TLDR:

MicroStrategy (MSTR) stock hit a 25-year high of $235.89, rising over 7% on October 25th

The company holds 252,222 BTC, worth approximately $17 billion at current prices

MSTR/BTC ratio reached an all-time high of 0.00346, exceeding 2021 bull run levels

Stock is up 244% year-to-date and 55% over the past month

Market analysts set next target at $245 for MSTR stock

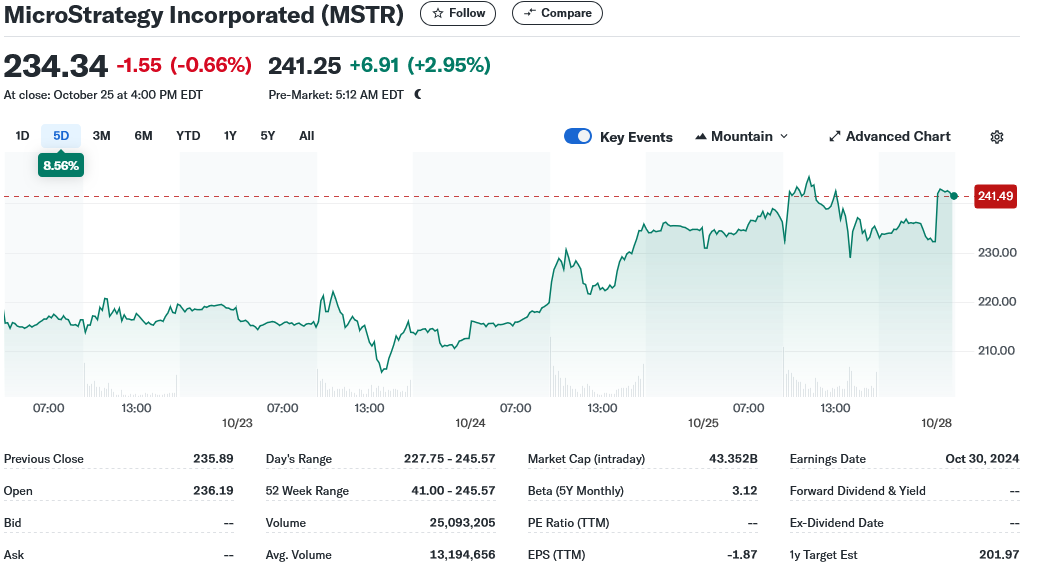

MicroStrategy, the world’s largest corporate holder of Bitcoin, reached a new milestone as its stock hit a 25-year high of $235.89 on October 25, 2024. The company’s shares rose more than 7% in Thursday’s trading session, continuing a six-week rally ahead of its scheduled third-quarter earnings report.

The Virginia-based company currently holds 252,222 Bitcoin, valued at over $17 billion with Bitcoin trading at $67,392. This massive cryptocurrency position has helped drive MicroStrategy’s stock to new heights, with shares up 244% year-to-date and 55% in the past month alone.

MicroStrategy Incorporated (MSTR)

Market data reveals that MicroStrategy’s stock-to-Bitcoin ratio has reached an unprecedented level of 0.00346, surpassing the previous peak seen during the 2021 cryptocurrency bull run. The company’s market capitalization now stands at $47 billion, marking a remarkable transformation since its pivot to Bitcoin in 2020.

The company’s journey to this point began in August 2020, when it shifted its business model from software development to focus on Bitcoin acquisition. Since then, MicroStrategy has raised $4.25 billion through equity offerings to fund its cryptocurrency purchases.

Mark Palmer, a market analyst, notes that the company has achieved a 17.8% yield since implementing its Bitcoin strategy. Analysts have set a new target of $245 for the stock, reflecting continued optimism about the company’s direction.

The company’s performance has outpaced many of its peers in the S&P 500 index, including tech giant Microsoft. MicroStrategy’s share price has increased by approximately 1,600% over the past four years, demonstrating the success of its Bitcoin-focused strategy.

Michael Saylor, MicroStrategy’s executive chairman, remains committed to the company’s Bitcoin strategy. He recently made headlines with a social media post directed at Microsoft CEO Satya Nadella, suggesting potential cryptocurrency-related opportunities.

However, the company’s Bitcoin-centric approach has not been without challenges. MicroStrategy has expanded its convertible note offering to fund Bitcoin purchases, with most notes not maturing until 2032. This financial structure has raised concerns among some market observers about the company’s exposure to cryptocurrency market volatility.

The company’s stock is currently trading at its highest premium over its Bitcoin holdings in three years. Market data shows that investors value the company’s stock at 2.783 times its Bitcoin-equivalent net asset value.

MicroStrategy originally competed with companies like IBM Cognos, Oracle Corporation’s BI Platform, and SAP AG Business objects in the software analytics space. The company developed tools to analyze external and internal data for decision-making purposes before its strategic shift to Bitcoin investment.

Under Saylor’s leadership, the company maintains a strategy of acquiring Bitcoin at every opportunity. Despite criticism about the risks associated with this approach, particularly during market downturns, MicroStrategy has doubled down on its Bitcoin investments.

The company’s stock performance reflects growing institutional interest in Bitcoin, which has gained 6% over the past month and approaches the $70,000 mark. This alignment between MicroStrategy’s stock price and Bitcoin’s value demonstrates the company’s success in positioning itself as a proxy for cryptocurrency investment in traditional markets.

The recent price action continues a pattern of strong performance that has characterized MicroStrategy’s stock since its adoption of Bitcoin as a treasury asset. The company’s market value has grown substantially, reflecting both the appreciation of its Bitcoin holdings and investor confidence in its strategy.

Trading data from October 25 shows the stock maintaining its upward momentum, with steady volume supporting the price increase. This latest rally comes as part of a broader upward trend in both cryptocurrency markets and technology stocks.

The post MicroStrategy (MSTR) Reaches 25-Year Stock High as Bitcoin Holdings Value Tops $17 Billion appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.