Bitcoin is back in focus as Elon Musk renews his support, calling it “energy-based” and “inflation-proof,” while the IMF warns of rising global market risks. At the same time, Japan’s Metaplanet faces a sharp valuation drop despite holding over $3.5 billion in BTC.

Yet, technical charts show BTC stabilizing near $111,000, with a triple-bottom pattern hinting at a possible breakout toward $130,000 as institutional demand strengthens.

Elon Musk Calls Bitcoin “Energy-Based and Inflation-Proof”

Elon Musk, CEO of Tesla, described Bitcoin as “energy-based” and “inflation-proof,” contrasting it with “fake fiat” currencies. He noted that BTC’s proof-of-work model prevents the creation of “fake energy,” unlike fiat money that governments can print at will.

Musk made the remarks in response to analyst ZeroHedge, who linked rising Bitcoin and gold prices to government spending on artificial intelligence.

This marks Musk’s most direct statement on Bitcoin in nearly three years, following his 2022 prediction of a prolonged bear market after the FTX collapse. His renewed endorsement underscores Bitcoin’s role as a hedge against inflation and its increasing relevance in an AI-driven economy, despite ongoing concerns about mining energy use.

Following Musk’s comments, Bitcoin regained momentum, rising toward $111,000 as investor sentiment improved and confidence in the asset’s long-term outlook strengthened.

IMF Warns of Global Market Risks

The International Monetary Fund warned that global markets are becoming complacent about risks such as trade tensions, high debt levels, and inflated asset prices. It cautioned that a sudden loss of confidence could trigger a “disorderly” market downturn.

The warning followed renewed tariff threats from former U.S. President Donald Trump, which briefly pressured both Bitcoin and equity markets. The IMF urged governments to tighten oversight of cryptocurrencies and stablecoins and reduce fiscal deficits.

Despite short-term volatility, Bitcoin’s quick recovery suggests traders remain confident in its long-term resilience.

Metaplanet’s Value Falls Below Its BTC Holdings

Metaplanet, Japan’s leading Bitcoin treasury firm, has seen its enterprise value drop below the worth of its Bitcoin assets for the first time. The company’s market-to-Bitcoin net asset value (mNAV) fell to 0.99, indicating that the market now values Metaplanet at less than its 30,823 BTC holdings, currently worth about $3.5 billion.

The decline comes after the company paused Bitcoin purchases for two weeks, despite its reputation as one of Asia’s most aggressive corporate Bitcoin accumulators. Metaplanet’s stock has fallen 75% since June, reflecting investor caution and broader uncertainty around Bitcoin treasury strategies.

Analysts, however, compare the reaction to early skepticism toward Tesla, arguing the selloff reflects market mispricing rather than weakness in Metaplanet’s model. They note that the company’s large Bitcoin reserve and long-term accumulation plan continue to support confidence in its balance sheet strength.

Meanwhile, Bitcoin traded steadily around $113,000, as analysts said Metaplanet’s holdings reaffirm institutional conviction in Bitcoin’s long-term growth potential.

Bitcoin Price Prediction: Triple-Bottom Setup Targets $130,000 Breakout

Bitcoin (BTC/USD) is forming a triple-bottom pattern near $109,600, a level that has triggered multiple reversals since late September. The setup indicates selling pressure is easing while buyers gradually regain control.

On the two-hour chart, the 100-period SMMA at $116,676 overlaps the 0.5 Fibonacci retracement at $116,108, forming a key resistance area that could restrict gains before a confirmed breakout.

The RSI has rebounded from oversold levels to 47, showing early bullish divergence and slowing downside momentum. A bullish engulfing candle above $114,500 would confirm the pattern and reinforce short-term buying strength.

Bitcoin remains inside a descending channel, but the TradingView path projection suggests a breakout toward $119,800, aligning with the 0.786 Fibonacci level. A close above $120,000 would signal a shift from consolidation to recovery, targeting $125,000 and $130,000 next.

Traders may look for long setups above $114,600 with stops below $109,500, eyeing $119,800 as the initial target. A move above the 100-SMA would confirm trend reversal potential. With volatility easing and institutional accumulation picking up, Bitcoin’s current base may serve as the foundation for a sustained Q4 rally.

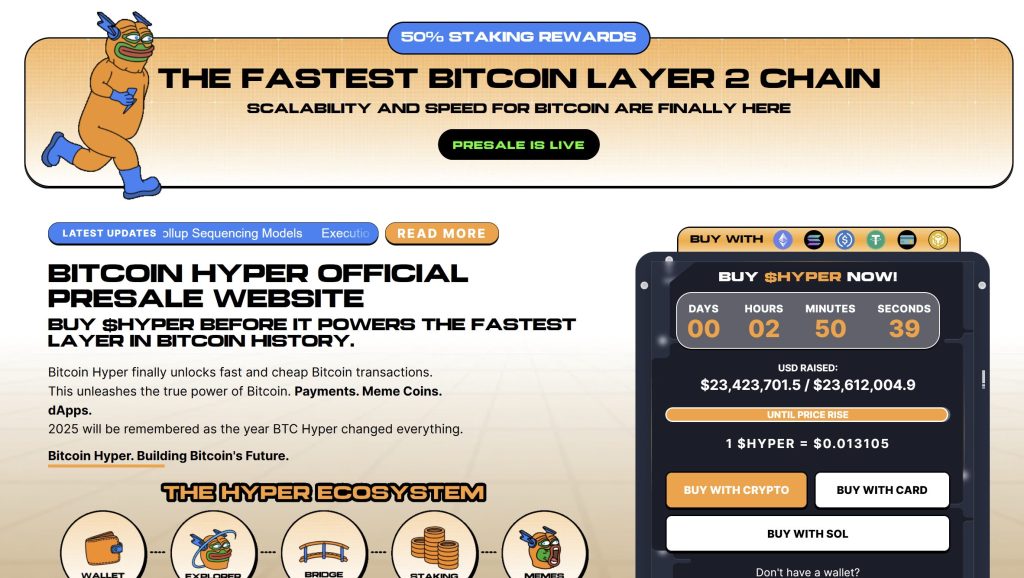

Bitcoin Hyper: The Next Evolution of Bitcoin on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $23.4 million, with tokens priced at just $0.013105 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Nears $111K as Musk Backs BTC, Metaplanet’s $3.5B Bet Faces Test appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

Elon Musk says, “

Elon Musk says, “