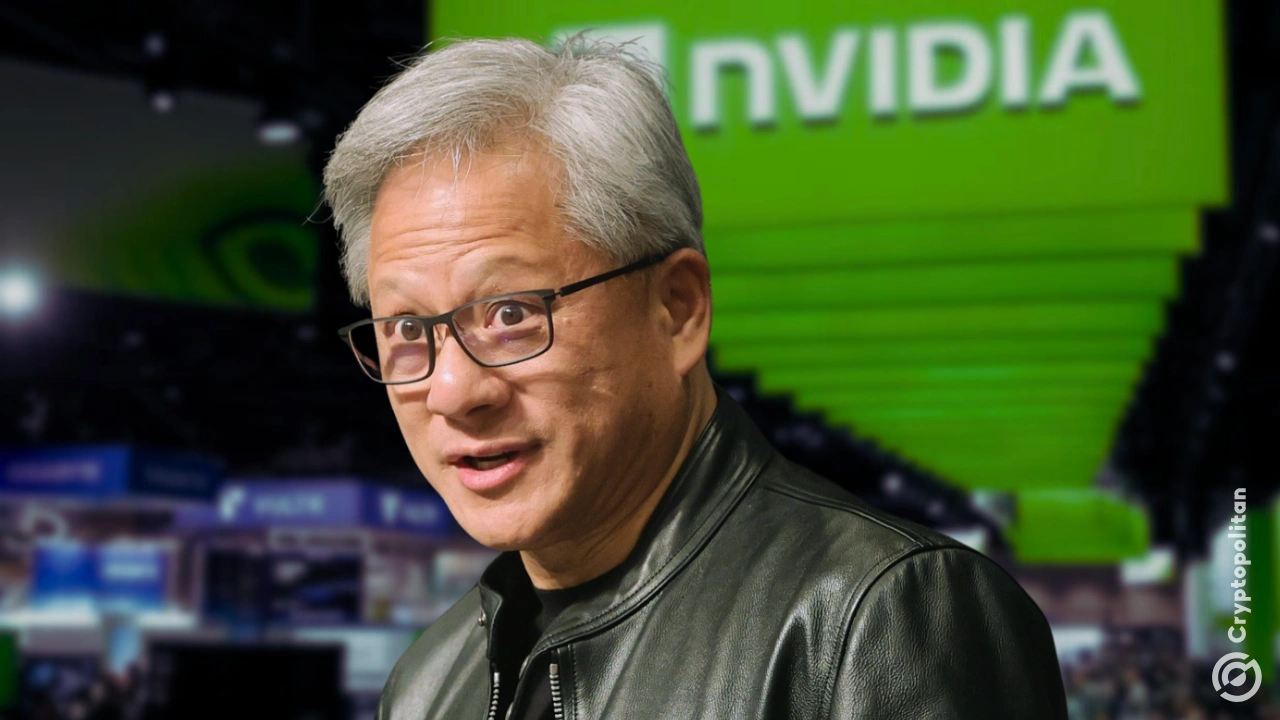

Nvidia CEO Jensen Huang on Thursday defended the company’s $5 billion deal with Intel, calling the collaboration a well-planned move after nearly a year of private talks.

The announcement came during a press call where Jensen confirmed he personally discussed the terms with Intel’s CEO Lip-Bu Tan, a longtime associate. “We thought it was going to be such an incredible investment,” Jensen said, adding that the agreement was finalized Saturday after months of back-and-forth.

As Cryptopolitan reported, the partnership involves Nvidia building AI systems and PC chips alongside Intel, combining Nvidia’s graphics processors with Intel’s x86 CPUs.

The deal covers more than just a handshake. Nvidia will be buying central processors from Intel to power its NVLink rack AI servers, which currently use Arm chips. Jensen explained:

“We’ll buy those CPUs from Intel, and then we’ll connect it into super chips that then becomes our compute node, that then gets integrated into a rack scale AI supercomputer.”

At the same time, Intel will start pushing laptops and PC chips that include Nvidia’s GPU components, tech that Jensen says will help both companies tap into a $50 billion market.

Nvidia plugs into Intel’s hardware as Intel sells off assets

Greg Ernst, Intel’s revenue chief, said on LinkedIn that the agreement came together over the past few months and was finalized on Saturday. Under the deal, Nvidia becomes a major customer of Intel CPUs while also supplying GPU chiplets that go into Intel’s client-side products.

“We’re going to become a very large customer of Intel CPUs, and we’re going to be a large supplier of GPU chiplets into Intel chips,” Jensen told reporters. He clarified that the partnership won’t affect Nvidia’s existing work with Arm, and that Thursday’s announcement is only about products, not Intel’s foundry.

Right now, Nvidia uses Taiwan Semiconductor Manufacturing Company (TSMC) to manufacture its chips. But Jensen said they still evaluate Intel’s foundry capabilities and may work with them down the line.

For this partnership though, the collaboration will only involve Intel’s chip packaging, the late-stage part of chip production that combines components into a single part ready for installation.

Tan, who was named Intel’s CEO in March after Pat Gelsinger was ousted, said during the same press call, “I’d like to thank Jensen for the confidence in me, and our team and Intel will work really hard to make sure it’s a good return for you.”

Pat was removed by Intel’s board last year due to rising costs in manufacturing and failure to break into the AI chip market. Since then, Tan has led Intel through major cost-cutting and fundraising moves.

Intel has raised $2 billion from SoftBank, sold a majority stake in its ASIC subsidiary Altera to Silver Lake for $3.3 billion, and offloaded $1 billion in stock from Mobileye, its self-driving tech unit. The company also said in July that it’s laying off 15% of its workforce by year’s end.

In total, Intel has received $8.9 billion in CHIPS Act grants and loans from the U.S. government—but the Trump administration requested a 10% equity stake in exchange for the funds. That stake was secured in August.

Despite the cash, Intel still hasn’t landed any major foundry customers like Nvidia or Apple. Analysts have said the company needs at least one to prove that its technology is reliable at scale.

If it doesn’t, it may be forced to abandon the foundry business altogether. That has raised concern in Washington, where lawmakers see Intel as strategically important due to its status as the only American firm that can build top-tier chips onshore.

Jensen was in England earlier this week with President Donald Trump, attending a state dinner at Windsor Palace and announcing new projects in the U.K.

But both Jensen and a White House official confirmed that the U.S. government was not involved in the Nvidia-Intel deal. Kush Desai, a White House spokesman, later said in a statement, “Intel’s new partnership with Nvidia is a major milestone for American high-tech manufacturing.”

Intel’s fall over the last five years has been steep. Its shares have dropped 31.78%, while Nvidia’s have jumped 1,348%, putting Nvidia’s market cap at $4.25 trillion compared to Intel’s $143 billion as of Thursday’s close.

The smartest crypto minds already read our newsletter. Want in? Join them.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.