In the world of digital commerce, it’s easy to get lost in the metrics. We talk about conversion rates, churn percentages, and uptime stats. But behind every single data point is a human being making a decision. There is a moment of hesitation before clicking “Buy,” a feeling of frustration when a page loads slowly, or a sigh of relief when a favorite payment method appears on the screen.

Every year, we focus on the customer flows that matter most. Last year, we kept that momentum going with meaningful improvements across the journey. Our mission in 2025 was to smooth out the road beneath their feet, making every interaction—from the first click to the tenth renewal—feel natural, safe, and easy.

We focused on the human side of the transaction. Here is the story of how our product evolved to serve you and your customers better.

Making the World Feel a Little Closer

Imagine a shopper in Australia or Hong Kong finding your product. They love what they see, add it to their cart, and head to checkout. To make that moment even smoother, we invested more in expanding global payments—because we believe commerce shouldn’t have borders. By adding local bank transfers for key markets like Australia, Canada, the UAE, Singapore, and Hong Kong, we help you speak the local language of payments.

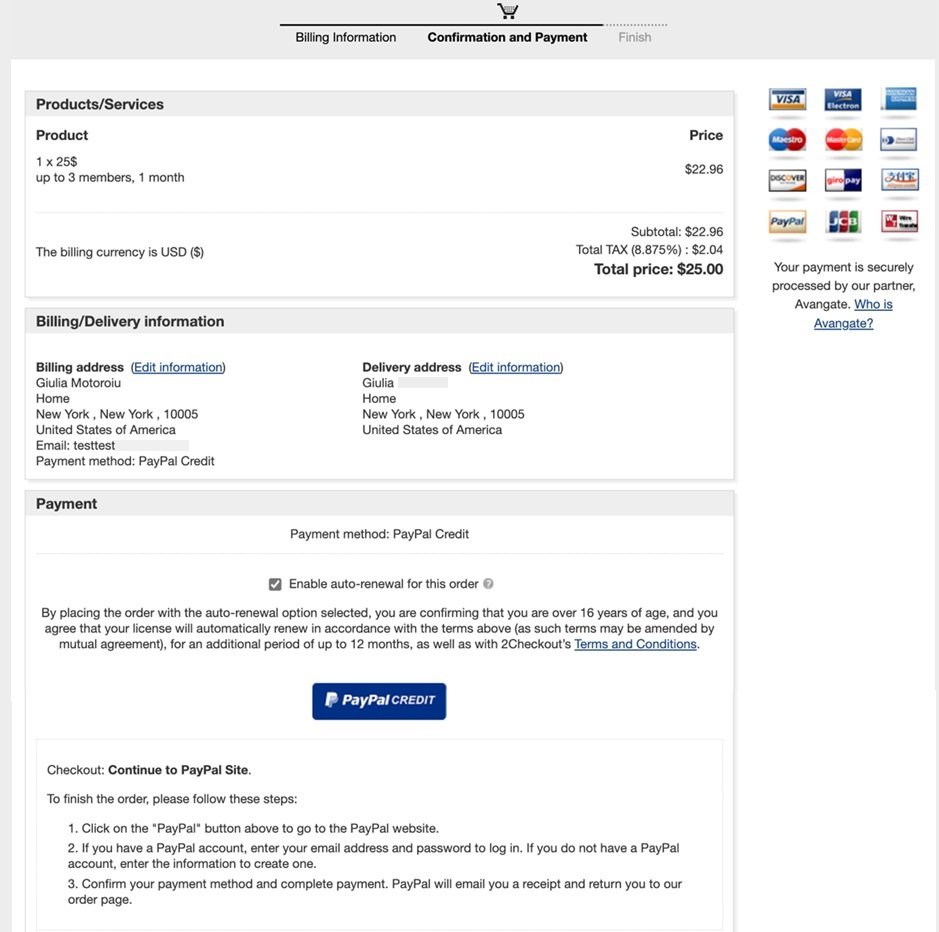

We also introduced PayPal Credit. This isn’t just a payment method; it’s a tool for flexibility. It allows your customers to finance larger purchases instantly, removing the financial friction that often stops a sale in its tracks.

Key takeaways:

- Expanded global payment coverage with local bank transfers in key regions.

- Introduced PayPal Credit to increase purchasing flexibility and conversion.

The Art of The Invisible Checkout

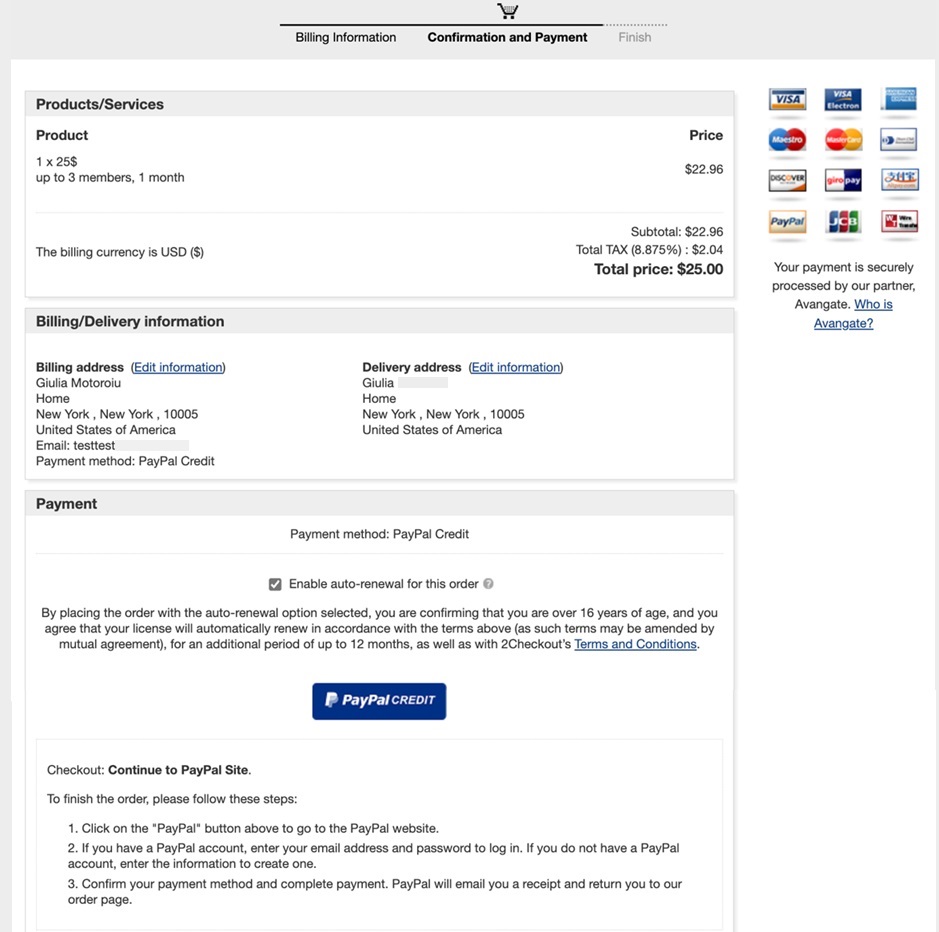

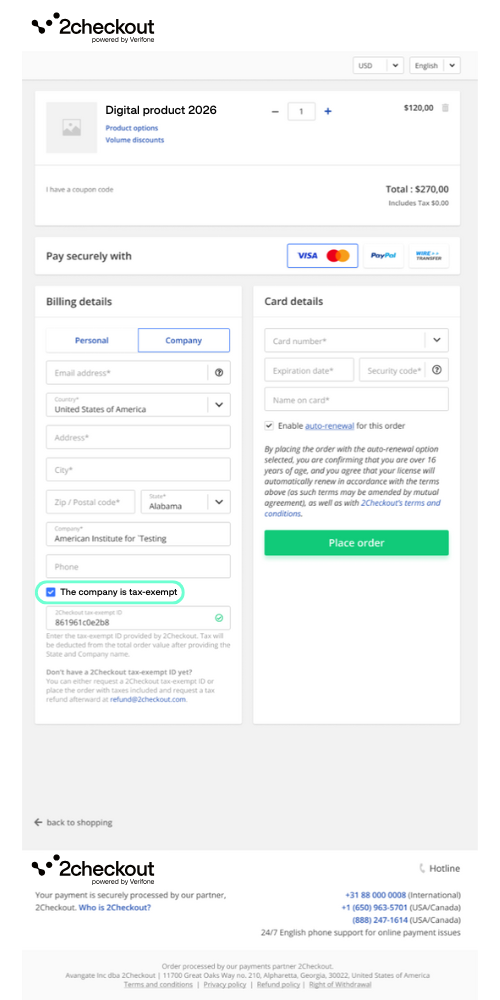

Checkout is where intent turns into action. When it works well, it stays out of the way and lets customers focus on the purchase. That’s the experience we continue to work toward every year. In 2025, we invested further in making checkouts faster, simpler, and more intuitive across our entire platform—regardless of which integration or solution our customers choose.

Alongside performance improvements, we refined key checkout capabilities across all our offerings, from ConvertPlus and Inline Cart to every cart solution.

We introduced Google Pay to speed up the checkout flow for customers and added support for sales tax exemptions handling for B2B transactions, and enhanced Partner and Channel Manager flows to give vendors more control and automation.

The goal was simple: remove friction so the technology fades into the background, allowing customers to focus fully on the excitement of their purchase.

Key takeaways:

- Modernized checkout flows with faster, scalable technology.

- Added Google Pay and tax exemptions for US businesses.

- Enhanced Partner and Channel Manager flows for more control and automation.

- Delivered frictionless, adaptive, and intuitive checkout experiences.

Security as a Silent Guardian

Fraud never stands still, and neither do we. Attackers constantly change tactics, which means static rules aren’t enough. Our fraud engine evolves continuously, analyzing new threat patterns, unusual transaction behavior, and emerging attack vectors in real time.

Our adaptive, context-aware monitoring works silently in the background, allowing real shoppers to glide through checkout without interruption, while potential threats are blocked automatically. This approach strengthens fraud prevention, keeps the checkout flow smooth, and maintains the trust and confidence your customers expect.

Key takeaways:

- Strengthened fraud prevention without disrupting the user experience.

- Adaptive, real-time security allows legitimate shoppers to check out smoothly while blocking threats.

Turning “Goodbye” into “Welcome Back”

Even with smooth checkouts, customers sometimes step away and return later. Instead of presenting this as a lost opportunity, our focus is on ensuring that any new functionality added to the checkout flow continues to serve returning shoppers seamlessly.

When customers come back, their items, shipping details, and preferred payment methods remain where they left them, making the process effortless. Additionally, we provide tools to configure customized emails through vendors’ accounts—crafted and refined using experimentation and data insights—to gently guide customers back to their carts and purchases.

Key takeaways:

- New checkout features are designed to support returning shoppers seamlessly.

- Vendors can configure customized, data-driven emails to engage returning customers.

Nurturing the Long-Term Relationship

For subscription businesses, the initial sale is just the first chapter. The real story is about retention. Nothing damages a relationship faster than a failed payment or a confusing renewal process.

Building on our existing payment reliability tools, we enhanced Smart Retries to further reduce involuntary churn. Leveraging intelligent data, the system now times retries to maximize the likelihood of success, helping keep customers subscribed seamlessly.

We also empowered your customers with more control. With multi-subscription management, shoppers can handle all their subscriptions in one go. By giving them the wheel, we reduce frustration and build the kind of trust that keeps them subscribed for years.

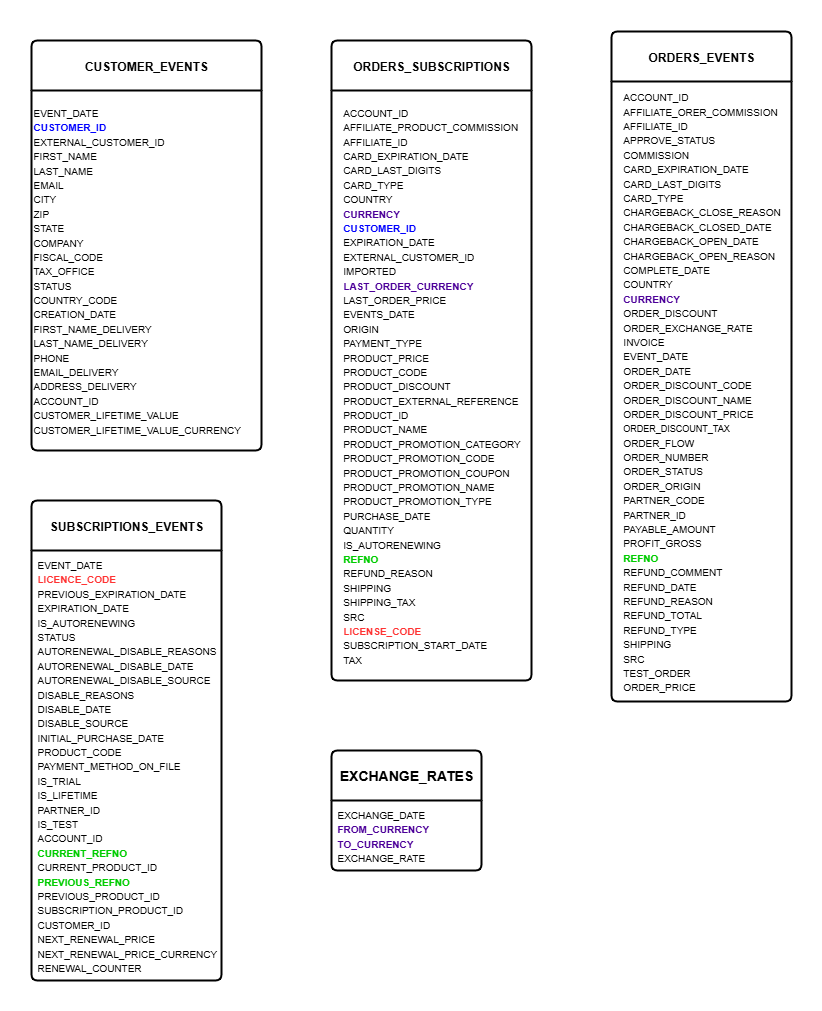

On top of that, we provided businesses with deeper insights into recurring revenue and subscriber behavior through raw data access via Snowflake integration. This allows subscription-based businesses to track trends, identify risks, and take proactive steps to retain customers before issues arise.

Key takeaways:

- Reduced involuntary churn with Smart Retries for failed payments.

- Gave customers more control through multi-subscription management.

- Enabled better retention strategies through Snowflake integration.

Staying Compliant in a Changing Landscape

In 2025, we made significant strides in updating our systems to align with the latest compliance standards. We have long maintained robust data protection measures to safeguard customer information and ensure our payment processes comply with the stringent requirements of various jurisdictions, and we continue to strengthen these systems to stay ahead of evolving standards.

Our commitment to compliance not only protects your business but also enhances the checkout experience for your customers. By staying ahead of regulatory changes, we help you avoid potential pitfalls and ensure that your operations remain seamless and trustworthy.

Key takeaways:

- Continuous updates to align with compliance requirements, including EEA regulations.

- Enhanced data protection measures to safeguard customer information.

- A commitment to maintaining trust and ensuring smooth transactions across all markets.

By prioritizing compliance, we empower your business to thrive in a complex regulatory environment, allowing you to focus on what matters most: building better journeys for your customers.

The Road Ahead

2025 was a year of connection. Every update, from backend API enhancements to frontend design refinements, was designed to elevate not just the act of shopping, but the entire experience around it.

We built a platform that is smarter, faster, and closer to your needs. Looking towards 2026, our mission continues: to create experiences that go beyond transactions, inspiring meaningful interactions, strengthening relationships, and unlocking new ways for you and your customers to grow together.

Ready to see how these stories unfold for your business?

Dive into your dashboard today to explore these new features, or contact our team to learn how we can help you craft better customer journeys.

The post 2Checkout’s 2025 Recap: A Year of Building Better Journeys appeared first on The 2Checkout Blog | Articles on eCommerce, Payments, CRO and more.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.