The Bitcoin price seems to be facing somewhat of a price failure since it crossed above the $100,000 price level. In the few hours after crossing above this psychological threshold, the Bitcoin price faced rejection and corrected until it reached $94,000.

However, this correction does not necessarily signal a bleak outlook for the world’s largest cryptocurrency, especially as investor sentiment continues to hover in the extreme greed zone. According to technical analysis, the Bitcoin price is still open to climbing well above $100,000 by the end of December 2024.

Record Bitcoin Liquidations Shake The Market

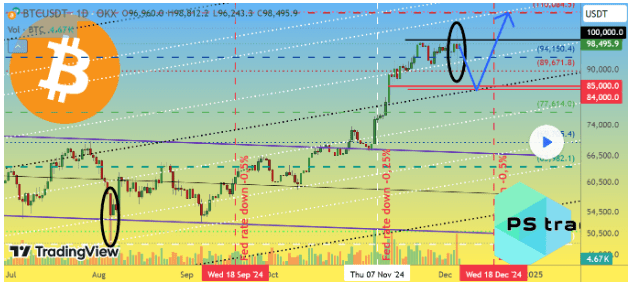

Bitcoin’s broader market dynamics and investor sentiment suggest that Bitcoin’s failure at $100,000 could be a temporary pause rather than a long-term reversal. Interestingly, a detailed analysis posted on the TradingView platform supports this outlook and offers a bold prediction for the year’s end.

The analysis highlighted December 5, 2024, as a historic day for cryptocurrency liquidations. Total liquidations reached a staggering $1.1 billion, surpassing the previous record of $950 million set on August 5, 2024. The breakdown included $820 million in liquidated long positions and $280 million in liquidated short positions.

Although price data from Coinmarketcap and CoinGecko shows a bottom around $93,600, the Bitcoin price dipped to $89,000–$90,000 depending on the exchange.

According to the analysis, such a dramatic move is described as a “helicopter” on the BTCUSDT chart, and it reflects a cooling-off period due to overheating from all technical indicators.

Despite the correction and crazy liquidations, the analyst maintained that Bitcoin’s uptrend remains intact. This is because the Fear and Greed Index, a popular sentiment indicator, remained in the “greed” zone at 71 despite Bitcoin’s sharp drop. At the time of writing, the Fear and Greed Index has increased to the “extreme greed” zone at 82, suggesting that market participants are still optimistic about Bitcoin’s future trajectory.

Bold Year-End Price Prediction

Interestingly, the altcoin market barely reacted to the Bitcoin price reaction, which also creates the possibility of another wave downwards before a broader market recovery.

The analyst outlined a scenario for the Bitcoin price probably going on another decline and break below $90,000. The forecast suggests Bitcoin could drop further to the $84,000–$85,000 range before rallying to $110,000.

Adding to the bullish narrative is the upcoming Federal Open Market Committee (FOMC) meeting, which is scheduled to take place on December 18. Market expectations point to a 0.25% rate cut by the Federal Reserve, a move that could inject further momentum into Bitcoin’s price recovery much like the September and November rate cuts.

At the time of writing, the Bitcoin price is trading at $99,450 and is about to break above $100,000 again. On-chain data shows that Bitcoin whales have taken advantage of the price decline to load up more BTC. Particularly, addresses holding between 100 and 1,000 BTC have increased their collective holdings by 20,000 BTC in the past 24 hours, valued at $2 billion.

Featured image from Pixabay, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.