Bitcoin is hovering around $101,800 after a steady decline pushed it below the October 10th low. This level is being watched by market analysts as it matches an earlier area where liquidity was absorbed.

With selling pressure increasing and market activity rising, this point could play an important role in what happens next.

Price Tests Liquidity Area Below October Crash

Bitcoin has seen a drop of over 10% in the last seven days. It is now trading just above $100,000, near a zone that some consider critical. Analyst Michaël van de Poppe said he is watching to see what happens “when Bitcoin takes the liquidity from the October 10th crash.” He pointed out that this could lead to a bounce or mark the start of a bottoming phase.

Really keen to be seeing what’s happening when #Bitcoin takes the liquidity form the October 10th crash.

That should be a key point for potential bounces/bottom formations.

Disastrous start of the month.

$112K remains the crucial level for any new ATH attempt. pic.twitter.com/x6fDoQBTIk

— Michaël van de Poppe (@CryptoMichNL) November 4, 2025

Notably, the price has moved between $99,000 and $104,500 in the past 24 hours (CoinGecko data). Its all-time high remains at $126,080, which it hit 30 days ago. Van de Poppe also noted that a move back to $112,000 would be needed before any serious talk of a new high can begin.

Bullish Signals and Recovery Scenarios

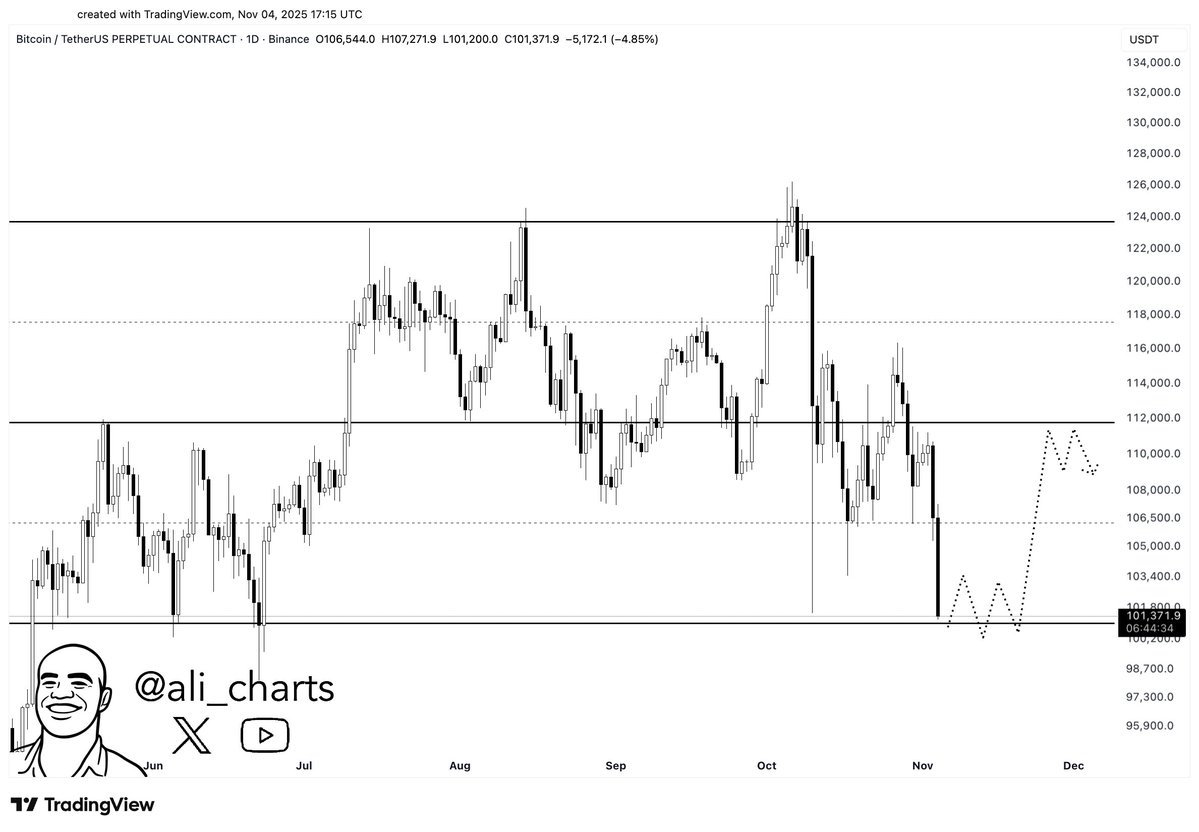

Analyst Ali Martinez stated, “Bitcoin could rebound here to at least $106,500 or $112,000.” The support zone around $100,000 has acted as a base before and may do so again if selling slows.

Based on his chart, there are two likely paths: a quick rebound or a small dip before recovering. In both, the first target sits around $106,500.

Another analyst, CryptoBull_360, stated that Bitcoin has broken out of an ascending wedge pattern with strong volume. He noted that the price is still trading above the 50-day moving average, which is acting as support.

“The price is expected to retest the breakout level, and a break below the 50-day moving average could trigger further declines,” he said.

Bearish Pressure and Liquidity Risks Remain

Not all signals point to recovery. Analyst Ted pointed to two areas with large liquidity: around $90,000 and near $126,000. He warned that “a dump to fill the CME gap before reversal could happen.” The option market is showing smaller moves, which often means traders are unsure and staying out for now.

Reports also show that recent buying has not gained much strength. Self-custody is rising, but buyers aren’t stepping in with enough volume. Meanwhile, treasury firm Sequans Communications sold 970 BTC, cutting its holdings by nearly one-third. The firm used the sale to reduce its debt from $189 million to $94.5 million.

So far, the zone between $100,000 and $102,000 is holding, but pressure remains. Whale wallets sold off $272 million worth of Bitcoin, as previously reported. If that trend continues, bulls may struggle to defend current levels.

The $112,000 mark remains a key area for any larger recovery. Until that point is regained, Bitcoin may stay in a holding pattern.

The post Crypto Panic or Buying Opportunity? Bitcoin (BTC) Hits Key Zone appeared first on CryptoPotato.

Bitcoin hovers near $100K after a 10% drop. Analysts eye key support and liquidity zones for signs of a possible rebound or breakdown. Crypto Bits, Crypto News, Bitcoin (BTC) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.