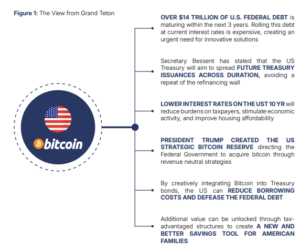

In their new policy brief, “Bitcoin-Enhanced Treasury Bonds: An Idea Whose Time Has Come,” the co-authors, Andrew Hohns and Matthew Pines, present a fresh approach to tackling the $9.3 trillion of federal debt set to mature within the next year.

With interest rates approaching 4.5%, servicing this debt is putting a heavy strain on taxpayers and limiting the government’s ability to grow the economy.

BitBonds: A Strategy to Cut Debt and Strengthen Finances

The proposal builds on President Donald J. Trump’s 2025 Executive Order, which established the Strategic Bitcoin Reserve, recognizing Bitcoin as a strategic reserve asset similar to digital gold. The policy brief suggests adopting Bitcoin-enhanced US Treasury Bonds, or “₿ Bonds” (also known as BitBonds), to address several key fiscal goals.

We’re proud to announce our latest policy brief, “Bitcoin-Enhanced Treasury Bonds: An Idea Whose Time Has Come.” Co-authored by Andrew Hohns & @matthew_pines, it explores the viability of a BitBonds strategy.

Read here: https://t.co/Z65iqHnZB9 pic.twitter.com/XzIZC2n87B

— Bitcoin Policy Institute (@btcpolicyorg) March 31, 2025

BitBonds would offer immediate relief by significantly reducing interest costs on Treasury bonds, expand the Strategic Bitcoin Reserve without burdening taxpayers, and create a tax-advantaged savings option for American families. It also opens a path to reduce the federal debt through the appreciation of Bitcoin, rather than relying on increased taxes or cuts to government spending.

BitBonds: Saving Billions and Reducing Debt Through Bitcoin

The structure of BitBonds is simple yet effective: 90% of the proceeds would be used for traditional government funding, while 10% would go towards purchasing Bitcoin, ensuring a balance between stability and exposure to Bitcoin’s growth potential. This strategy capitalizes on America’s leadership in finance and technology, positioning the country to become a “Bitcoin superpower” while addressing its fiscal challenges.

Source: Bitcoin Policy Institute

Financial analysis reveals that implementing BitBonds on a scale of $2 trillion—roughly 20% of the 2025 refinancing needs—could save up to $70 billion annually in interest costs. Over a decade, these savings could total $700 billion, with a present value of $554.4 billion. Even with a conservative approach to Bitcoin’s price growth, the program could still generate net taxpayer savings of $354.4 billion. With Bitcoin’s historical performance considered, the returns from these holdings could substantially reduce, or even eliminate, the federal debt burden for future generations.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers, and their risk tolerance may be different from yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The post BitBonds: A New Solution to America’s Debt Crisis? appeared first on Altcoin Buzz.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.