According to reports, XRP is trading near $2.78 as markets head toward the year-end, with less than 100 days left until 2026. The token slipped more than 10% in the last week, a pullback that comes after stronger showings earlier this year.

Traders and analysts are watching a mix of on-chain signals and community chatter for clues about whether XRP can push into higher price tiers before the calendar flips.

Community Predicted Targets

Social media has become the loudest forum for price calls. One long-time Bitcoin investor active since 2013, who posts as Pumpius, put a $25 target on XRP before 2026 — a move that would mean over nine-fold gains from current levels.

#XRP to $25 before 2026 https://t.co/7GMFJ9psR9

— Pumpius (@pumpius) September 24, 2025

Other voices have offered different ceilings: Alex Cobb has floated $22 by December, some expect $10, while a few see at least $5 as a nearer-term milestone.

A handful of commenters even suggested figures above $30, tying those hopes to potential ETF flows. Replies on the thread ranged from bullish cheers to reminders to aim for smaller wins first, like cracking $4.

ETF Interest And Market Flows

Based on reports, optimism around potential XRP ETFs is a core driver behind the larger forecasts. Executives such as the CEO of Canary Capital have suggested that ETFs could open the door to billions of dollars of new inflows.

That thesis has brought new life to bull cases and provided momentum to speculation about double-digit prices. Meanwhile, market behavior has been mixed: XRP had its strong periods in January and once more in July, yet momentum was lost thereafter, leaving traders hesitant as they balance ETF optimism with subsequent price weakness.

Trading Behavior And On-Chain Signals

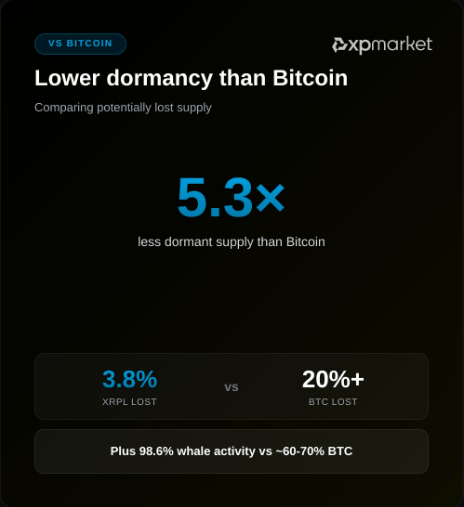

XRP is seen to have a lower dormancy rate than Bitcoin and Ethereum in recent chain data. That indicates the units of XRP change hands more frequently, which generally means active usage — payments, transfers, and liquidity trades.

Reports indicate that Bitcoin’s higher dormancy corresponds with a stronger “store of value” mental attitude, whereas Ethereum’s dormancy corresponds with developer and DeFi activity.

XRP’s active circulation fits Ripple’s long-stated push to make the token a bridge asset for payments, rather than a coin mainly held for long-term gains.

Dormancy Signals And Implications

If transactional use continues to rise, it may help XRP build a case as a utility-driven asset. But higher movement alone does not guarantee price appreciation.

Accumulation patterns also matter: assets that are hoarded tend to build scarcity narratives that can support higher valuations.

Analysts and investors will likely watch whether greater on-chain use is matched by fresh buying pressure, including from institutional products, before updating their long-term views.

Featured image from Unsplash, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.