TLDR

- Bitcoin trades sideways near $92,000 with weak spot demand and limited leverage keeping price range-bound

- Altcoin markets see sharp moves with Story’s IP up 40% weekly despite minimal on-chain activity

- US stock futures decline slightly ahead of crucial December CPI inflation data releasing Tuesday

- Gold reaches record $4,588 per ounce as dollar weakens following Federal Reserve chair investigation news

- JPMorgan Chase kicks off bank earnings season Tuesday morning with results before market open

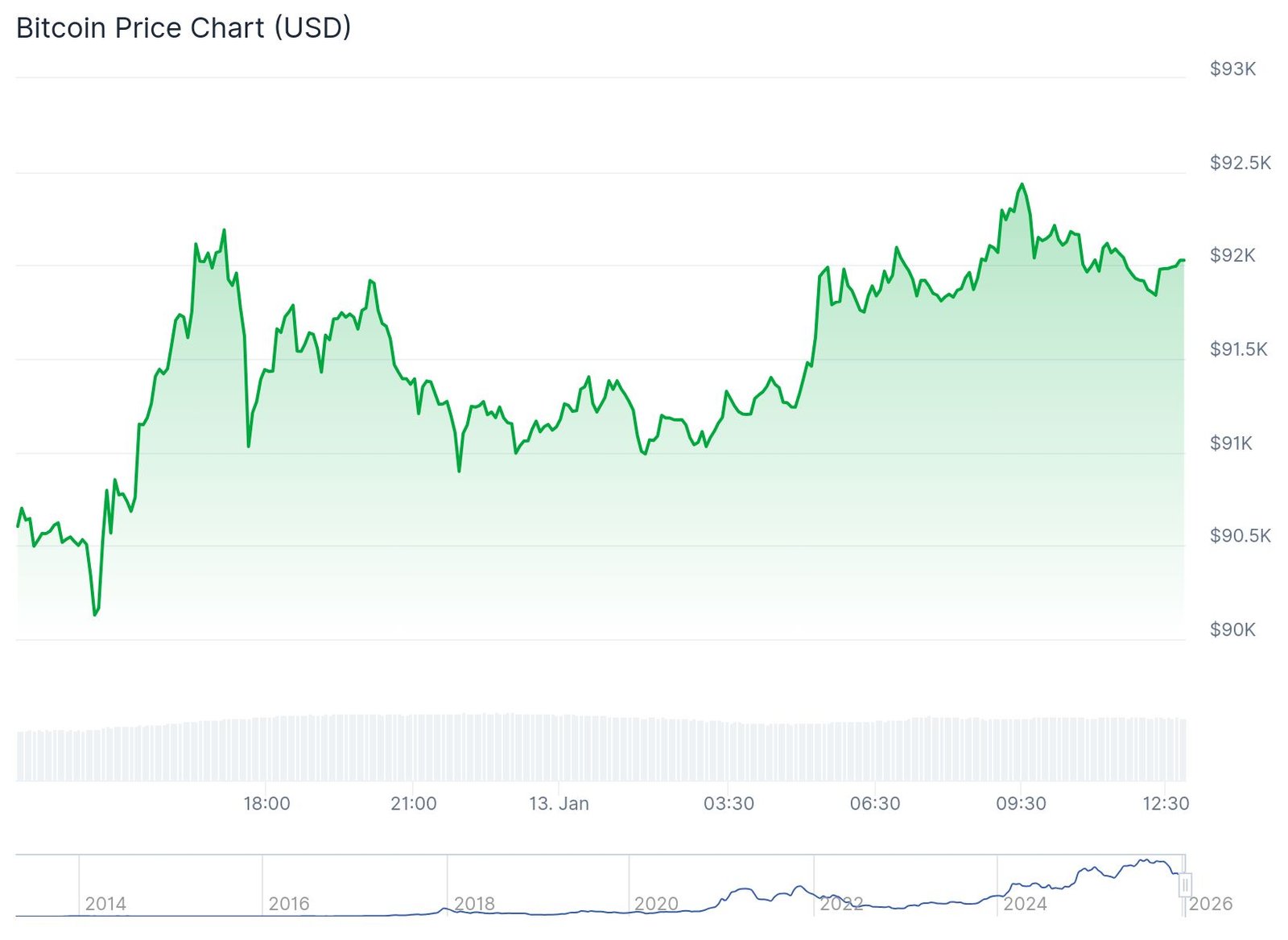

Bitcoin continues trading in a narrow range near $92,000 as crypto markets show limited directional momentum. The consolidation follows a period where leveraged positions were eliminated from the market.

Spot buying demand remains weak according to market analysis. Ethereum maintains its position above $3,000 but struggles to generate upward momentum.

This rebalancing process removes liquidity from Bitcoin markets. The reduced liquidity contributes to Bitcoin’s inability to break out of its current trading range.

Altcoin Trading Shows High Volatility

Data shows the project has $4.75 million in total value locked. Daily fees and revenue amount to just $27 while decentralized exchange volume sits at roughly $220,000.

The token offers no incentive programs. Analysts attribute the price action to trader rotation between different cryptocurrencies rather than genuine user growth.

Glassnode’s weekly report indicates Bitcoin faces minimal downside risk with leverage removed. However, negative ETF flows and soft spot demand prevent sustained price increases.

Money circulates within the market instead of fresh capital entering. This environment allows Bitcoin to act as a stable base while smaller tokens experience sharp price swings.

Prediction markets assign high probability to Bitcoin staying near $90,000 through mid-January. Limited chances exist for moves above the mid-$90,000s according to current market pricing.

Stock Futures Drop Before Key Economic Data

US stock index futures moved lower Monday night as traders positioned ahead of inflation data. Dow Jones futures fell 0.1% while S&P 500 futures decreased by the same margin.

Nasdaq 100 futures declined 0.3%. The December consumer price index report releases Tuesday morning.

Economists surveyed by Bloomberg expect inflation remained unchanged last month. The data gains importance after December employment figures showed labor market cooling.

Interest rate futures currently price two quarter-point cuts in 2026. Markets expect the Federal Reserve to make the first cut in June based on CME Group data.

The S&P 500 and Dow Jones reached fresh record highs during Monday’s regular trading session. Markets largely dismissed news about a Justice Department criminal probe involving Fed Chair Jerome Powell.

Powell characterized the investigation as political pressure from President Trump. The president has repeatedly called for aggressive interest rate reductions.

Banking Sector Faces Challenges

Bank stocks experienced selling pressure after Trump proposed limiting credit card interest rates to 10% for one year. Trump also announced 25% tariffs on countries conducting business with Iran.

Earnings season begins Tuesday with JPMorgan Chase reporting before the opening bell. Bank of America, Citigroup, and Morgan Stanley follow with reports later this week.

Gold prices stabilized near $4,588 per ounce after rallying 2% to record levels. Silver declined 1.2% after a recent 6% surge.

Precious metals benefited from US dollar weakness. Concerns about Federal Reserve independence following the Justice Department probe supported gold demand.

The post Daily Market Update: Bitcoin Holds $92,000 as Stock Futures Fall Before CPI Inflation Data appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.