However there’s extra to the story. Regardless of these headwinds, the techbio sector continues to draw important funding and drive innovation. 2024 noticed the launch of Xaira, a techbio with the monetary backing of over $1 billion. On the helm of the agency is a crew of business veterans, together with former Genentech CSO Marc Tessier-Lavigne. Xaira’s objective is to harness superior AI, together with foundational fashions like RFDiffusion and ProteinMPNN, to design novel therapeutic proteins and deal with beforehand undruggable targets. This notable launch, together with different main offers and the assist of main companies starting from NVIDIA to Novo Nordisk, illustrates the rising convergence of know-how and biology.

The next snapshot of 25 techbio organizations paints an image of a sector maturing by way of strategic consolidation, important capital deployment, technical diversification, and regular medical validation.

New entrants and main offers

1. Xaira

- Launch funding: $1B+ (April 2024)

- Expertise focus: Foundational fashions like RFDiffusion and ProteinMPNN for novel therapeutic proteins

- Differentiator: Built-in strategy combining computational design with high-throughput validation

- Management: CEO: Marc Tessier-Lavigne (former Genentech CSO); Board consists of Scott Gottlieb, Carolyn Bertozzi, Alex Gorsky

Particulars: Whereas particulars of Xaira’s AI technique are underneath wraps, a GeekWire article provided a glimpse at what the company is up to. Beneath the management of former Fb AI scientist Hetu Kamisetty, Xaira’s Seattle crew is utilizing foundational fashions like RFDiffusion and ProteinMPNN — initially developed on the College of Washington’s Institute for Protein Design (IPD) — to engineer novel therapeutic proteins that would doubtlessly deal with beforehand “undruggable” illness targets. The corporate’s built-in strategy combines computational design with high-throughput experimental validation, enabling fast iteration between in silico predictions and laboratory testing. This tight suggestions loop between AI fashions and empirical knowledge, applied throughout Xaira’s Seattle and Bay Space services, goals to hurry up the historically prolonged drug improvement timeline.

Particulars: Whereas particulars of Xaira’s AI technique are underneath wraps, a GeekWire article provided a glimpse at what the company is up to. Beneath the management of former Fb AI scientist Hetu Kamisetty, Xaira’s Seattle crew is utilizing foundational fashions like RFDiffusion and ProteinMPNN — initially developed on the College of Washington’s Institute for Protein Design (IPD) — to engineer novel therapeutic proteins that would doubtlessly deal with beforehand “undruggable” illness targets. The corporate’s built-in strategy combines computational design with high-throughput experimental validation, enabling fast iteration between in silico predictions and laboratory testing. This tight suggestions loop between AI fashions and empirical knowledge, applied throughout Xaira’s Seattle and Bay Space services, goals to hurry up the historically prolonged drug improvement timeline.

Notable backing and management: Co-led by Arch Enterprise Companions and Foresite Capital. The board consists of Dr. Scott Gottlieb (former FDA Commissioner), Carolyn Bertozzi (Nobel laureate), and Alex Gorsky (ex-J&J CEO). CEO Marc Tessier-Lavigne, former Genentech CSO and Denali Therapeutics co-founder, confronted scrutiny over early-2000s analysis. He was cleared of private wrongdoing however acknowledged oversight flaws. Traders emphasize his “express exoneration” and corrective efforts.

2. Isomorphic Labs

- Strategic worth: $3B in pharma partnerships (2024)

- Partnership particulars: Eli Lilly: $45M upfront, $1.7B potential milestones; Novartis: $37.5M upfront, $1.2B potential milestones

- Technical achievement: AlphaFold 3 launch with Google DeepMind

- Recognition: 2024 Nobel Prize in Chemistry awarded to CEO Demis Hassabis and John Jumper

Strategic partnerships (January 2024): Collaborations with Eli Lilly and Novartis valued as much as $3 billion mixed. Eli Lilly supplied $45 million upfront with potential $1.7 billion milestones; Novartis $37.5 million upfront, as much as $1.2 billion in milestones.

Strategic partnerships (January 2024): Collaborations with Eli Lilly and Novartis valued as much as $3 billion mixed. Eli Lilly supplied $45 million upfront with potential $1.7 billion milestones; Novartis $37.5 million upfront, as much as $1.2 billion in milestones.

Focus: AI-driven small molecule discovery. Though not all phrases are public, these offers verify pharma’s willingness to combine computational platforms at scale.

In 2024, the Alphabet subsidiary Isomorphic partnered with a sister division, Google DeepMind, to launch AlphaFold 3, a mannequin that may predict complicated biomolecular interactions. In October 2024, Demis Hassabis, CEO of Isomorphic Labs and Google DeepMind, and John Jumper, a senior researcher at DeepMind, have been awarded the Nobel Prize in Chemistry for his or her improvement of earlier variations of AlphaFold.

3. Generate:Biomedicines

- Novartis collaboration (September 2024): Over $1B deal to develop novel protein therapeutics

- Core Expertise: Generative AI platform for designing novel proteins in immunology, oncology, and different areas

In September 2024, Generate:Biomedicines sealed a significant collaboration with Novartis price over $1 billion. By tapping Generate’s AI-driven protein design platform, this partnership goals to create protein therapeutics that may deal with quite a lot of complicated illnesses. The deal reveals how AI can establish not solely simple targets but in addition allow the design of fully new courses of medicine.

In September 2024, Generate:Biomedicines sealed a significant collaboration with Novartis price over $1 billion. By tapping Generate’s AI-driven protein design platform, this partnership goals to create protein therapeutics that may deal with quite a lot of complicated illnesses. The deal reveals how AI can establish not solely simple targets but in addition allow the design of fully new courses of medicine.

Core know-how: Makes use of generative AI to design novel protein therapeutics in immunology, oncology, and past.

4. Recursion Prescribed drugs

- Acquisition of Exscientia (August 2024): $688M acquisition consolidating AI capabilities

- Tech improve: BioHive-2 supercomputer (#35 on TOP500) for foundational mannequin coaching

When Recursion Prescribed drugs acquired Exscientia for $688 million in August 2024, it consolidated AI-powered capabilities underneath one roof. Recursion’s high-throughput screening and strong knowledge technology complemented Exscientia’s generative AI platform, bringing goal identification, compound design, and optimization right into a single built-in pipeline.

Tech improve: BioHive-2, an NVIDIA DGX SuperPOD with 63 DGX H100 programs and 504 NVIDIA H100 GPUs (~2 exaflops), ranks #35 on the TOP500 (Might 2024). Practically 5x sooner than its predecessor, it fuels foundational mannequin coaching and fast drug discovery cycles.

5. Schrödinger Inc.

- Novartis collaboration (November 2024): $150M upfront, as much as $2.3B in milestones and royalties

- Scope: AI-driven molecular discovery and predictive modeling at scale

In November 2024, Schrödinger, Inc. solid a significant collaboration and licensing settlement with Novartis AG. This multi-year, multi-target partnership noticed Schrödinger obtain a $150 million upfront cost, with the potential to earn as much as roughly $2.3 billion extra in milestone funds. The startup stands to obtain as much as $892 million for analysis, improvement, and regulatory milestones, and one other $1.38 billion contingent on business success. On high of this, Schrödinger is ready to obtain tiered royalties, starting from the mid-single digits to low double digits, on web gross sales of any merchandise commercialized by Novartis underneath the settlement. Novartis will then take the reins for medical improvement, manufacturing, and international commercialization. As a part of the deal, Novartis additionally considerably expanded its entry to Schrödinger’s full suite of drug discovery applied sciences, together with its computational predictive modeling and enterprise informatics platform, for the following three years.

Different partnerships and progress

6. Genesis Therapeutics

- Funding and Valuation (2023): $256.1M raised, $750M valuation

- Strategic Partnership: Gilead cope with $35M upfront (Sept 2024)

- Platform: GEMS integrates diffusion fashions, language fashions, and physics-based ML for molecular design

Funding and Valuation (2023): $256.1M raised with $750M valuation, culminating in a strategic Gilead partnership valued at $35M upfront in September 2024.

Funding and Valuation (2023): $256.1M raised with $750M valuation, culminating in a strategic Gilead partnership valued at $35M upfront in September 2024.

Particulars: Beneath the management of CEO Ben Sklaroff, Genesis has developed GEMS (Generative Evolutionary Machine studying System), an AI platform that mixes physics-based modeling with deep studying architectures. In keeping with the corporate’s web site, Genesis has created a number one molecular AI platform that integrates proprietary diffusion fashions, language fashions, and bodily ML simulations for molecular technology and property prediction. The corporate has a hybrid computational-experimental pipeline that makes use of neural networks engineered for molecular property prediction and drug candidate optimization.

7. Immunai

7. Immunai

- AstraZeneca Deal (September 2024): $18M upfront for immune system modeling in oncology trials

- Platform: Integrates single-cell genomics with ML for mapping immune dynamics

Immunai’s platform integrates single-cell genomics with superior machine studying to create complete maps of immune system dynamics. The corporate’s proprietary database encompasses tens of millions of annotated immune cells to discover immune response patterns. Its September 2024 AstraZeneca partnership, valued at $18M upfront, particularly targets the appliance of AI-driven immune system modeling in oncology trials.

Rising gamers

8. Archon Biosciences

8. Archon Biosciences

- Stealth emergence (November 2024): $20M seed funding

- Core Innovation: “Antibody Cages” (AbCs) – AI-driven protein therapeutics

- Grants: $7M+ NIH/DoD funding

- Management: Based by IPD alumni (James Lazarovits, George Ueda, David Baker)

- Platform: Growing “Antibody Cages” (AbCs), AI-driven protein therapeutics with geometrically tunable properties.

Management and scientific roots: Co-founded by James Lazarovits, Ph.D., George Ueda, Ph.D., and David Baker, Ph.D., from the Nobel Prize-winning labs on the College of Washington’s Institute for Protein Design (IPD).

Technical validation and platform capabilities: AbCs mix antibodies with AI-designed protein scaffolds, enabling extremely particular and potent biologic medication to focus on difficult illness pathways. This strategy, acknowledged by the 2024 Nobel Prize in Chemistry for advances in computational protein engineering, permits for exact nanostructures that may deal with beforehand intractable targets.

Funding and grants: Past the preliminary $20 million seed financing (led by Madrona Ventures, with participation from DUMAC Inc., Sahsen Ventures, WRF Capital, Pack Ventures, Alexandria Enterprise Investments, and Cornucopian Capital), Archon secured over $7 million in NIH and Division of Protection grants to assist R and D and early preclinical research.

Pipeline and targets: Though Archon has not publicly disclosed its precise medical pipeline, the corporate has indicated it can pursue “well-known targets,” suggesting an preliminary deal with oncology and different prevalent illness areas. The platform’s flexibility permits fast iteration and optimization, doubtlessly bettering pace to medical validation.

Significance: Archon’s emergence exemplifies how generative protein design can develop the therapeutic frontier, facilitating new precision biologics that conventional modalities can not obtain.

9.  AION Labs

AION Labs

- Innovation mannequin: Enterprise studio launching a number of AI-based startups

- Portfolio corporations: DenovAI (AI-driven antibody), TenAces Biosciences (ML-based molecular glue), CombinAble.AI (antibody optimization)

- Consortium members: AstraZeneca, Merck KGaA, Pfizer, Teva, AWS

Innovation spins: Enterprise studio mannequin launching a number of AI-based startups. DenovAI (Feb 2023) focuses on AI-driven antibody discovery, TenAces Biosciences (Jan 2024) on ML-based molecular glue discovery, and CombinAble.AI (Mar 2024) on in silico optimization of antibody properties.

Consortium-based mannequin: Established in 2021 in Israel, AION Labs unites AstraZeneca, Merck KGaA, Pfizer, Teva, AWS, Israel Biotech Fund, and Amiti Ventures underneath the steering of the Israel Innovation Authority. Its mission is to deal with urgent R and D challenges by figuring out unmet wants, recruiting international expertise, and offering early funding and proprietary knowledge to speed up startup formation.

Affect and recognition: This strategy has led to a number of spinouts that combine AI into goal discovery, antibody optimization, and predictive analytics. AION Labs’ portfolio corporations have garnered business recognition and function a blueprint for collaborative, AI-driven drug discovery ecosystems.

10.  Antiverse

Antiverse

- Funding (October 2024): $4.6M seed spherical, whole $10.1M raised

- Partnerships: Collaborations with Nxera Pharma and a high 20 pharma validating antibody discovery

- Platform: ML and phage show to design de novo antibodies

Funding (October 2024): $4.6 million seed spherical, including as much as a complete of $10.1 million in fairness financing.

Partnerships: Working with Nxera Pharma (previously Sosei Heptares) to develop AI-engineered antibodies in opposition to GPCR targets. A high 20 pharmaceutical firm collaboration enabled Antiverse’s platform to establish 248 sequences, with over 230 confirmed as antibody binders, demonstrating larger variety and accuracy than conventional strategies.

Platform and strategy: Antiverse integrates machine studying and phage show methods to mannequin antibody-antigen interactions and design de novo antibodies. Their AI-augmented strategy reduces the invention timeline to ~6 months, accelerating the trail to medical candidates. With new services in Boston and Prague, the corporate advances inside property focusing on GPCRs and ion channels towards medical readiness.

Up to date particulars on choose corporations

11.  Insilico Drugs

Insilico Drugs

- Licensing deal (January 2024): $12M upfront, $500M milestones with Menarini’s Stemline

- Pipeline: Over $400M raised, 11 preclinical candidates

- Scientific progress: TNIK inhibitor (ISM001-055) displaying dose-dependent FVC enhancements in Section IIa for IPF

Licensing deal (January 2024): Unique settlement with Menarini’s Stemline Therapeutics for a novel breast most cancers candidate consists of $12 million upfront and as much as $500 million in milestones.

Pipeline and medical progress: Over $400 million raised and 11 preclinical candidates nominated. A lead TNIK inhibitor (ISM001-055) for idiopathic pulmonary fibrosis confirmed dose-dependent pressured important capability (FVC) enhancements in a Section IIa trial.

In 2024, Insilico Drugs superior its generative AI-driven platform into a number of medical phases. On November 12, 2024, the corporate introduced constructive topline outcomes from the Section IIa trial of ISM001-055, displaying it was secure, well-tolerated, and exhibited dose-dependent enhancements in IPF. In April 2024, the FDA authorized an IND for ISM3412, focusing on a novel enzyme in oncology and immunology. Insilico additionally reached a significant milestone in its collaboration with Sanofi (October 30, 2024), using Chemistry42 to deal with difficult drug targets, and partnered with Inimmune in September 2024 to co-develop next-generation immunotherapeutics. On November 13, 2024, Insilico acquired the Showcase AI and Biotech Innovation Award, additional recognizing its rising affect. CEO Alex Zhavoronkov was named to Clarivate’s Extremely Cited Researchers record for 2024, underscoring the corporate’s scientific management in AI-driven drug discovery.

12.  NeuroX1

NeuroX1

- Funding (by April 2024): ~$1.83M from Techstars and Drive Capital

- Partnership (January 2024): With Everlum Bio for preclinical neurotherapeutics

- Platform: Chiron AI platform for novel goal identification in Alzheimer’s, Parkinson’s

Funding (by April 2024): ~$1.83 million from Techstars and Drive Capital, constructing on earlier $1.34 million and $500K seed rounds since 2021.

Partnership (January 2024): With Everlum Bio Inc. for preclinical small-molecule neurotherapeutics focusing on neurological problems, together with uncommon pediatric situations. This collaboration combines NeuroX1’s AI-driven drug discovery platform, Chiron, with Everlum’s experience in personalised medication and in vitro platform applied sciences. The partnership goals to streamline the drug improvement course of, scale back prices, and expedite the supply of efficient remedies to market.

Platform and focus: Headquartered in Austin, Texas, NeuroX1 makes use of its proprietary AI-driven platform, Chiron, to establish novel targets and design new compounds. The corporate is exploring remedies for Alzheimer’s and Parkinson’s illness, and using in silico preclinical screening to cut back attrition charges.

13.  ImmunoMind

ImmunoMind

- Collaborations: Pfizer, Novartis, UCSF, Stanford, MIT, MD Anderson

- Technical capabilities: CAR-T optimization, T-cell characterization, open-source immune profiling

- Scientific functions: Autoimmune illnesses, oncology, orphan illnesses

Collaborations: Working with Pfizer, Novartis, UCSF, Stanford, MIT, and MD Anderson on personalised immunotherapies and vaccines.

Platform: Open-source frameworks integrating T- and B-cell multi-omics knowledge information autoimmune, oncology, and orphan illness therapies.

Further particulars: ImmunoMind makes a speciality of personalizing immunotherapies and vaccines by way of programs immunology. Their platform focuses on de-risking immunotherapy improvement by figuring out environment friendly candidates and stratifying sufferers for medical trials. ImmunoMind’s platform permits analysis of CAR-T cell traits equivalent to activation, proliferation, cytotoxicity, senescence, and exhaustion, helping corporations in choosing the simplest CAR-T product candidates. By assessing T-cell exhaustion, ImmunoMind refines merchandise for improved efficacy. The platform, together with Immunarch, has been cited in quite a few scientific publications, indicating its broad software in medical analysis and biomarker discovery. By way of these capabilities, ImmunoMind helps the event of personalised immunotherapies, aiming to enhance medical outcomes and scale back R and D dangers.

14.  Deep Genomics

Deep Genomics

- BioMarin partnership: Figuring out oligonucleotide candidates for 4 uncommon illnesses utilizing AI-based RNA instruments

- Recognition: Stevie Award (Sept 2024) for Biotechnology Firm of the 12 months

- Enlargement: New Cambridge, MA and expanded Toronto services

BioMarin partnership (ongoing): Figuring out oligonucleotide candidates for 4 uncommon illnesses utilizing AI-based RNA evaluation instruments.

Makes use of AI to streamline genetic medication discovery, specializing in areas with excessive unmet wants and complicated genetic etiologies. In September 2024, Deep Genomics was honored with the Stevie Award for Biotechnology Firm of the 12 months, acknowledging its contributions to AI-driven RNA therapeutics.

By June 2024, Deep Genomics expanded its operations by opening a brand new workplace and laboratory facility in Cambridge, Massachusetts, and enlarging its Toronto workplace. This progress was accompanied by key management appointments, together with:

- Radu Dobrin, Ph.D., as Chief Expertise Officer

- Greg Hoffman, Ph.D., as Chief Scientific Officer

- Joel Shor as Vice President and Head of Machine Studying

- Clive Bertram as Chief Enterprise Officer

15.  BioSymetrics

BioSymetrics

- Pharma collaborations: With Sema4 for integrative phenomic-genomic-clinical evaluation

- Alliances: Moleculera Biosciences (Oct 2024) and Deerfield Administration JV (Oct 2022)

- Platform: Elion integrates healthcare and experimental knowledge for goal discovery

Pharma collaborations: Working with Sema4 to combine phenomic, genomic, and medical knowledge for improved goal discovery.

Additional alliances and ventures: Partnered with Moleculera Biosciences (Oct 2024) to develop predictive remedy algorithms for immune-mediated neuropsychiatric problems, and entered a five-year JV with Deerfield Administration (Oct 2022) to speed up therapeutic improvement. BioSymetrics’ Elion platform combines healthcare and experimental knowledge, guiding high-confidence goal identification.

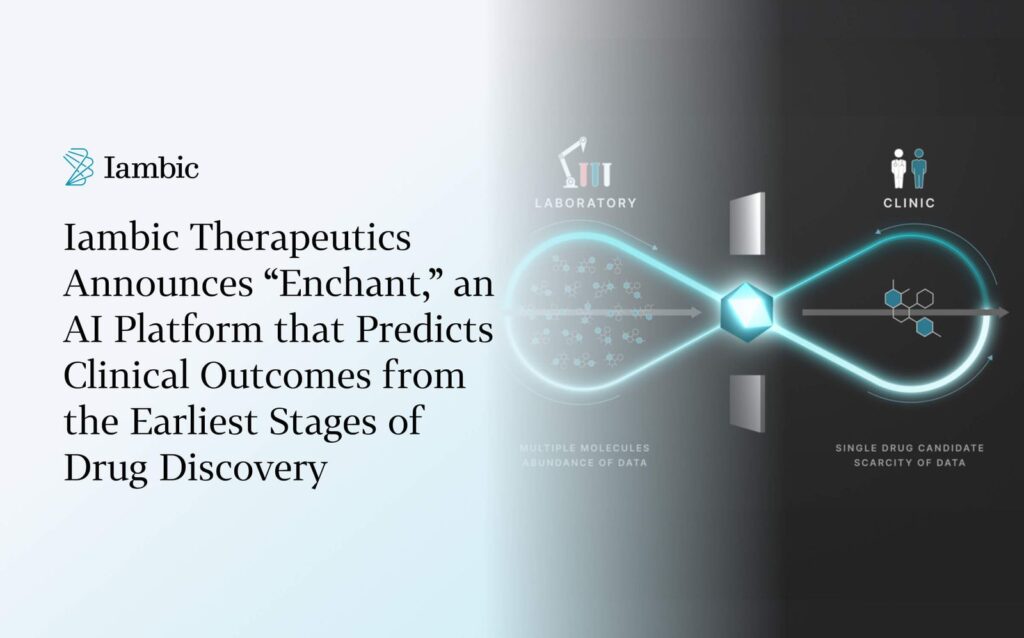

16. Iambic Therapeutics

- Financials: $203M raised; $600M valuation (2024)

- Strategy: Combines physics-based and ML strategies for fast protein-ligand evaluation

- Platform: “Enchant” predicts medical outcomes from early-stage knowledge

Financials: $203 million raised; $600 million valuation in 2024.

Philosophy: Combines physics-based and ML strategies. CEO Tom Miller confused in an article earlier this 12 months that AI is an augmentation tool rather than a cure-all. “Simply to hit on this recurring theme about the truth that drug discovery is a tough job — AI is not going to make a tough job a simple job. It would make a tough job marginally extra navigable. And I believe that’s actually the strategy we take.”

Philosophy: Combines physics-based and ML strategies. CEO Tom Miller confused in an article earlier this 12 months that AI is an augmentation tool rather than a cure-all. “Simply to hit on this recurring theme about the truth that drug discovery is a tough job — AI is not going to make a tough job a simple job. It would make a tough job marginally extra navigable. And I believe that’s actually the strategy we take.”

In 2024, Iambic Therapeutics expanded its pipeline and platform capabilities. Its analysis was additionally featured on the quilt of Nature Machine Intelligence. On June 18, 2024, the corporate closed a $50 million extension to its Collection B, bringing whole funding past $150 million. This extension was led by Mubadala Capital and Exor Ventures, with participation from Qatar Funding Authority and present traders. The funding will speed up improvement of IAM1363, a selective, brain-penetrant HER2 inhibitor in Section 1/1b research, and a twin CDK2/4 inhibitor focusing on treatment-resistant strong tumors. Iambic launched “Enchant” on October 29, 2024 — an AI platform that analyzes early-stage knowledge to foretell medical outcomes and scale back improvement prices. On September 27, 2024, Endpoints 11 acknowledged Iambic’s improvements, whereas Lundbeck partnered with the corporate to advance neurological illness analysis.

Further innovators (now a part of AbbVie)

Key deal details

- Deal Worth: $250M money acquisition

- Key asset: CEL383 – first-in-class anti-TREM1 antibody

- Improvement stage: Accomplished Section 1 medical examine

- Goal indication: Inflammatory Bowel Illness (IBD)

- Mechanism: Inhibits TREM1 signaling to cut back inflammatory mediators

- Scientific trial: NCT05901883 (Section 1 concluded)

- Acquirer: AbbVie (NYSE: ABBV)

- Goal: Celsius Therapeutics (Cambridge, MA)

17. Celsius Therapeutics

- Funding (Early 2024): $55M Collection B

- Strategy: Single-cell genomics + ML for goal identification in immunology and oncology

- Acquisition: Acquired by AbbVie in June 2024 for $250M

Funding (Early 2024): $55 million Collection B.

Strategy: Integrates single-cell genomics and ML for exact goal identification in immunology and oncology.

Further particulars: Based in 2018, Celsius Therapeutics makes use of single-cell genomics and machine studying to develop therapeutics for autoimmune illnesses and most cancers. Its SCOPE platform (Single Cell Observations for Precision Impact) analyzes mobile gene expression patterns to establish drug targets and affected person teams.

The corporate’s single-cell database and ML algorithms establish cell varieties concerned in illness development and remedy resistance. This technique recognized TREM1’s function in IBD, resulting in CEL383, an anti-TREM1 antibody.

Key partnerships embrace:

- Janssen Biotech (2019): Biomarker identification for ulcerative colitis trials.

- Servier (2021): Colorectal most cancers analysis with potential $700M in milestones.

- Analysis collaborations: Parker Institute for Most cancers Immunotherapy, Institut Gustave Roussy, and College Well being Community for immunotherapy biomarker research.

AbbVie acquired Celsius for $250 million in June 2024, gaining the SCOPE platform and CEL383 program.

18. PathAI

18. PathAI

- Collaborations (2024): A number of pharma companions leveraging AI-driven pathology

- Focus: Correct, scalable AI pathology options for oncology trials

Collaborations (2024): Partnered with a number of biopharmas on AI-driven pathology.

Further particulars: Based in 2016, PathAI develops AI-powered pathology fashions skilled on tens of millions of annotations for medical diagnostics and pharma analysis. GSK and Novo Nordisk use PathAI’s AIM-NASH software in medical trials for endpoint evaluation. The corporate’s algorithms embrace AIM-NASH for liver illness classification and AIM-HER2 for breast most cancers scoring.

In November 2024, PathAI launched PathExplore Fibrosis, an AI software that quantifies fibrotic areas and collagen fibers from H&E-stained whole-slide photos, eliminating the necessity for specialised staining methods. The software program analyzes tumor microenvironment options that affect remedy response, together with tumor stiffness and immune cell infiltration, utilizing normal laboratory imaging programs. The software permits retrospective evaluation of archival picture knowledge and helps biomarker discovery for affected person stratification and remedy evaluation.

19. Valo Well being

- Scientific milestone (2024): First-in-human knowledge for OPL-0401 (ROCK1/2 inhibitor)

- Partnership: Novo Nordisk (2023) $60M upfront, potential $2.7B whole

Scientific milestone (2024): First-in-human knowledge for OPL-0401, an AI-identified ROCK1/2 inhibitor. By March 2024, a Section II trial in non-proliferative diabetic retinopathy had began.

Valo Well being underwent management transitions in 2024, with Christian Schade changing into Govt Chairman and Graeme Bell interim CEO on January 16, adopted by Brian M. Alexander, M.D., M.P.H., assuming the CEO function on November 13. The corporate accomplished enrollment for its Section 2 Spectra trial of OPL-0401 in diabetic retinopathy on March 4, with topline outcomes anticipated by year-end 2024. In September 2023, Valo partnered with Novo Nordisk on AI-driven cardiometabolic drug discovery, securing $60 million upfront with potential earnings of $2.7 billion.

20. Ginkgo Bioworks (NYSE: DNA)

- Scope: AI-driven mobile programming throughout therapeutics, agriculture, industrial biotech

- Progress (2024): 25% income improve (Q3 2024), new strategic collaborations (Google Cloud, NOVUS)

Scope: AI-driven mobile programming at scale, increasing functions past human therapeutics into agriculture, industrial biotech, and extra.

In 2024, Ginkgo Bioworks reported blended outcomes. Whereas Q3 income elevated 25% to $100 million from cell programming and biosecurity companies, the corporate’s inventory fell 83.98% YTD and 97.42% from its all-time excessive, closing at $10.70 on December 9 from a excessive of greater than $550 per share in October 2021. But the corporate strengthened its strategic place by way of authorities partnerships, internet hosting Congressional leaders to debate its function within the U.S. bioeconomy and nationwide safety, together with plans for its 250,000-square-foot Biofab1 facility.

Key developments this 12 months included a September 2024 partnership with NOVUS for animal feed components and a five-year Google Cloud collaboration launched August 2023 to develop organic engineering AI platforms. A January 2024 collaboration with Biogen centered on gene remedy manufacturing enhancements. The corporate additionally acquired AgBiome’s platform property in April 2024, gaining 115,000 sequenced strains and 500 million gene sequences. In September 2024, Ginkgo launched its Automation product line, that includes Reconfigurable Automation Carts, Management Software program, and Managed Options for laboratory operations.

21. Dyno Therapeutics

21. Dyno Therapeutics

- Focus: AI-optimized AAV vectors for gene remedy

- Technical basis: LEAP platform integrating ML and high-throughput in vivo screening

- Industrial validation: Second collaboration with Roche ($50M upfront)

Focus: AI-optimized AAV vectors for gene remedy, enhancing tissue specificity and supply effectivity.

Dyno Therapeutics integrates computational strategies and experimental validation to engineer AAV vectors. Their LEAP platform combines machine studying with high-throughput screening, producing Dyno eCap 1, which confirmed 80-fold improved retinal supply versus AAV2 vectors in primate research. By way of NVIDIA partnerships, they leverage cloud computing and BioNeMo platforms for sequence design. A 2024 Roche collaboration ($50M upfront) validates their strategy to neurological functions. Dyno focuses on tissue focusing on, immune evasion, and manufacturing effectivity by way of iterative optimization and computational design.

22. BigHat Biosciences

22. BigHat Biosciences

- Platform: Milliner integrates AI and high-throughput synthesis to optimize antibodies

- Partnerships: AbbVie, Janssen, Lonza’s Synaffix

- Funding: $100M+ raised; $75M Collection B (July 2022)

Platform: Combines AI with high-throughput synthesis to quickly optimize antibodies’ affinity, specificity, and stability.

Further particulars: Based in 2019, BigHat Biosciences develops antibody variants by way of its Milliner platform, integrating ML algorithms with automated lab programs. The platform processes a whole lot of antibody assessments weekly. The corporate secured partnerships with AbbVie, Janssen Biotech, and Lonza’s Synaffix, advancing pipeline property together with ADCs in IND-enabling research. BigHat raised over $100 million, with a $75 million Collection B in July 2022.

23. Healx

23. Healx

- Uncommon illness focus: Accelerating options in underserved areas

- Funding (August 2024): $47M Collection C

- Partnerships and milestones: Sanofi settlement, Section 2 IND for HLX-1502 in NF1

Uncommon illness focus: In 2024, Healx superior its uncommon illness applications whereas securing new partnerships and funding. The corporate raised $47 million in Collection C funding in August and appointed Dr. Jonathan Milner as Non-Govt Chairman on December 3. Healx acquired FDA clearance for a Section 2 trial of HLX-1502 in Neurofibromatosis Sort 1 (NF1), deliberate to begin by year-end, and partnered with the Kids’s Tumor Basis in April to assist NF1 analysis. On November 13, Healx partnered with Sanofi to make use of its Healnet platform for figuring out new uncommon illness indications for a Sanofi compound.

24. Insitro

24. Insitro

- Scale and strategy: Excessive-throughput experimental biology + ML at giant scale

- Current offers: Three strategic agreements with Eli Lilly (Oct 2024) for metabolic illnesses

Based by machine studying pioneer Daphne Koller, Insitro has developed a particular platform that merges high-throughput experimental biology with superior machine studying. In October, Insitro entered into three strategic agreements with Eli Lilly and Firm to develop novel remedies for metabolic illnesses, together with metabolic dysfunction-associated steatotic liver illness (MASLD).

Its automated labs in South San Francisco generate large proprietary organic datasets, feeding into ML fashions that uncover novel targets. Insitro’s strategy is widely known for tackling complicated illness areas which have defied conventional strategies.

25. A-Alpha Bio

25. A-Alpha Bio

- Metrics: $47.6M raised

- Platform: AlphaSeq measures tens of millions of protein-protein interactions concurrently

- Partnerships: BMS, Amgen, LLNL’s GUIDE program

Metrics: $47.6 million raised. Makes a speciality of mapping protein interactions at scale utilizing AI-driven experimental platforms.

Further particulars: Based in 2017, A-Alpha Bio’s AlphaSeq platform measures tens of millions of protein-protein interactions concurrently, delivering quantitative binding affinities from picomolar to micromolar scales. Partnerships with BMS and Amgen deal with figuring out novel ligase-target pairs for molecular glue design, whereas a long-term collaboration with LLNL underneath the GUIDE program helps large-scale antibody-antigen binding knowledge technology. The AlphaBind mannequin applies deep studying for predicting and optimizing antibody-antigen affinities. With over a billion protein-protein interactions measured and elevated DoD funding, A-Alpha Bio’s integration of artificial biology and ML offers a sturdy framework for accelerating antibody discovery and optimization.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.