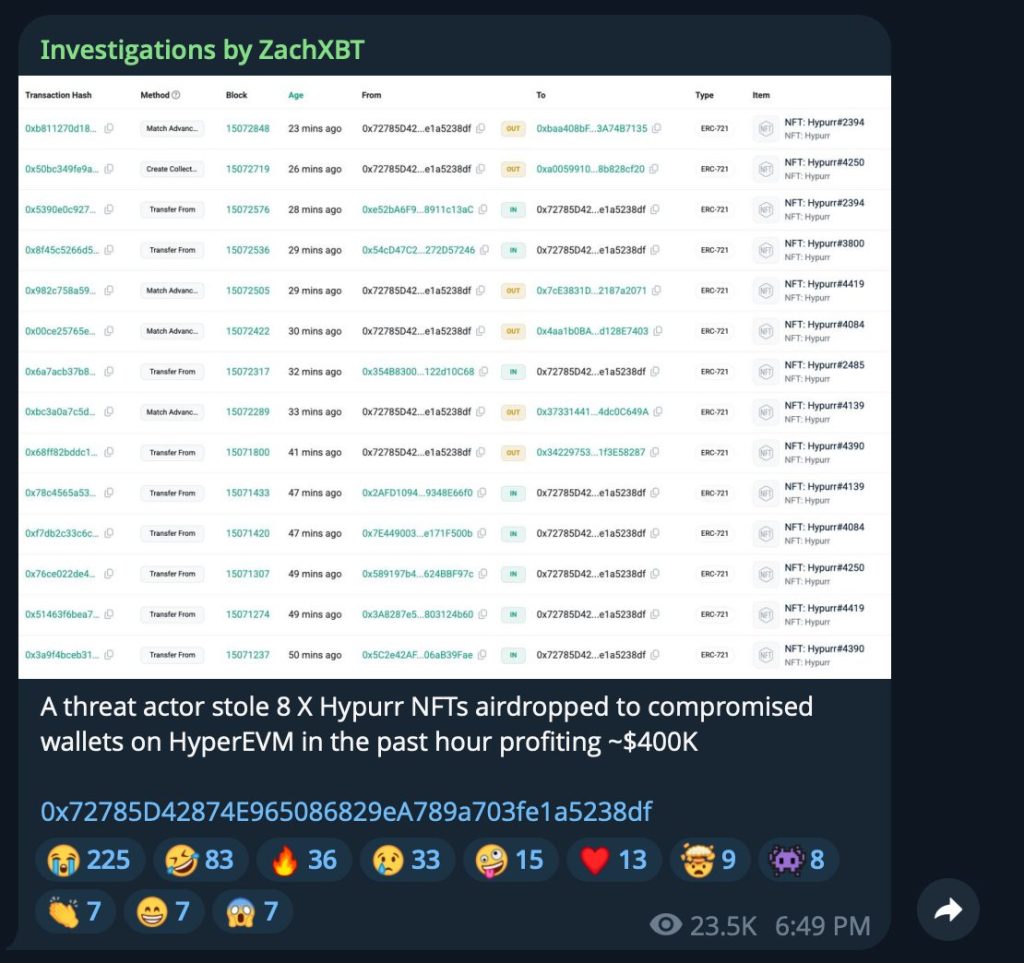

A threat actor stole eight Hypurr NFTs worth approximately $400,000 within hours of the collection’s launch by compromising wallets that received the airdropped tokens on Hyperliquid’s HyperEVM layer.

Blockchain investigator ZachXBT first reported the sophisticated theft targeting early Genesis Event participants who had opted to receive the free digital collectibles.

The Hyper Foundation distributed 4,600 unique cat-themed NFTs on September 28 to reward early supporters from the November 2024 Genesis Event.

The collection immediately achieved a floor price of $68,900, with total trading volume reaching $45 million within 24 hours on OpenSea. At the time of writing, the floor price has surpassed $70K.

The most expensive sale involved Hypurr #21, which featured rare “Knight Ghost Armor” traits, selling for 9,999 HYPE tokens, worth approximately $470,000.

Some NFTs had traded over-the-counter for $88,000 before the official launch through DripTrade’s collateralized pre-sale system.

The theft compounds security concerns plaguing Hyperliquid’s ecosystem following the $773,000 HyperDrive exploit and $3.6 million HyperVault rug pull within the same week.

The rapid succession of attacks has intensified scrutiny of security practices across projects building on the decentralized exchange platform.

Digital Cats Command Six-Figure Prices Despite Global Economic Pressures

The Hypurr collection features generative art depicting cartoon cats with various traits, including sunglasses, wizard robes, and armor elements.

Distribution allocated 4,313 NFTs to Genesis Event participants, 144 to the Hyper Foundation, and 143 to core contributors, including developers and artists.

According to OpenSea data, over 1.3 million HYPE tokens were traded in the past 24 hours, equivalent to $61 million at current prices.

The collection maintained 92.8% of supply held by 4,270 unique owners.

Community reactions varied widely, with some celebrating life-changing windfalls while others criticized the wealth disparity.

Creative director Alex Obymuralex praised the Hypurr design language as “timeless” rather than trend-driven, noting the collection’s simple forms and saturated colors lower intimidation barriers for mainstream adoption.

He argued that recognizable silhouettes and joyful palettes create lasting brand equity beyond speculation cycles.

Early adopters who participated in November’s Genesis Event received the NFTs at no cost beyond their initial platform engagement.

The event centered on the launch of Hyperliquid’s native HYPE token and HyperEVM programmability layer.

Notably, DripTrade’s over-the-counter system enabled pre-launch trading through collateralized agreements requiring sellers to fulfill transactions within seven days of receiving NFTs or forfeit deposited security.

This mechanism allowed price discovery even before official distribution.

Security Breaches Threaten Ecosystem Credibility

The Hypurr NFT theft follows three major security incidents targeting Hyperliquid projects within one week.

HyperDrive DeFi lost $773,000 through router contract vulnerabilities that enabled arbitrary function calls, while HyperVault developers executed a $3.6 million exit scam after ignoring community warnings about fabricated audit claims.

Previous exploits include the March JELLY token manipulation, which cost $13.5 million, and the “ETH 50x Big Guy” trader, who netted a $1.8 million profit while causing $4 million in vault losses.

This incident prompted a reduction in maximum leverage limits from 40x to 25x for major cryptocurrencies.

Competition intensifies as ASTER DEX processes over $13 billion in daily perpetual futures volume, compared to Hyperliquid’s reduced activity.

ASTER’s Trust Wallet integration provides 100 million users with direct access to perpetual contracts, challenging Hyperliquid’s market dominance.

Arthur Hayes exited his entire HYPE position with a $823,000 profit, citing the massive token unlocks worth $11.9 billion that were set to start on November 29.

He recently polled followers about re-entering after HYPE dropped 23% weekly to $35.50.

However, community members have proposed blacklisting Hayes from purchasing HYPE, with some labeling his trades as the “ultimate sell signal.”

Despite security challenges, Hyperliquid launched its USDH stablecoin, generating $2.2 million in early volume, while Native Markets secured the issuance mandate through a competitive governance voting process.

The platform also activated HYPE/USDH spot trading following Native Markets’ commitment to stake 200,000 tokens for a period of three years.

HYPE traded up 4.65% following the Hypurr launch, reaching $47.14 as community enthusiasm temporarily overshadowed ongoing security concerns and competition threats across the broader ecosystem.

The post Hyperliquid’s Hypurr NFTs Hit $76K Floor Price, But Hacker Steals 8 for $400K Profit appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

HyperDrive DeFi loses $773,000 in router vulnerability exploit as second major Hyperliquid ecosystem breach in 72 hours.

HyperDrive DeFi loses $773,000 in router vulnerability exploit as second major Hyperliquid ecosystem breach in 72 hours.