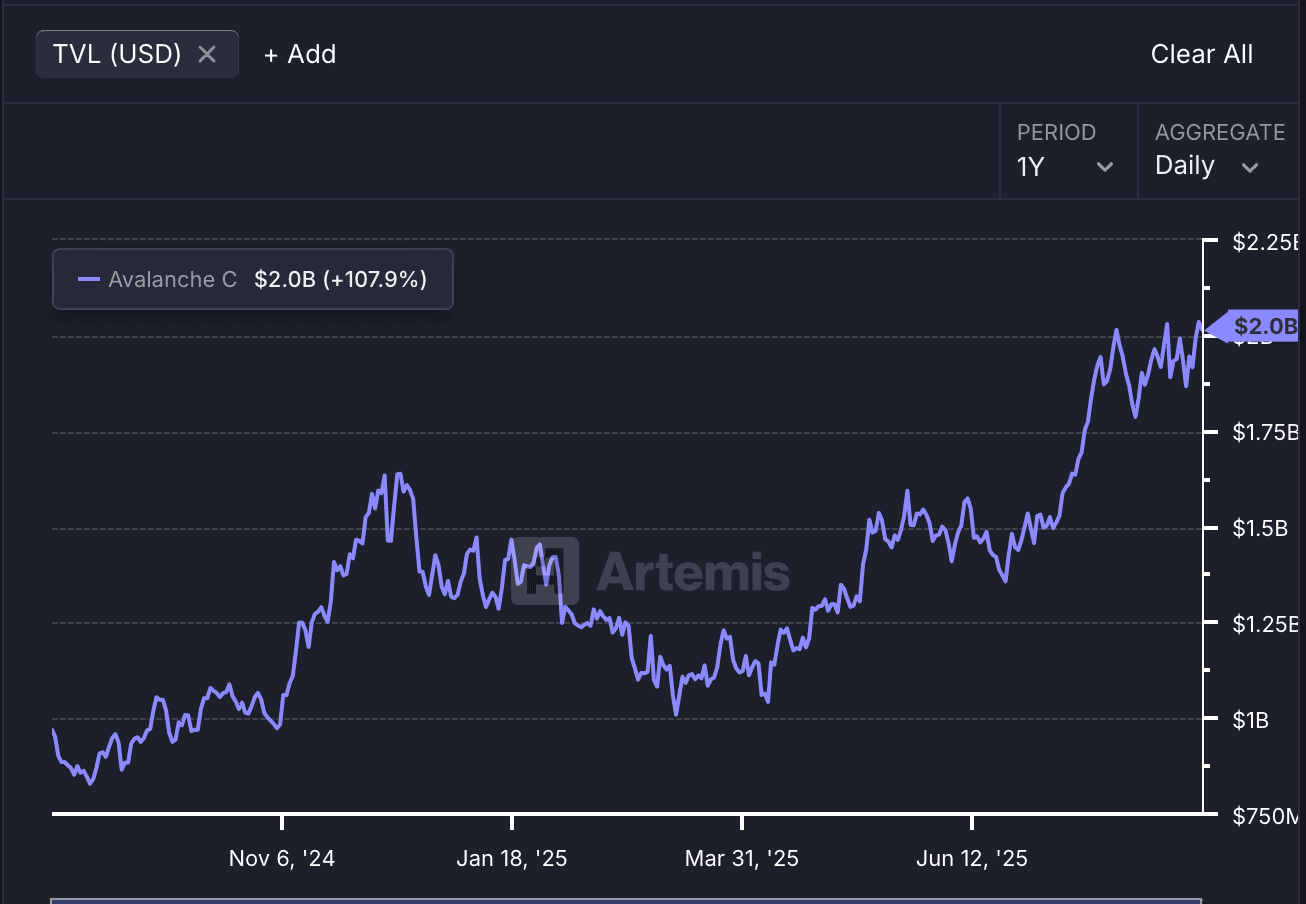

Avalanche’s TVL is $2.0B (Aug 26, 2025) per Artemis. The trend shows a steady climb through 2024 and faster growth in 2025, reaching near 1-year highs, but nowhere near prior cycle records.

Weekly Setup and Targets

CLS Global reports early signs of a bullish weekly structure. The team marks a 1-week Fair Value Gap (FVG) at $19–$20 as its interest zone for bids. The price trades above that area, keeping the setup constructive on their timeframe.

$AVAX/USDT Global Outlook

AVAX showing signs of potential bullish rally on weekly timeframe.

Key Points:

– Upward structure forming on weekly

– FVG 1W ($19.173 – $20.382) serving as interest zone

– Potential upside exceeds 70%Targets: → $27.415 (weekly high) → $28.763 →… pic.twitter.com/pUc1AtUJrv

— CLS GLOBAL (@CoinLiquidity) August 26, 2025

CLS maps upside potential above 70% from the FVG, with targets at $27 (weekly high), $28, $31, and $34. A dip into the FVG could precede continuation. CLS wrote,

“AVAX showing signs of potential bullish rally on weekly timeframe.”

Grayscale Files for Avalanche Trust

Grayscale Investments filed an S-1 with the US SEC to launch the Grayscale Avalanche Trust (AVAX). The trust seeks to track AVAX’s price, with Coinbase Custody as custodian and Coinbase, Inc. as prime broker.

Grayscale aims to list the product on Nasdaq, pending approval. Market participants are weighing how a listed vehicle could broaden access. Swanson linked growth to “partnerships, RWA tokenization, and gaming,” noting a gaming market forecast of nearly $615B by 2030.

The post Avalanche Logs 10.9M Transactions as Grayscale Pushes for Spot AVAX Trust appeared first on CryptoPotato.

Avalanche posts 10.9M weekly transactions and $3B DEX volume as Grayscale files an S-1 for a spot AVAX trust; price $23, TVL $2B. AVAXBTC, AVAXUSD, Crypto Bits, Crypto News, Avalanche (AVAX) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.