Cryptocurrency asset manager Grayscale recently stated that the Bitcoin mining industry is essential for maintaining the Bitcoin network’s transparency and long-term security.

Although miners play a critical role in the growth of Bitcoin, a lot of risk and operational expenses are involved. Purchasing mining hardware and acquiring land for facilities is expensive.

Miners also struggle to maintain revenue due to the volatility of Bitcoin (BTC).

Hashrate Derivative Products Gain Interest

Bitcoin miners today are therefore exploring new ways to ensure that their operations remain profitable. One of these ways is through the financialization of Bitcoin mining hashrate.

Andy Fajar Handika, CEO of Loka Mining, told Cryptonews that “hashrate derivatives” allow Bitcoin miners to hedge against fluctuations in mining revenue by locking in a fixed price for their future hashrate.

“This means that miners can secure predictable cash flows regardless of Bitcoin’s price volatility or changes in network difficulty,” Fajar Handika said.

How Miners Can Sell Future Hashrate

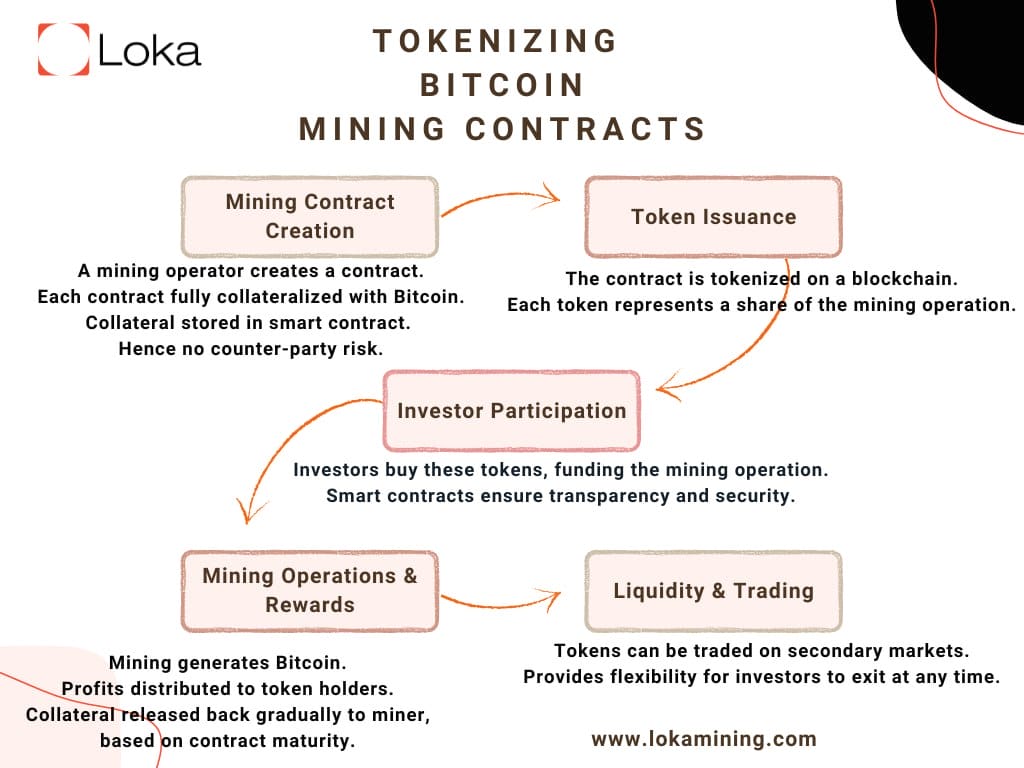

For example, Loka Protocol is a platform that enables Bitcoin miners to sell their future hashrate in the form of tokenized mining contracts.

Fajar Handika explained that these contracts function similarly to commodity futures in traditional markets.

“Just like corn farmers hedge against crop price fluctuations, Bitcoin miners can sell hashrate contracts upfront to secure capital while investors gain exposure to mining rewards without operating hardware,” he said.

This concept reduces risk for both parties, while making mining financing more accessible.

Ryan Condron, CEO of Titan.io, told Cryptonews that hashpower marketplace Lumerin offers a decentralized ecosystem for miners to sell off their hashpower for up to 7 days in the future.

Bitcoin mining hashpower can then be traded by Lumerin users on-chain.

Aaron Foster, director of business development at Luxor Technology, told Cryptonews that Luxor also offers a “Non-Deliverable Forward” (NDF) product that allows miners to take a position on hashprice.

“This lets miners effectively lock in 1-12 month revenue certainty for their mining operations (this product is also available to non-miners as well),” Foster said. “Miners are naturally long Bitcoin (hashprice), so taking a position and locking in a price to create revenue certainty makes sense.”

Foster believes that hashrate derivatives will likely extend the lifetime of mining operations by reducing exposure to short-term downturns.

Bitcoin Mining Hashrate Derivatives Critical With Rising Bitcoin Price

It’s also interesting to point out that as the price of Bitcoin rises, hashrate derivatives are becoming more important.

Fajar Handika explained that as more miners enter the market, the Bitcoin network faces increasing difficulty. This makes it harder for existing miners to maintain profitability.

“Hashrate derivatives provide upfront liquidity that allows Bitcoin miners to buy new hardware and expand operations,” he said.

Financializing hashrate may also reduce the need for miners to sell off their BTC over time.

“Instead of selling mined Bitcoin at lower prices to cover operational costs, miners can use forward hashrate contracts to secure capital without giving up their BTC holdings,” Fajar Handika remarked.

Echoing this, Foster noted that miners who hedge their exposure to hashprice volatility as a percentage of their operational costs will lock in longer-term profit margins before a depressed hashprice market develops.

“These instruments allow miners to hedge against hashprice volatility, making mining more predictable and financing easier,” he commented.

Hashrate Derivative Products Gain Traction

While hashrate derivatives have been a known concept for a few years, industry experts believe that this is finally catching on for both Bitcoin miners and institutions.

Speaking about the topic at The North American Blockchain Summit (NABS) in November last year, Condron stated, “This is very much the next stage in this market for evolution and maturity. The financialization of hashpower needs to be treated more as a commodity than a hobby.”

Foster – who was also on the derivatives panel at NABS – further remarked that institutions want to buy hashrate to get exposure to this asset class. He explained that this is why Luxor created its NDF product.

“We created that product to service the institutional side to allow them access to the product without having to go through the hurdles of setting up on the physical side,” he said.

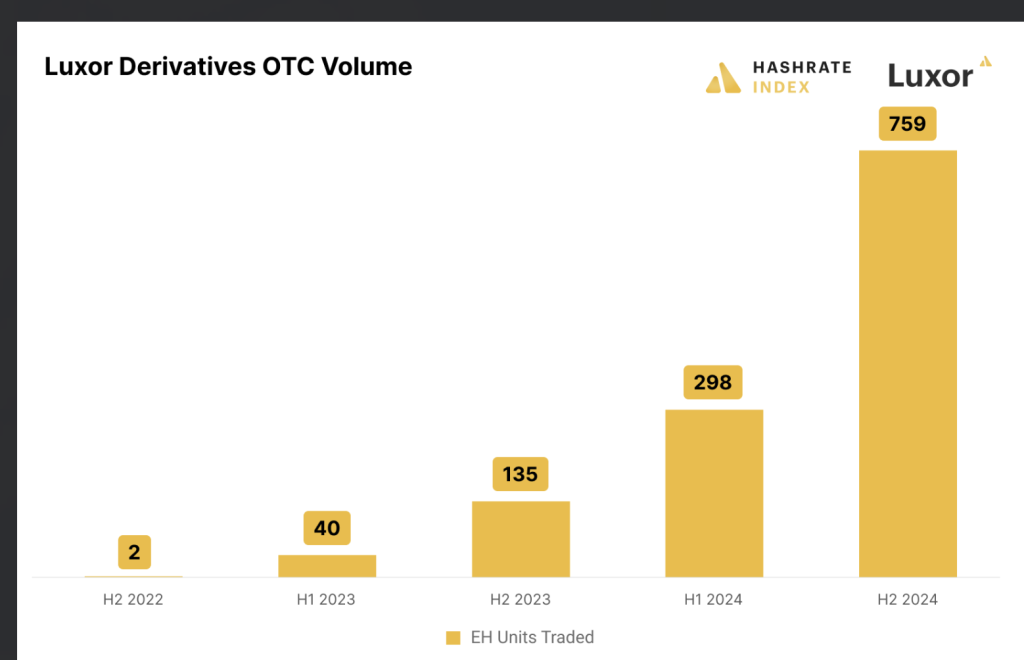

Luxor’s end of year summary report for 2024 notes that its hashrate derivative product witnessed exponential growth.

The report states that last year Luxor’s hashrate derivatives were used by public and private miners, prop trading funds, financiers, market makers, hosting providers, hashrate marketplaces, and ASIC brokers.

“On the business side, we onboarded 30 new clients into our markets and traded $65 million in notional USD, settling about 1.2EH per day on average,” the report states.

It’s further documented that interest from miners and traditional finance communities reached a record high at the end of 2024.

As a result, Luxor has continued to expand its product offering by increasing its tenures to 12 months in duration. The company also recently launched hashrate exchange-traded futures.

Additionally, last week Grayscale announced the launch of a new exchange-traded fund (ETF) offering exposure to Bitcoin mining.

Known as “Grayscale Bitcoin Miners ETF” (MNRS), the fund specifically invests in companies that comprise the Indxx Bitcoin Miners Index.

This is a proprietary index designed to measure the performance of global Bitcoin mining companies that generate the majority of their revenue from Bitcoin mining or mining-related hardware, software, services, and projects.

Key Hurdles for Miners and Institutions

While hashrate derivatives are becoming more popular, challenges may prevent some miners and institutions from using these products.

Fajar Handika pointed out that this is likely due to a lack of education around these offerings.

“Many miners are unfamiliar with these products and may hesitate to use them,” he said.

Liquidity concerns also remain, as Fajar Handika noted that investors must be willing to buy hashrate contracts, but if demand is low, pricing may not be favorable for miners.

Moreover, decentralized derivative solutions – like the product offering from Loka Protocol – are subject to smart contract risks.

Yet while challenges remain, Condron believes that all miners will eventually start to sell their hashpower.

“This may be to a global hashpower ‘grid’ or mining pool. Countries, banks, and large corporations will bid against each other to buy up the hashpower in order to mine blocks and process transactions on the BTC network,” he said.

Condron added that while hashrate derivatives may be a “less sexy” part of the ecosystem, miners need to start hedging strategies to generate predictable revenue regardless of market volatility.

“This will help stabilize the entire ecosystem as Bitcoin continues to become part of the world’s core economic architecture,” he said.

The post Bitcoin Miners Consider Hashrate Derivatives as BTC Price Rises appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

(@luxor)

(@luxor)