TLDR

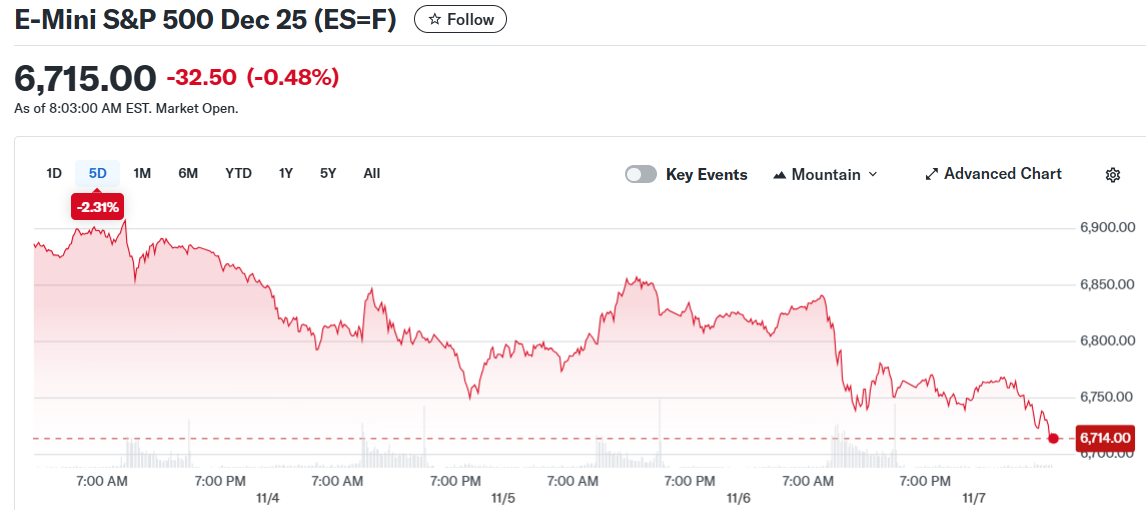

- Stock futures remained mostly flat Friday morning as Wall Street prepared to finish a volatile week with major indexes tracking toward steep losses

- The S&P 500 is on pace for its worst November performance since 2008 with the index down approximately 4% for the month

- Nvidia experienced extreme volatility Thursday, swinging from a 5% gain to a 2% loss despite reporting better-than-expected earnings results

- Bitcoin continued declining Friday, trading near $84,000 after falling below $87,000 Thursday, marking a sharp retreat from recent record highs

- Weekly losses are mounting with the S&P 500 down over 2% and the Nasdaq facing a decline exceeding 3% for the week

US stock futures showed minimal movement Friday morning as investors braced for the close of another challenging week. Nasdaq 100 contracts edged higher by 0.1% while S&P 500 futures remained nearly unchanged.

The S&P 500 is tracking toward its weakest November since the 2008 financial crisis. Technology stocks have led the decline despite several companies reporting strong quarterly results.

Dow Jones Industrial Average futures gained 0.2% in early trading. The blue-chip index has weathered the recent selloff better than technology-focused benchmarks.

Nvidia Earnings Trigger Wild Market Swings

Nvidia released its quarterly earnings Wednesday with results that topped Wall Street estimates. CEO Jensen Huang presented figures that initially pushed the stock higher.

Thursday brought dramatic reversals across technology stocks. Nvidia shares climbed as much as 5% before erasing all gains to finish down more than 2%.

The chip maker’s price action set the tone for other semiconductor companies. The broader tech sector followed Nvidia’s path with the Nasdaq Composite giving back a 2.5% intraday gain to close down nearly 2%.

Both the S&P 500 and Nasdaq are now trading at their lowest points since September. The selloff has spread beyond the technology sector into other market areas.

For November, the S&P 500 has dropped around 4% while the Nasdaq has fallen over 6%. Weekly losses are also piling up with the S&P 500 down more than 2% and the Nasdaq off over 3%.

Bitcoin Extends Losses Below $85,000

Cryptocurrency markets joined the broader asset decline on Friday. Bitcoin traded around $84,000 per token as selling pressure continued.

The world’s largest cryptocurrency fell below $87,000 on Thursday. This represents a steep drop from the record highs Bitcoin reached slightly over a month ago.

September Jobs Report Creates More Questions

Thursday brought the delayed release of September’s employment data. The report showed hiring numbers that surpassed the low expectations set by economists.

However, the unemployment rate increased to its highest level in nearly four years. This combination of data points left market participants uncertain about economic conditions.

The jobs figures provided little clarity on Federal Reserve policy direction. Most market expectations still point to the Fed keeping rates unchanged at its December meeting.

Several Federal Reserve officials are scheduled to speak Friday. Their comments may offer additional insight into the central bank’s thinking on interest rates.

The University of Michigan will publish its final November consumer confidence reading Friday. The preliminary report indicated confidence levels near a three-year low.

The S&P 500 and Nasdaq are both sitting at their lowest levels since September as the week draws to a close.

The post Why Are Stocks Down Today? appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.