The latest wave of S-1 amendments suggests final preparations for spot XRP ETFs are underway, fueling fresh bullishness for XRP price predictions.

Some updated filings now include official tickers, a detail ETF Institute co-founder Nate Geraci cites as a sign the altcoin is “getting close” to approval.

Bloomberg’s own Senior ETF analyst Eric Balchunas notes these S-1s as the final barrier to approval after a major procedural shift by the SEC.

The agency’s adoption of generic listing standards has eliminated the need for 19b-4 filings, leaving only S-1 registration forms for review.

Under this framework, XRP qualifies as an eligible asset, placing it on the fast track to approval and paving the way for regulated spot exposure in U.S. TradFi markets

XRP Price Prediction: Is this the Catalyst That Puts $1,000 In Focus?

Fresh demand from TradFi markets could give XRP the momentum it needs to confirm the breakout of a year-long ascending triangle pattern.

Although the weekend’s mass liquidation event invalidated most short-term bullish setups, this wider structure remains in play.

Momentum indicators now refocus attention on the breakout, reaffirming $1.50 as a potential bottom.

The RSI has sharply reversed after dipping into oversold territory at 30, while the MACD histogram shows a possible bottom forming below the signal line—signaling buyers are returning as sellers lose steam.

The key breakout threshold sits at $3.40, a resistance level that has capped upside throughout the pattern. Once flipped to support, XRP could rally 210% toward its $8 technical target.

In the near term, however, traders should watch for a bounce from the $2.70 demand zone to confirm higher support for a sustained uptrend.

Looking further ahead, expanding exposure to U.S. TradFi markets and U.S. interest rate cuts to fuel risk-on sentiment could propel XRP toward $15 running into 2026—a potential 500% gain.

While the $1,000 XRP price target remains distant right now, these new touchpoints for mainstream capital inflows create a strong foundation for it to be realized long-term.

PepeNode: The New Way to Earn This Cycle?

Pepe took over the meme world last cycle, turning a viral frog into one of crypto’s biggest cultural moments.

Now, feeding off that same energy, a new offshoot, PepeNode ($PEPENODE), is adding something the original never had: real passive income.

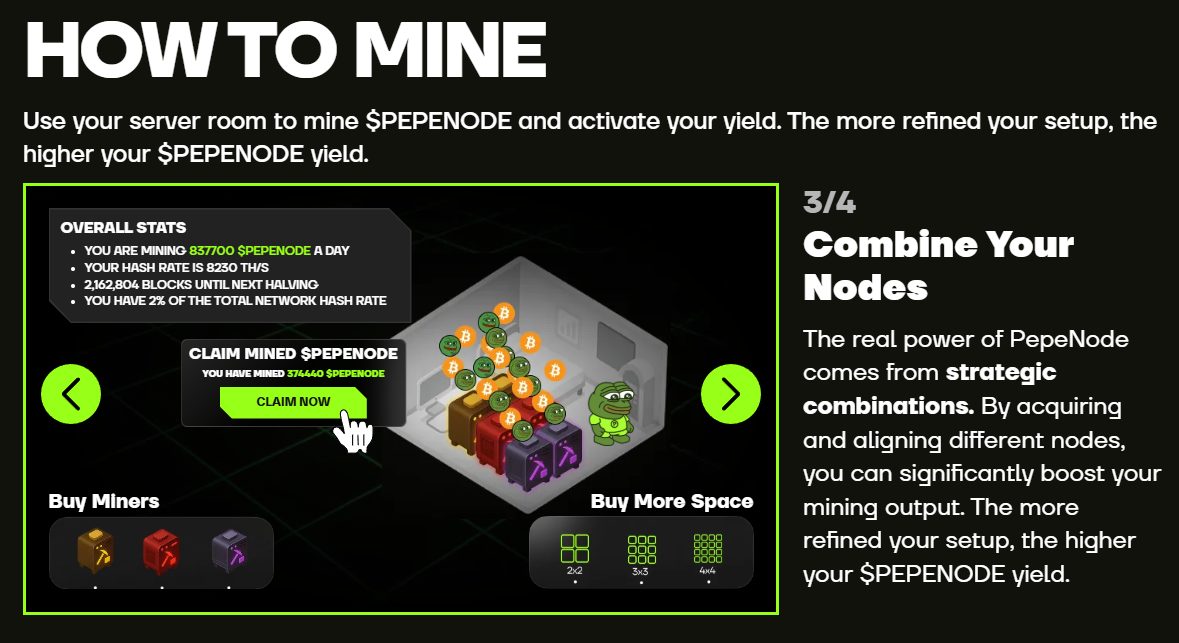

Other meme coins have tried before; Shiba Inu brought staking, but PepeNode goes a step further with a fresh mine-to-earn model.

Mining without any hardware needed.

Just log in, acquire virtual nodes, assemble rigs, and start generating rewards across proven meme coins.

The stats look solid too. The presale has already exceeded $1.7 million, while early stakers are still earning up to 740% APY before the next phase begins.

With the added fuel of 70% burns on all $PEPENODE spent on nodes and rigs, deflation supports long-term token value.

And the timing couldn’t be better. The macro narrative is driving capital back into risk assets like meme coins, making PepeNode’s rewards model even stronger as momentum builds across the sector.

Visit the Official Website Here

The post XRP Price Prediction: SEC Filings Hint at Imminent ETF Launch – Is This XRP’s Moment to Hit $1,000? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.