TLDR:

- Bitcoin and Ethereum combined outflows exceeded $3.3 billion, marking the highest weekly exodus since November 10.

- Tether on Ethereum saw $3.11 billion withdrawn while Tron network gained $905 million in USDT inflows concurrently.

- Simultaneous withdrawal of risk assets and stablecoins typically precedes heightened volatility rather than clear trends.

- Large-scale exchange outflows suggest traders moving to self-custody or responding to market uncertainty concerns.

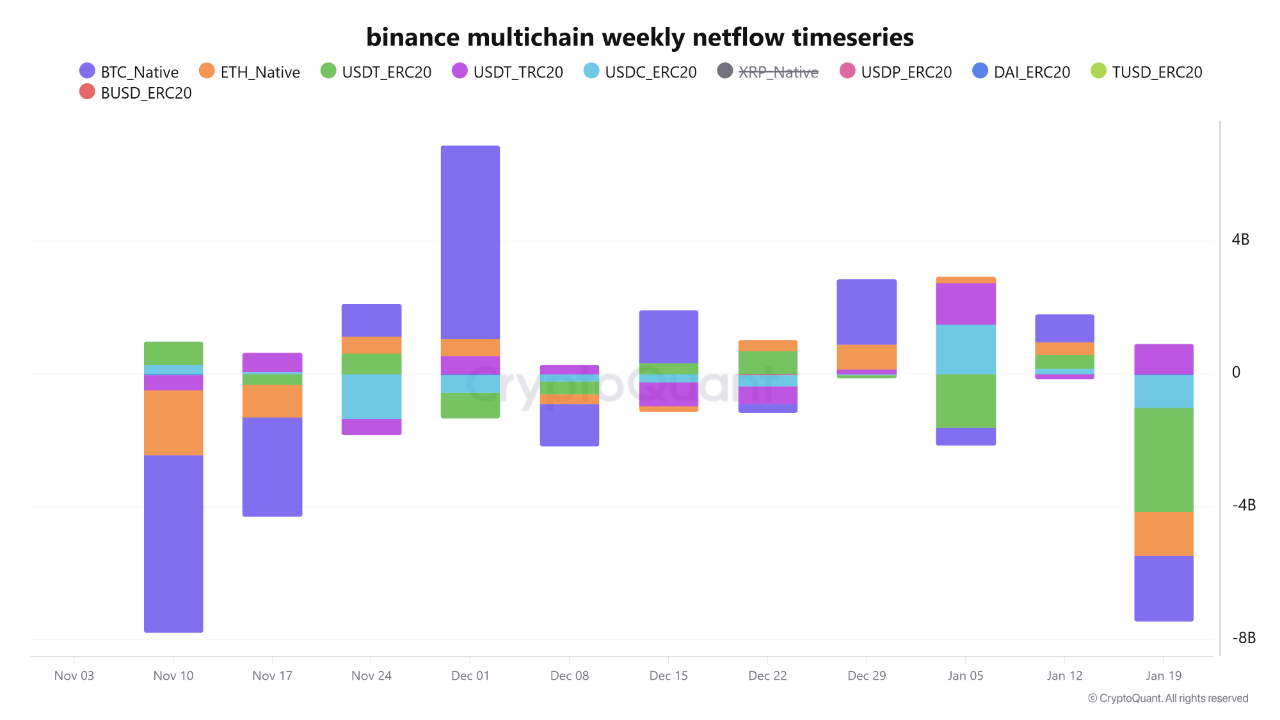

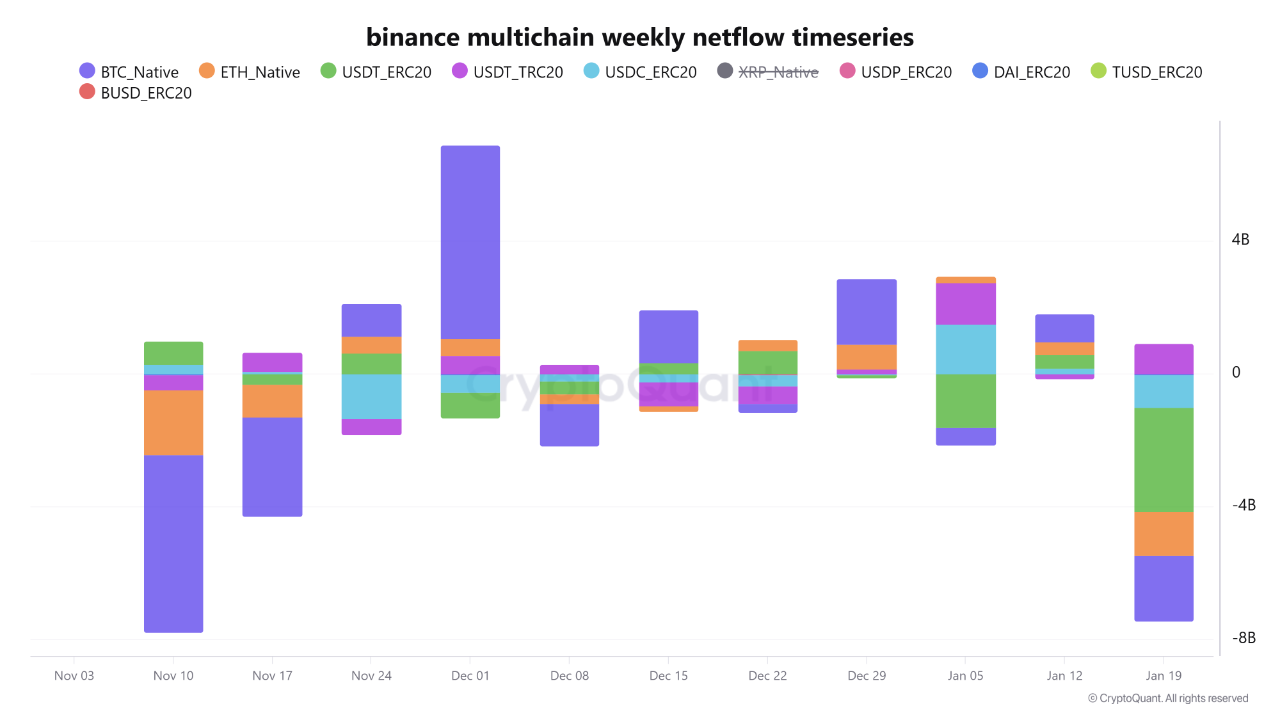

Binance experienced its largest weekly asset withdrawal since November 10, with over $6 billion leaving the exchange across multiple blockchain networks.

On-chain tracking data shows Bitcoin, Ethereum and Tether dominated the outflows during the week beginning January 19, 2026.

The exodus represents a notable shift in trader behavior on the world’s largest cryptocurrency platform.

Multi-Billion Dollar Withdrawal Marks Exchange Exodus

Bitcoin withdrawals reached approximately $1.97 billion during the seven-day period, while Ethereum saw roughly $1.34 billion move off the platform.

Tether on the Ethereum network recorded the largest single-asset outflow at $3.11 billion. The combined movement of risk assets and stablecoins suggests traders are repositioning holdings rather than exiting crypto markets entirely.

Multichain weekly netflow data confirms the withdrawal pattern affected major digital assets simultaneously. However, the Tron network presented a contrasting trend with USDT-TRC20 recording positive inflows around $905 million.

Source: Cryptoquant

This pattern indicates capital rotation between blockchain networks instead of wholesale flight from centralized exchanges.

The timing and scale of withdrawals draw parallels to previous periods of market uncertainty. Large institutional holders often move assets into cold storage ahead of anticipated price movements. Self-custody solutions have gained traction among traders seeking direct control over their digital holdings.

Market Dynamics Point to Potential Volatility Ahead

Exchange outflows of this magnitude typically precede periods of increased price swings across cryptocurrency markets.

The simultaneous withdrawal of both trading assets and stablecoins creates conditions for supply constraints. Reduced liquidity on centralized platforms can amplify price movements in either direction.

Two competing narratives have emerged around the data. Some analysts view the outflows as preparation for future price appreciation through reduced available supply.

Others interpret the movement as risk mitigation amid broader market concerns or platform-specific factors affecting trader confidence.

The withdrawal pattern differs from typical market cycles where stablecoins flow into exchanges before major purchases.

Instead, USDT exited alongside Bitcoin and Ethereum, complicating immediate directional forecasts. Historical precedent suggests this configuration often leads to heightened volatility rather than clear trends.

Network-specific data reveals traders are selectively choosing blockchain platforms for asset storage. The positive Tron network inflow contrasts sharply with Ethereum’s stablecoin exodus.

This selective migration points to cost considerations and transaction efficiency driving allocation decisions beyond simple exchange exit strategies.

The post Binance Sees $6 Billion Weekly Outflow as Bitcoin, Ethereum and Stablecoins Leave Exchange appeared first on Blockonomi.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.