The developments surrounding Tremendous Micro Laptop (NASDAQ: SMCI) have turn out to be a few of the most fascinating chapters within the broader synthetic intelligence (AI) story.

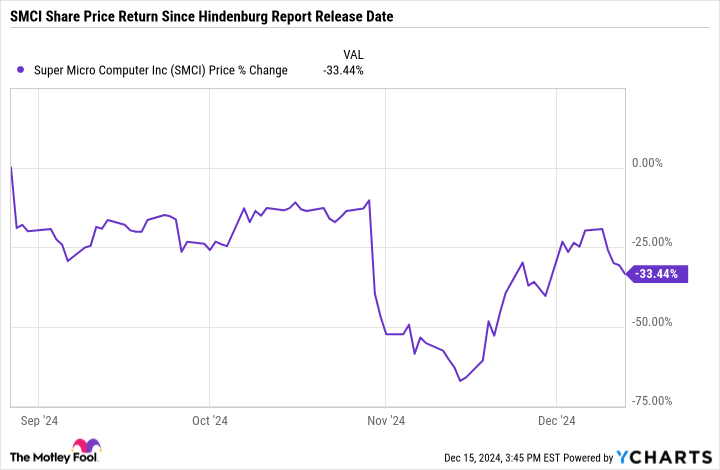

At its peak, shares of Supermicro have been up over 300% earlier this 12 months. Nonetheless, starting in August, shares entered a chronic sell-off of epic proportions.

Over the previous couple of months, it has been a collection of falling dominoes for Supermicro. But, what if I informed you higher days may very well be on the horizon?

I will element every part that is taking place at Supermicro and clarify why the inventory entered freefall. Extra importantly, I am going to additionally discover why Supermicro may very well be on the verge of a turnaround, and what that might imply for traders.

There have been so many ongoing storylines at Supermicro over the previous couple of months that is it is legitimately tough to maintain up with all of the hoopla. Beneath is an annotated timeline of every highway bump Supermicro has encountered, and a few particulars across the inventory motion in consequence.

-

August: In late August, Hindenburg Analysis revealed a report alleging accounting malpractice protocols at Supermicro. Inside one buying and selling day of Hindenburg’s report changing into public data, shares of Supermicro cratered by 19%. This was the primary domino to fall. Precisely in the future after the Hindenburg report was launched, Supermicro filed an 8K asserting that the corporate “expects to file a Notification of Late Submitting” for its 10K annual report.

-

September: A few month after the Hindenburg piece, The Wall Avenue Journal reported that the Division of Justice (DOJ) was investigating Supermicro over its accounting controls, following a collection of allegations touted by whistleblowers. The committees on the Nasdaq inventory alternate additionally despatched Supermicro a discover explaining that the corporate was vulnerable to being delisted from the exchange attributable to compliance causes.

-

October: On Oct. 30, it was revealed that Huge 4 accounting specialist Ernst & Younger LLP (“EY”) resigned as Supermicro’s auditor.

-

November: In mid-November, experiences started swirling that Nvidia was re-routing some of its Blackwell order flow away from Supermicro. So as to add some context right here, Supermicro specializes within the structure for servers and storage clusters that home Nvidia’s graphics processing items (GPUs). Since Blackwell is predicted to be a bellwether for Nvidia, Supermicro was well-positioned to profit from huge tailwinds surrounding these GPUs.

Whereas accounting fraud is a critical allegation, I might warning traders in opposition to hitting the panic button. It is vital to take into account that brief sellers comparable to Hindenburg have a vested curiosity in seeing a inventory value decline. Furthermore, in gentle of all these highway bumps, Supermicro has taken some respectable steps with the intention to tackle the problems head on and proper the ship.

In late November, Supermicro introduced the appointment of a brand new auditor agency, BDO USA, P.C. In the identical press launch, administration additionally shared that the corporate had submitted a compliance plan to the Nasdaq to keep away from delisting.

In early December, traders acquired optimistic information because the Nasdaq granted Supermicro’s “request for an exception” to stay listed on the alternate by means of Feb. 25, 2025. If Supermicro doesn’t file its 10K by then, the corporate will fall out of compliance once more.

One other announcement from earlier this month revolved round a Particular Committee shaped by Supermicro’s Board of Administrators. Per the interior overview, the Particular Committee “decided that the resignation of the Firm’s former registered public accounting agency, Ernst & Younger LLP (“EY”) and the conclusions EY acknowledged in its resignation letter weren’t supported by the information examined within the Evaluation.”

On the floor, it appears like Supermicro is lastly getting some momentum again, and that the proactive steps from administration may very nicely put the corporate on a path to show issues round.

Because the chart beneath illustrates, Supermicro’s ahead value to earnings (P/E) a number of of 12.9 is nicely off prior intra-year highs and is basically hovering round a low level. The present valuation image, mixed with a few of the optimistic information outlined above, may trigger you to suppose that Supermicro is an absolute cut price proper now.

Nonetheless, I believe leaping to such a conclusion is extra aligned with a “pigs get slaughtered” kind of mentality.

There are a number of shifting variables with Supermicro, and at this level, I believe nearly any piece of stories (optimistic or destructive) may trigger the inventory to whipsaw.

To me, there are simply too many unknowns surrounding Supermicro in the meanwhile. Investing within the inventory is akin to throwing a dart on the wall or flipping a coin — it simply is not for the faint of coronary heart and certain is finest averted for now.

Before you purchase inventory in Tremendous Micro Laptop, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Tremendous Micro Laptop wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $799,099!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 16, 2024

Adam Spatacco has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

This Struggling Artificial Intelligence (AI) Stock Could Be About to Take Off. Here’s Why. was initially revealed by The Motley Idiot

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.