A widely followed crypto analyst is issuing an alert about Bitcoin (BTC), saying that the top digital asset could collapse if one key level breaks down.

In a new strategy session, crypto trader Justin Bennett tells his 113,900 followers on the social media platform X that Bitcoin could plunge more than 8% from its current value.

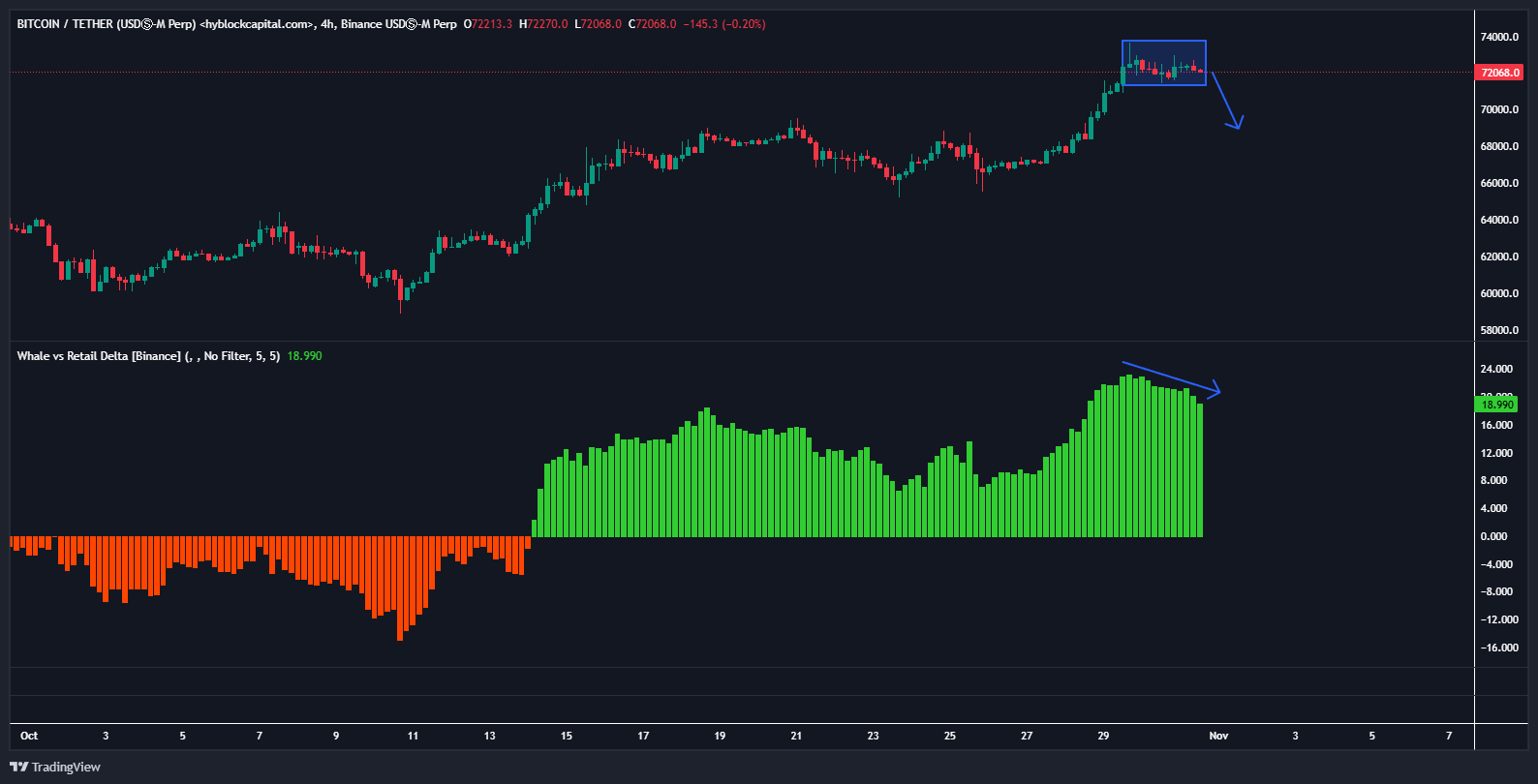

Bennett uses the whale versus retail delta indicator (WRD), which gauges whether whales or retail traders are more bullish. A higher value means more whales are longer Bitcoin than retail traders.

The declining WRD value is bearish Bitcoin since whales tend to be a better predictor of the market direction.

“Given everything I’m seeing, a pullback from BTC into $69,300-$70,000 seems likely. From there, bulls must hold the line into the daily/monthly close. If they can, things remain constructive. If they can’t, $65,000 is next. I’m not ruling out a $73,000 intraday sweep first to clear those equal highs, but Bitcoin pumping at the NY (New York stock exchange) open has been a bearish signal all month. Let’s see.”

Bennett also believes that a market correction in the near term is more likely than a bullish continuation due to the trading volume metric.

“If this BTC breakout is the one to trigger $100,000-plus, why is it stalling? Why is volume not at multi-year highs? Bitcoin has been sideways for seven months! That alone should trigger consecutive +5% days or better and massive volume. But it isn’t. Why?”

He also says that Tether (USDT) stablecoin’s market cap relative to other cryptocurrencies may continue to increase, a bearish signal for Bitcoin.

He shares a chart of USDT Dominance (USDT.D) that appears to predict it will gain more market share in the near term.

“Tether dominance. It moves inversely to BTC, so add it to the other clues I’ve shared. A daily close above this level is bearish for Bitcoin.”

Lastly, he warns of market volatility due to upcoming events.

“[October 31st] is the last day of October, and early next week is the US presidential election. Not to mention Friday’s NFP (Non-farm payrolls data). Don’t get too comfy with any assumptions.”

Bitcoin is trading for $70,725 at time of writing, down 1.6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Analyst Justin Bennett Issues Bitcoin Alert, Says BTC Primed To Plunge if Major Support Level Fails To Hold appeared first on The Daily Hodl.

A widely followed crypto analyst is issuing an alert about Bitcoin (BTC), saying that the top digital asset could collapse if one key level breaks down. In a new strategy session, crypto trader Justin Bennett tells his 113,900 followers on the social media platform X that Bitcoin could plunge more than 8% from its current

The post Analyst Justin Bennett Issues Bitcoin Alert, Says BTC Primed To Plunge if Major Support Level Fails To Hold appeared first on The Daily Hodl. Bitcoin, BTC, News

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.