The post Arthur Hayes Says Yen Intervention Could Push Bitcoin to $200,000 appeared first on Coinpedia Fintech News

BitMEX co-founder Arthur Hayes said Bitcoin could get a major boost if global central banks step back into money printing.

He linked the recent rise in the Japanese yen to possible U.S. Federal Reserve action, saying new liquidity could enter markets and help push Bitcoin toward $200,000 by March 2026.

Bitcoin To Benefit From Yen Intervention and Fed Liquidity

According to Hayes, there is growing talk that Japan may step in to strengthen its currency, possibly with help from the U.S. Federal Reserve. Recently, the yen jumped about 1.75% to 155.63 per dollar.

This sudden move followed reports that the New York Fed contacted major banks to check conditions in the yen market.

Arthur Hayes believes that if the Fed supports the yen, it would likely do so by printing dollars, creating new banking reserves, and using those funds to buy yen. If this happens, the Fed’s balance sheet would expand under its foreign currency assets line, a figure that is reported weekly in the H.4.1 release.

Right now, that line sits near $19.1 billion.

Hayes says this kind of liquidity expansion has historically been very positive for Bitcoin.

Although no official action has been confirmed, traders see this as a sign that intervention may be coming.

- Also Read :

- Bitcoin Price Analysis: Rising Profit-Taking Signals More Volatility—What’s Next for BTC?

- ,

Hayes’ Bold Bitcoin Price Targets

Hayes remains strongly bullish if liquidity returns. He believes Bitcoin could reach $200,000 by March 2026 if the Fed starts expanding its balance sheet again.

In an even more aggressive outlook, he has suggested Bitcoin could climb as high as $500,000 by the end of the year if global money flows accelerate.

Despite rising speculation, Bitcoin is currently trading near $89,500, showing little reaction so far.

Bitcoin Price Outlook

Despite rising speculation, Bitcoin is currently trading near $89,471, showing little reaction so far.

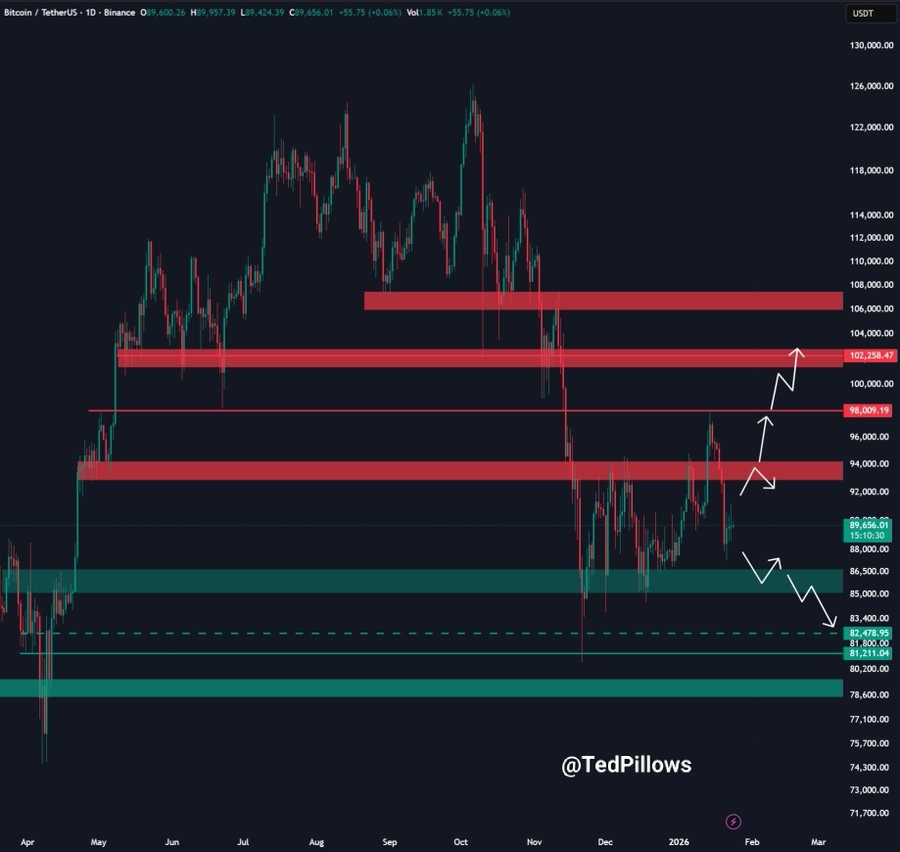

Looking at the daily chart, crypto trader TED, bitcoin trading back inside what many traders call a “no-trading zone. This area sits between key support and resistance levels, where price often moves sideways without a clear direction

The chart highlights a major resistance zone around $91,000. If Bitcoin manages to break above this level with strong spot demand, it could open the door for a cleaner move toward $98,000 and even $102,000.

On the downside, the chart shows important support levels near $89,000, followed by stronger support around $86,500 to $83,000.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Hayes suggests Bitcoin could reach $200,000 by March 2026 if global liquidity expands and demand remains strong.

Support is near $83,000–$89,000, while resistance sits around $91,000, $98,000, and $102,000, guiding potential price moves.

More liquidity usually fuels asset buying, which can lift Bitcoin prices, especially when major central banks intervene globally.

The post Arthur Hayes Says Yen Intervention Could Push Bitcoin to $200,000 appeared first on Coinpedia Fintech News

BitMEX co-founder Arthur Hayes said Bitcoin could get a major boost if global central banks step back into money printing. He linked the recent rise in the Japanese yen to possible U.S. Federal Reserve action, saying new liquidity could enter markets and help push Bitcoin toward $200,000 by March 2026. Bitcoin To Benefit From Yen …

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.