Bitcoin has seen a pullback below the $121,000 mark in the past day. Here’s where the next support level could lie, according to on-chain data.

Bitcoin Has Witnessed A Fast Plunge During The Last 24 Hours

Bitcoin looked to be entering into an extended all-time high (ATH) exploration mode as it set multiple new records over the weekend and Monday, but the market has been delivered a Tuesday shock as the cryptocurrency has seen a quick crash back below $121,000.

Compared to the new ATH around $126,200, Bitcoin is now down more than 4%. The altcoins have also taken a hit during the past day, with many top coins even printing returns worse than the number one digital asset. 24-hour losses stand at 5% for Ethereum and 6% for XRP. BNB is the only cryptocurrency among the large caps that has managed a positive return of 5%.

With Bitcoin now sliding down, one question naturally arises: how much lower can the asset go? While markets are unpredictable, there can still be some factors worth keeping an eye on. One such factor may be on-chain support clusters.

BTC CBD Shows Support Cluster Around $117,000

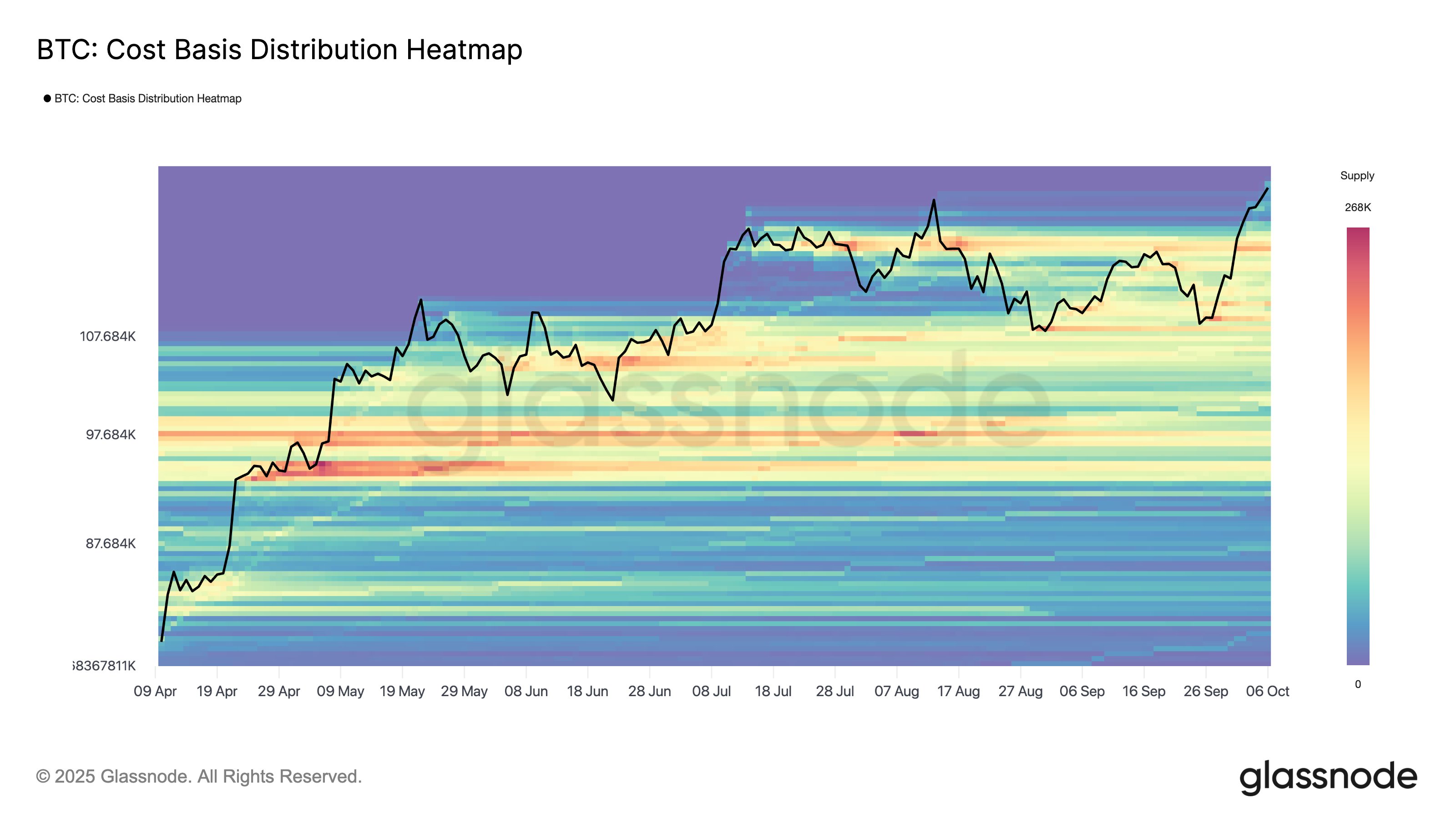

In a new post on X, on-chain analytics firm Glassnode has talked about how the Cost Basis Distribution (CBD) is looking for Bitcoin. The CBD is an indictor that tells us about how many tokens of the cryptocurrency were last acquired at the various spot price levels.

Below is the chart for the metric shared by Glassnode.

As displayed in the above graph, the $120,000 to $121,000 range, which the cryptocurrency is retesting right now, carries the cost basis of a thin amount of supply.

In on-chain analysis, investor cost basis is considered an important topic because holders tend to react in a special manner whenever their break-even level is retested. The more supply that was last purchased at a particular level, the stronger is the market’s reaction to a retest.

When investors face a retest of their profit-loss boundary from the above, they may decide to buy more, believing the drawdown to be a “dip” or for simply defending their cost basis.

Given that the current range contains the cost basis of some investors, some degree of accumulation could happen, but it only remains to be seen whether it will be enough for a bottom.

In the scenario that BTC declines further, the next key support cluster to watch is located near $117,000, where a notable 190,000 BTC was acquired. “A pullback into this area could attract demand as recent buyers defend the level,” explains the analytics firm.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.