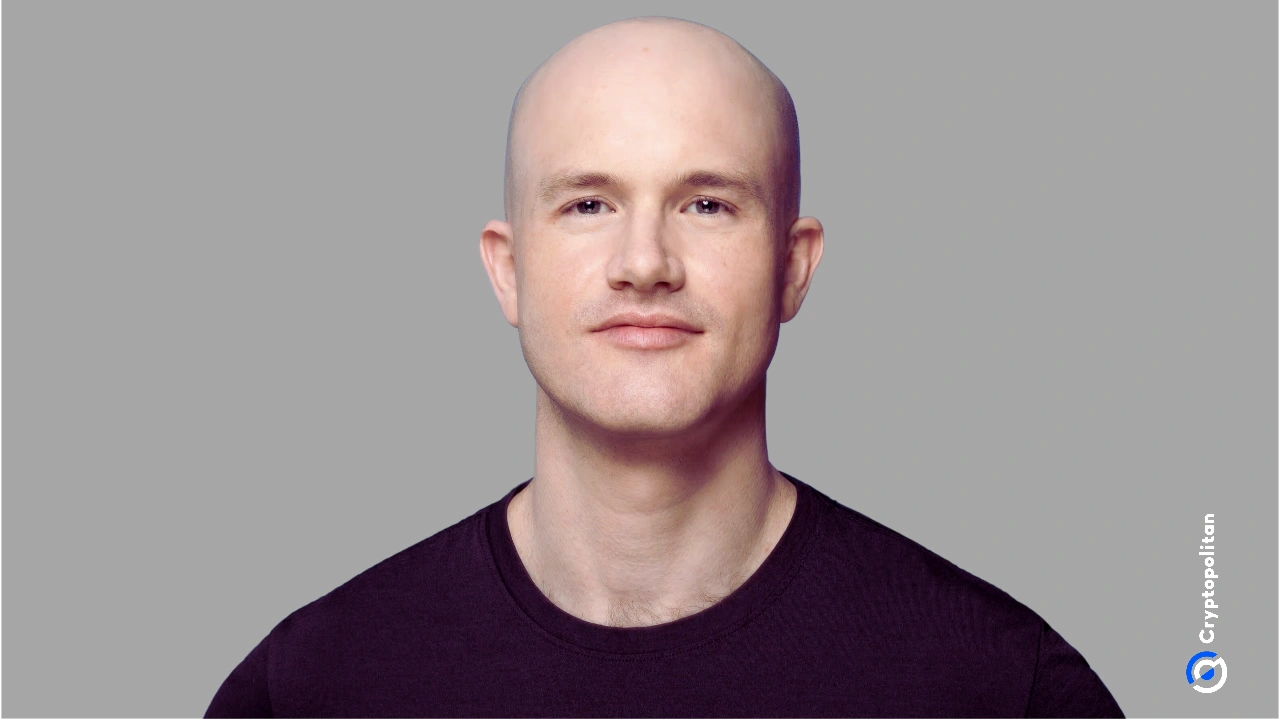

Coinbase CEO Brian Armstrong stormed into Capitol Hill this week with a message that made zero room for interpretation.

Sitting across from lawmakers in Washington D.C., he and a group of crypto executives made it clear that they were there to defend what they see as a basic right to compete.

According to CNBC, the dispute centers on whether crypto exchanges like Coinbase should be allowed to offer staking and rewards that function like interest payments offered by banks, and the blowback from the banking world has been swift and loud.

Brian didn’t dodge the attacks. “I’m not sure why the banks would want to bring that up again at this point,” he said during an interview on Wednesday. “But they should have to compete on a level playing field in crypto.”

That line drew a sharp contrast between how Coinbase sees itself and how banks are treating the situation. Coinbase currently gives users 4.1% rewards for holding USDC, while Kraken is offering a higher 5.5% on the same stablecoin.

Under the new GENIUS Act, interest on stablecoins is off the table, but rewards are still legal. That legal difference is exactly what banks want shut down.

Banks lobby to kill crypto rewards as capital outflow fears grow

Banking trade groups are actively pressuring Congress to ban these crypto rewards. They argue that offering rates like Coinbase’s 4.1% will lure customers away from small banks.

John Court, who serves as executive vice president at the Bank Policy Institute, warned lawmakers that these reward programs pose a threat to the country’s broader economic stability.

“If people are pulling their deposits out of their bank accounts and transferring them into stablecoin investments,” Court said, “you are effectively neutering, to some degree, the ability of the banks to continue to lend into the real economy and to support and fuel the economic growth.”

The warning didn’t come out of nowhere. A report from the Treasury Borrowing Advisory Committee in April estimated that as much as $6.6 trillion in customer deposits could shift from traditional banks into stablecoins if reward systems continue.

The banks say that kind of change would break their lending models. Brian doesn’t buy that. He called the whole argument a “boogeyman” and accused big banks of hiding behind fake narratives.

“The real reason that they’re bringing this up as an issue,” Brian said, “is that they’re trying to protect the $180 billion that they made on their payment business. This is something that big banks are funding behind the scenes. It’s not small banks whatsoever.”

Meanwhile, just earlier, JPMorgan Chase CEO Jamie Dimon met with Senate Republicans. Dimon later said the issue of stablecoin rewards wasn’t mentioned in the meeting, but still told reporters that regulators need to be careful. “We’re not against crypto,” Jamie said, choosing his words carefully. But the bank industry he represents is moving fast to push lawmakers to act.

Lawmakers split as crypto groups and banks exchange letters

Both sides are filing letters with Congress. On August 12, the American Bankers Association and several state-level associations asked lawmakers to “close this loophole and protect the financial system.” The phrase “close this loophole” is what banks keep repeating. Their goal is to reclassify reward systems so they fall under the same restrictions as interest.

Crypto groups immediately fired back with a warning that banning rewards on exchanges like Coinbase and Kraken would “tilt the playing field in favor of legacy institutions, particularly larger banks, that routinely fail to deliver competitive returns and deprive consumers of meaningful choice.”

Inside the Senate, there’s still no final agreement on how to handle it. The market structure bill, which includes crypto platform regulations, has gone through several drafts. Nothing is finalized. But some lawmakers think the fight over staking and rewards is already done.

Senator Cynthia Lummis, a Republican from Wyoming who’s working with Banking Chair Tim Scott from South Carolina, said the matter has already been resolved. “The issue was heavily litigated in the GENIUS Act,” Cynthia said, “and I am supportive of the compromise achieved by the banks and the digital asset industry. I do not think this issue should be reopened.”

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.