Pune, Dec. 07, 2024 (GLOBE NEWSWIRE) — Synthetic Intelligence in Fintech Market Measurement Evaluation:

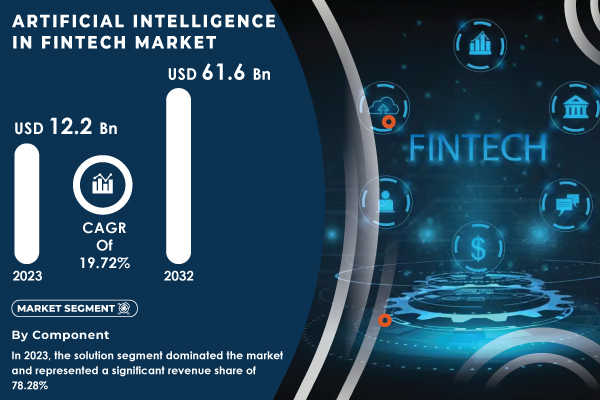

“The SNS Insider report signifies that the Artificial Intelligence (AI) in the Fintech market was valued at USD 12.2 billion in 2023 and is projected to develop to USD 61.6 billion by 2032, increasing at a compound annual progress price (CAGR) of 19.72% through the forecast interval from 2024 to 2032.”

The rising demand for Synthetic Intelligence (AI) within the fintech sector is pushed by monetary establishments and fintech corporations searching for to spice up the effectivity, accuracy, and buyer expertise of their choices. AI-driven applied sciences, equivalent to machine studying algorithms for fraud detection and AI-based chatbots for buyer help, are reshaping conventional monetary fashions, catalyzing a big shift inside the business. AI’s capability to course of giant volumes of information permits for extra exact danger assessments, predictions, and customized providers, enhancing each buyer satisfaction and operational effectivity. This offers early adopters a aggressive benefit within the quickly evolving market. AI additionally performs a vital position in enhancing cybersecurity throughout monetary methods. By detecting patterns and anomalies in real-time, AI is pivotal in figuring out and stopping fraudulent actions. Moreover, AI-powered chatbots streamline customer support operations, permitting customers to resolve points anytime, anyplace, boosting each effectivity and person expertise. As extra monetary establishments combine AI applied sciences, the market is poised for substantial progress, supported by authorities initiatives that promote digitalization and monetary inclusivity, additional driving AI adoption in fintech.

A key catalyst for AI’s position in fintech is its influence on monetary inclusion. AI and machine studying allow establishments to evaluate creditworthiness utilizing different information, granting entry to loans for people with out conventional credit score histories. This fosters higher monetary inclusion by enabling underserved populations to entry important providers like loans, insurance coverage, and credit score. AI has additionally revolutionized wealth administration with the rise of robo-advisors, providing customized funding recommendation at a fraction of the price of conventional advisors, making wealth administration providers extra accessible. This shift towards automated monetary advisory providers is predicted to considerably enhance the demand for AI in fintech.

Furthermore, AI’s capability to enhance decision-making and operational effectivity inside the fintech sector is driving its widespread adoption. Monetary establishments leverage AI to automate processes, reduce human error, and improve information evaluation capabilities, main to higher monetary predictions and insights. As the amount of information will increase, AI’s position in analyzing and extracting helpful insights will additional speed up market progress.

Get a Pattern Report of Synthetic Intelligence in Fintech Market@ https://www.snsinsider.com/sample-request/1259

Main Gamers Evaluation Listed on this Report are:

- Upstart – AI-driven mortgage origination platform

- Ant Group – Ant Monetary’s credit score scoring system

- Zest AI – AI-based credit score underwriting software program

- Cognitivescale – AI-powered monetary providers platform

- Kiva – AI-powered micro-lending platform

- PayPal – AI-based fraud detection system

- Mastercard – AI-driven fraud prevention options

- Credit score Karma – AI-driven credit score rating and monetary recommendation instrument

- Stripe – AI-powered fee processing and fraud detection

- Sq. – AI-based fee and point-of-sale options

- SoFi – AI-driven private finance and funding platform

- LenddoEFL – AI-based credit score scoring system utilizing different information

- Betterment – AI-powered robo-advisor platform

- Wealthfront – Automated AI-driven funding administration

- Kabbage – AI-powered small enterprise lending platform

- Onfido – AI-based identification verification and fraud detection

- IBM – Watson for Monetary Providers

- Nuance Communications – AI-powered voice biometric authentication

- Readability Cash – AI-based private finance administration app

- Finbox – AI-driven data-driven monetary evaluation platform

Synthetic Intelligence in Fintech Market Report Scope:

| Report Attributes | Particulars |

| Market Measurement in 2023 | USD 12.2 Billion |

| Market Measurement by 2032 | USD 61.6 Million |

| CAGR | CAGR of 19.72% from 2024-2032 |

| Base 12 months | 2023 |

| Forecast Interval | 2024-2032 |

| Historic Knowledge | 2020-2022 |

| Key Regional Protection | North America (US, Canada, Mexico), Europe (Jap Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Remainder of Asia Pacific), Center East & Africa (Center East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Remainder of Latin America) |

| Key Development Drivers | •Elevated reliance on AI-driven fraud detection methods to research transactions in actual time and improve safety

•Shift towards digital monetary providers accelerated by the pandemic and buyer preferences for on-line options. •Adoption of machine studying to research different information sources for correct credit score assessments and lowered defaults. |

Do you will have any particular queries or want any customization analysis on Synthetic Intelligence in Fintech Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1259

Segmentation Evaluation

By Deployment

In 2023, the on-premise accounted for the most important income share, at over 57.00%. On-premise deployment helps enterprises set up software program or providers on the premises/methods of a monetary establishment. The cloud section is predicted to develop on the highest CAGR within the interval, 2024 to 2032. Cloud-based AI algorithms study from historic information, determine present patterns, and supply suggestions, resulting in this progress. Cloud and AI have the potential to spice up productiveness, efficacy, and digital safety for information dealing with and authenticity and this automated course of eradicates the errors made by people whereas processing information. Many fintech corporations progressed in 2023 by leveraging synthetic intelligence within the monetary providers area. As an illustration, UnionBank within the Philippines used AI-based credit score scoring fashions to supply monetary providers to the unbanked inhabitants utilizing different information sources to develop credit score scores. Untapped communities have been capable of safe credit score that conventional banking methods lacked entry to via this initiative

AI is hosted within the cloud to study from the previous, present steering, and assess the present tendencies in AI. As an illustration, in 2023, U.S. Financial institution renewed a partnership with Microsoft to speed up the transformation of our banking operations on Microsoft Azure. This partnership is centered on not simply innovating quicker in digital banking however scaling its new merchandise quicker and enhancing experiences inside the buyer journey for the financial institution. U.S. Financial institution has additionally enabled the automation of core engineering, safety, and danger administration processes by way of the mixing of cloud applied sciences, shortening the time it takes to roll out new providers. This may even assist the financial institution in enhancing information evaluation and the flexibility to answer clients, thus making knowledgeable selections. That is in keeping with an rising digital banking development to boost agility and a customized, safe monetary providers expertise

Synthetic Intelligence in Fintech Market Segmentation:

By Parts

By Deployment

By Utility

- Digital Assistant (Chatbots)

- Enterprise Analytics and Reporting

- Buyer Behavioural Analytics

- Fraud Detection

- Quantitative and Asset Administration

- Others

Regional Evaluation

In 2023, North America dominated the market and represented income share of greater than 38.90% share of the worldwide income. The excessive share displays the significance of the superior economies of the U.S. and Canada to innovations originating in R&D. They’re among the many best and quickly creating areas on the planet associated to fintech AI know-how. Quite a few startups and rising companies providing AI options to the finance business are additionally fueling it.

Asia Pacific is predicted to develop on the quickest CAGR from 2024-2032. The upward development could be linked on account of the quick shift in direction of digital funds and an uptrend in web providers within the space. Because of elevated technical enchancment in APAC, this area has come out as a possible market. Furthermore, the speedy progress of home corporations together with favorable authorities insurance policies presents many prospects for AI growth within the fintech business. Furthermore, regional market progress is supplemented as key gamers are investing in new markets of the area as part of their enterprise technique.

Purchase an Enterprise-Consumer PDF of Synthetic Intelligence in Fintech Market Evaluation & Outlook 2024-2032@ https://www.snsinsider.com/checkout/1259

Latest Developments

Might 2024: Lemonade expanded its AI-powered insurance coverage platform to include new machine studying fashions that optimize claims processing and enhance fraud detection.

July 2024: The corporate unveiled an AI-driven auto insurance coverage pricing mannequin that gives extra customized premiums based mostly on driving habits, integrating machine studying to detect fraudulent claims.

Desk of Contents – Main Key Factors

1. Introduction

2. Government Abstract

3. Analysis Methodology

4. Market Dynamics Affect Evaluation

5. Statistical Insights and Traits Reporting

6. Aggressive Panorama

7. Synthetic Intelligence In Fintech Market Segmentation, By Part

8. Synthetic Intelligence In Fintech Market Segmentation, by Deployment

9. Synthetic Intelligence In Fintech Market Segmentation, by Utility

10. Regional Evaluation

11. Firm Profiles

12. Use Circumstances and Finest Practices

13. Conclusion

Entry Full Report Particulars of Synthetic Intelligence in Fintech Market Evaluation Report 2024-2032@ https://www.snsinsider.com/reports/ai-in-fintech-market-1259

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Providing/ Consulting Providers:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is without doubt one of the main market analysis and consulting companies that dominates the market analysis business globally. Our firm’s intention is to offer purchasers the data they require as a way to operate in altering circumstances. With a purpose to provide you with present, correct market information, client insights, and opinions with the intention to make selections with confidence, we make use of quite a lot of methods, together with surveys, video talks, and focus teams all over the world.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.