Interest in dependable, revenue-backed yield has risen as users acknowledge that most major blockchains still struggle to provide sustainable on-chain returns. Bitcoin has no native yield mechanism, and Ethereum’s staking payouts fluctuate according to validator issuance and network-wide inflation.

These limitations have intensified discussion around ecosystems designed around real protocol revenue. XRP Tundra fits directly into that shift, presenting a staking architecture built on measurable economic activity across its DeFi products rather than inflation-driven token minting. As a result, its yield structure diverges sharply from what Bitcoin and Ethereum can offer today.

Structural Limitations in Bitcoin and Ethereum’s Yield Frameworks

Bitcoin remains a non-yielding asset at the protocol level. Any returns must come through centralized lenders, custodial platforms or leveraged derivatives — all dependent on counterparty solvency and market cycles. When liquidity contracts, yields evaporate, revealing how fragile external dependency can be.

Ethereum provides on-chain staking, yet its reward system is inseparable from inflation and validator issuance. As more ETH is staked, rewards compress. The protocol does not generate revenue for stakers; instead, it redistributes inflationary issuance and priority fees. This creates a model where returns rise and fall with staking saturation rather than with genuine economic output.

Commentary from channels such as Crypto Goat has highlighted that the industry is steadily moving toward revenue-share models similar to traditional finance, where returns come from activity, not issuance. That trend shapes the context in which XRP Tundra has attracted attention.

XRP Tundra’s Revenue-Backed Model Establishes a Different Yield Standard

XRP Tundra was built to deliver the type of yield framework Bitcoin and Ethereum cannot. Its architecture splits execution and governance into two tokens: TUNDRA-S on Solana, which drives high-speed DeFi activity, and TUNDRA-X on the XRP Ledger, which anchors governance, reserves and future GlacierChain L2 functionality.

What sets the project apart is the source of its returns. All Cryo Vault rewards are funded from real protocol revenue. Every swap, borrow, lend, bridge or derivatives transaction on TUNDRA-S generates fees that go directly into the staking vault. Frost Key NFT mints add another continuous revenue stream, and a percentage of fees is used to market-buy and permanently lock TUNDRA-X, creating increasing scarcity without inflating supply.

Both tokens are hard-capped, with no mint functions and no inflation. APYs rise when revenue increases and adjust downward when activity slows. This mirrors the proven models used by GMX and Gains Network — systems praised for transparency and sustainability.

Verification is a core part of the project’s positioning. Independent audits from Cyberscope, Solidproof and FreshCoins, plus full team KYC through Vital Block, reinforce the project’s credibility.

For those researching whether XRP Tundra is legit, they can check the following article.

Staking Tier Comparison: How Tundra Provides Flexibility Bitcoin and Ethereum Lack

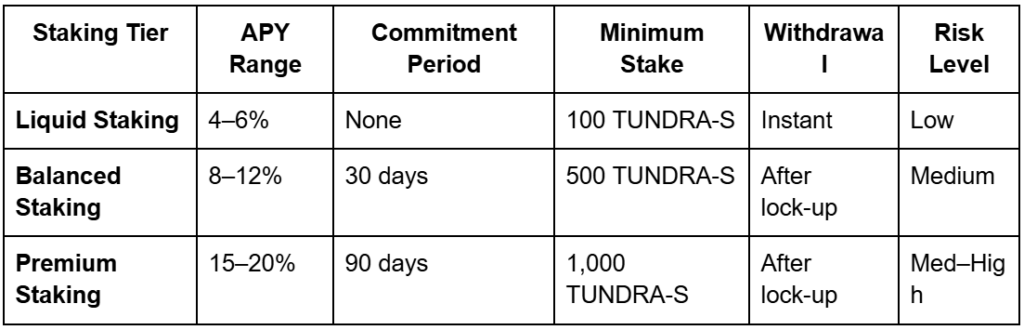

The structure of XRP Tundra’s staking system is another key point of contrast. Instead of a single yield mechanism, the platform offers multiple tiers with predictable, revenue-backed returns. The following comparison table outlines the differences in a newsroom format:

This tiered model allows users to choose between flexibility and higher rewards, with each tier funded by protocol fees rather than token inflation. Bitcoin cannot offer such a system at the protocol level, and Ethereum’s saturated validator landscape cannot provide comparable non-inflationary returns.

Alongside staking, XRP Tundra’s Arctic Spinner introduces instant bonuses based on purchase size — a feature absent from Bitcoin and Ethereum ecosystems. Users earn spin rewards that can grant immediate additional TUNDRA-S allocations, creating a supplementary incentive that does not alter supply or rely on lockups. For long-term participants, this system adds a second layer of value on top of Cryo Vault yields.

Why Analysts See XRP Tundra as a Superior Yield Option to Bitcoin and Ethereum

When compared directly, the distinctions become clear. Bitcoin offers no native yield and depends on external entities for returns. Ethereum provides on-chain rewards, yet those returns are tied to inflation and validator behavior. XRP Tundra delivers yield grounded in verifiable revenue, supported by a dual-token design, audited contracts, a fixed supply and a transparent dashboard.

With Phase 12 pricing at $0.214 for TUNDRA-S plus an 8% bonus — and free TUNDRA-X at a reference value of $0.107 — the presale offers early exposure ahead of confirmed listing prices of $2.5 and $1.25. More than $3.5M raised so far reflects the market’s interest in a staking platform designed for sustainable returns.

As the broader DeFi landscape shifts toward revenue-based models, XRP Tundra offers a yield structure Bitcoin and Ethereum cannot match.

Interested investors can secure their Tundra position and explore a yield model that outperforms Bitcoin and Ethereum.

Check Tundra Now: official website

Security and Trust: SolidProof audit

Join the Community: Telegram

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and to do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post How XRP Tundra Outpaces Bitcoin and Ethereum in Offering Real DeFi Yield Opportunities appeared first on CryptoPotato.

Interest in dependable, revenue-backed yield has risen as users acknowledge that most major blockchains still struggle to provide sustainable on-chain returns. Bitcoin has no native yield mechanism, and Ethereum’s staking payouts fluctuate according to validator issuance and network-wide inflation. These limitations have intensified discussion around ecosystems designed around real protocol revenue. XRP Tundra fits directly Projects

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.