TLDR

- Uber stock dropped over 5% Tuesday despite Q3 revenue of $13.47 billion beating analyst forecasts

- Jim Cramer recommends buying the dip, calling Uber a reliable profit engine with strong fundamentals

- BofA Securities increased price target to $119, implying 26% upside from current trading levels

- Mobility growth jumped 19% year-over-year while trip volume surged 22% in the quarter

- Stock maintains 57% gain for 2025 with analysts showing Strong Buy consensus rating

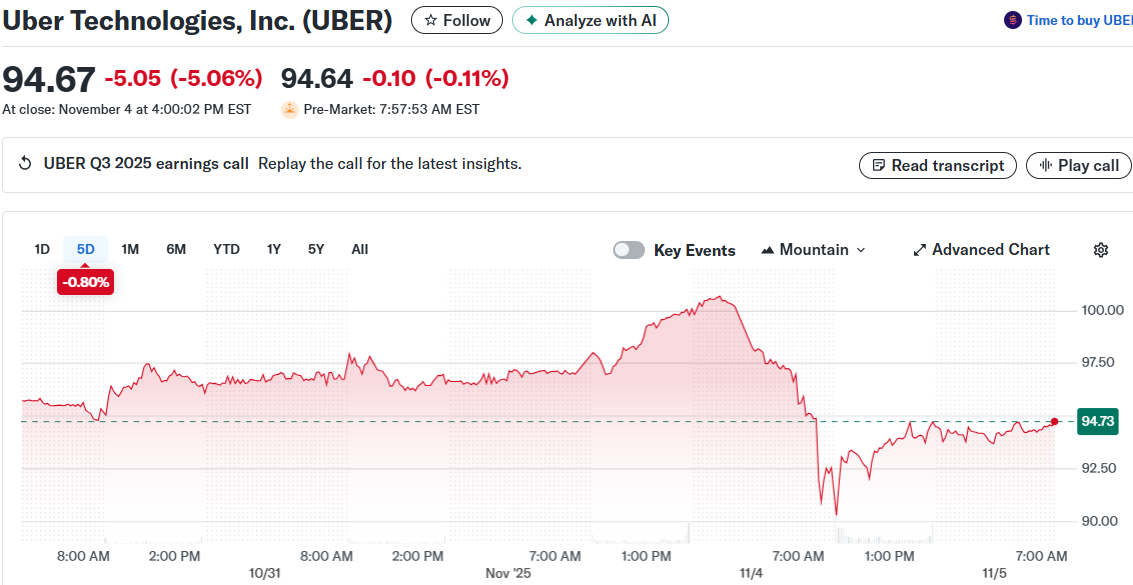

Uber stock fell more than 5% on Tuesday following third quarter earnings that exceeded Wall Street expectations. The drop puzzled some investors given the company’s strong financial performance.

Revenue reached $13.47 billion, topping analyst estimates of $13.26 billion. Earnings per share hit $1.20, crushing the consensus forecast of $0.69 by nearly 74%.

Jim Cramer told Mad Money viewers the selloff created a buying opportunity. He called Uber a “buy on weakness” and dismissed concerns about the quarter.

The company posted EBITDA of $2.26 billion. That came in slightly below Street expectations of $2.27 billion but showed 33% growth year-over-year.

Uber remains up 57% in 2025. The gains reflect consistent performance across Rides and Delivery operations.

Analyst Targets Point Higher

BofA Securities raised its price target to $119 from $115 while maintaining a Buy rating. The new target represents 26% upside from Tuesday’s close at $94.67.

Mobility growth accelerated to 19% year-over-year excluding foreign exchange impacts. Trip volume increased 22% during the same period.

Profit margins expanded 1.6 percentage points to 16.8%. The company grew platform engagement while strengthening its market position.

Cramer highlighted the Uber One membership program’s success. The subscription service drives customer loyalty and recurring revenue streams.

Some investors worried about margin pressure from competition. Cramer said Uber’s scale and efficiency maintain its competitive edge over DoorDash and Lyft.

Strong Fundamentals Drive Confidence

Adjusted costs grew 18% in the quarter, up from 15% in Q2. The increase funds growth initiatives across the platform.

BofA noted that while margin expansion slowed, profit growth remains robust. The firm sees continued gains in market share.

Cramer attributed the stock decline to broader market weakness rather than company-specific issues. He called it “a tough tape day” unrelated to Uber’s fundamentals.

TipRanks data shows a Strong Buy consensus from 27 Buy ratings and 4 Hold ratings. The average analyst price target of $110.61 implies 16.92% upside potential.

Trailing twelve-month revenue stands at $49.61 billion. EBITDA for the same period reached $5.29 billion.

Growth came from membership benefits, demand for budget-friendly ride options, and retail delivery expansion. Trip volume gains supported the mobility segment’s performance.

Cramer told investors not to worry about the quarterly results. “I’d be a buyer into weakness after today’s pullback and tomorrow’s uncertainty,” he said during his show.

The stock traded near its 52-week high of $101.99 before Tuesday’s decline. Analysts maintain bullish outlooks based on the company’s execution and growth trajectory.

The post Uber Stock: Cramer Says Buy the Dip After Post-Earnings Selloff appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.