U.S. spot Bitcoin exchange-traded funds (ETFs) have recorded their strongest inflows in nearly three months, showing a renewed wave of institutional interest as Bitcoin traded near record highs.

According to data from Farside Investors, Bitcoin ETFs attracted $1.19 billion in net inflows on Monday, the highest single-day total since July 10, when inflows reached $1.18 billion.

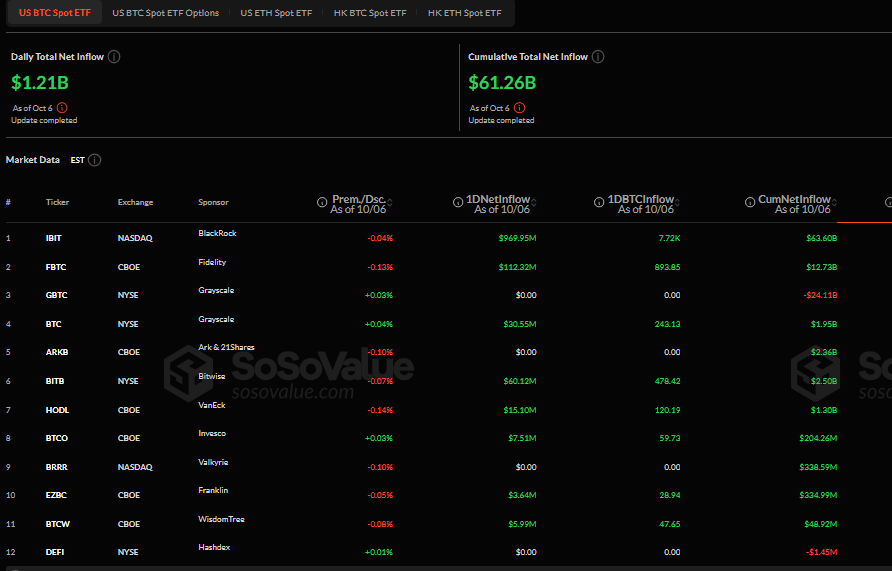

BlackRock’s iShares Bitcoin Trust (IBIT) dominated the surge, accounting for more than 81% of total inflows with $970 million added in a single day. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $112.3 million, while Bitwise’s BITB recorded $60.1 million.

BlackRock’s IBIT Leads Record $6B Crypto ETF Inflows

The renewed appetite for Bitcoin exposure coincides with a major milestone for BlackRock’s IBIT, which has now overtaken some of the firm’s legacy funds to become its highest-revenue-generating ETF.

Bloomberg ETF analyst Eric Balchunas noted that IBIT is now “a hair away from $100 billion” in assets under management (AUM), just 21 months after launch.

The fund currently manages $98.47 billion across 1.38 billion shares with a 0.25% fee, generating roughly $244 million in annual revenue for the world’s largest asset manager.

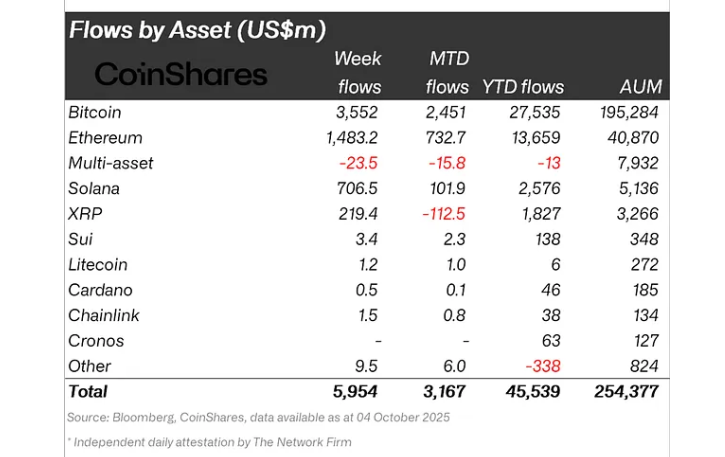

Monday’s inflows also capped off a record week for Bitcoin-linked investment products. Data from CoinShares showed that digital asset funds globally attracted $5.95 billion last week, the largest weekly inflow on record.

Bitcoin accounted for $3.55 billion of that figure, while Ethereum saw $1.48 billion, followed by Solana and XRP with $706.5 million and $219.4 million, respectively.

Bitcoin itself has been trading just below all-time highs, hovering around $124,500 on Tuesday after briefly crossing $126,000 earlier in the week. The latest surge came as institutional traders piled in over the weekend, sending Bitcoin past $125,000 for the first time since August.

October has historically been one of Bitcoin’s stronger months, and the token is already up more than 10% since the start of the month.

Data from SoSoValue shows that as of October 6, total cumulative net inflows into U.S. Bitcoin spot ETFs reached $61.26 billion, with total assets under management now at $169.54 billion, representing about 6.8% of Bitcoin’s total market capitalization.

Meanwhile, Ethereum spot ETFs have also benefited from the broader crypto rebound. As of October 6, they recorded $181.7 million in daily inflows and $14.6 billion in cumulative inflows, with total net assets now sitting at $32 billion, about 5.6% of Ethereum’s market capitalization.

Bitcoin Faces Short-Term Correction After Record Rally, Analysts Eye Key Support Levels

Bitcoin slipped 4.2% on Tuesday to around $122,000 after hitting an all-time high of $126,219 the previous day, pausing a week-long 12.5% surge. While the pullback sparked concerns of a deeper correction, derivatives data and institutional flows suggest the broader uptrend remains intact.

Bitcoin monthly futures continue to trade at an 8% annualized premium over spot prices, a level that reflects steady optimism without signs of speculative overheating. Analysts say this moderation helps reduce liquidation risk if prices fall further.

The rally that began after Bitcoin’s $109,000 retest in late September appears supported by genuine inflows, with bulls defending the $120,000 zone.

Exchange data reinforces that narrative. Glassnode reports Bitcoin balances on trading platforms have dropped to a five-year low of 2.38 million BTC, down from 2.99 million a month earlier, indicating ongoing accumulation.

The firm also identifies strong support near $117,000, where around 190,000 BTC last changed hands.

Open interest in Bitcoin futures stands at $72 billion, slightly lower on the day but still showing deep market participation. Meanwhile, VanEck analysts project Bitcoin could eventually capture half of gold’s market capitalization, potentially reaching $644,000 per coin.

Technically, Bitcoin is testing key support near its 200-day exponential moving average around $122,900. Analyst Ted Pillow noted that momentum has weakened after the failure to hold above $125,000.

A close below $122,900 could trigger a pullback toward $121,000, while a rebound above $125,500 would restore bullish momentum.

Short-term charts show Bitcoin consolidating between a seller zone at $123,000–$125,000 and a strong buyer zone near $112,000–$114,000. Multiple rejections around the upper band suggest short-term exhaustion, though the broader structure remains bullish.

Market analysts say a correction toward $118,000 would be a “healthy retracement” within Bitcoin’s larger uptrend, a phase that could reset leverage and prepare the market for another leg higher.

The post Bitcoin ETFs Smash $1.19B Inflows Since July as BlackRock Leads — But Is a Correction Coming? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.