Bitcoin is at $116,600 after dipping to $114,700 and rebounding quickly after the first rate cut of 2025. The Fed reduced its benchmark rate by 25 basis points, bringing the target range down to 4.00%–4.25%, citing slowing job growth and rising economic risks.

Chair Jerome Powell described the move as necessary but cautious, leaving the door open for further cuts this year.

Markets quickly interpreted the Fed’s softer stance as a positive for risk assets. With lower returns on traditional safe havens like bonds, cheaper rates make non-yielding assets like Bitcoin more attractive.

BTC is back above $117,000 as institutional inflows offset equity volatility and Bitcoin is becoming a hedge in uncertain times. FOMC member Stephen Miran dissented and wanted a 50 bps cut, showing the divisions on how to respond to slowing momentum.

Mining Sector Faces Structural Shifts

While Bitcoin’s price outlook is strengthening, the mining industry faces longer-term uncertainty. Bit Digital CEO Sam Tabar warned that most private miners may struggle to remain profitable after the next halving. He argued that sovereign states—able to access cheap or even free electricity—could take over mining dominance within a few years.

Bit Digital has already scaled back operations in the U.S., Canada, and Iceland to focus resources on Ethereum-related opportunities. Should governments expand into mining, the competitive landscape may change fundamentally, shifting power away from private operators and toward state-backed entities.

Key industry points:

- Halving risks squeezing miner profitability.

- States with low-cost energy could expand into mining.

- Some firms are diversifying away from Bitcoin production.

Market Outlook and Technical Setup

Institutional demand is the driver. On-chain data shows fewer new wallets are being created, retail is cautious but ETF inflows and fund allocations are supporting higher prices. As long as Bitcoin is above $117,000 the $120,000-$125,000 range is in play in the near term. Below $112,500 would erode the bullish momentum.

From a technical perspective Bitcoin is in an ascending channel since early September. The 50-SMA ($115,900) is acting as support above the 200-SMA ($113,300) and the structure is constructive. The candles at $117,900 were spinning tops and shooting stars, supply overhead.

Still, dip-buying has emerged along trend support, with bullish engulfing candles signaling buyers are active at key levels.

Immediate levels to watch:

- Resistance: $117,980, then $119,300–$120,300

- Support: $115,750, then $114,400 and $113,300

Bitcoin Trade idea:

Consider a starter long near $116,000–$116,100 if Bitcoin holds above the 50-SMA and confirms strength with a green close. A protective stop below $115,750 limits risk, with targets at $117,980 and potentially $120,000 if momentum extends. If $115,750 breaks on a close, the setup invalidates, shifting focus to $114,400 and the 200-SMA.

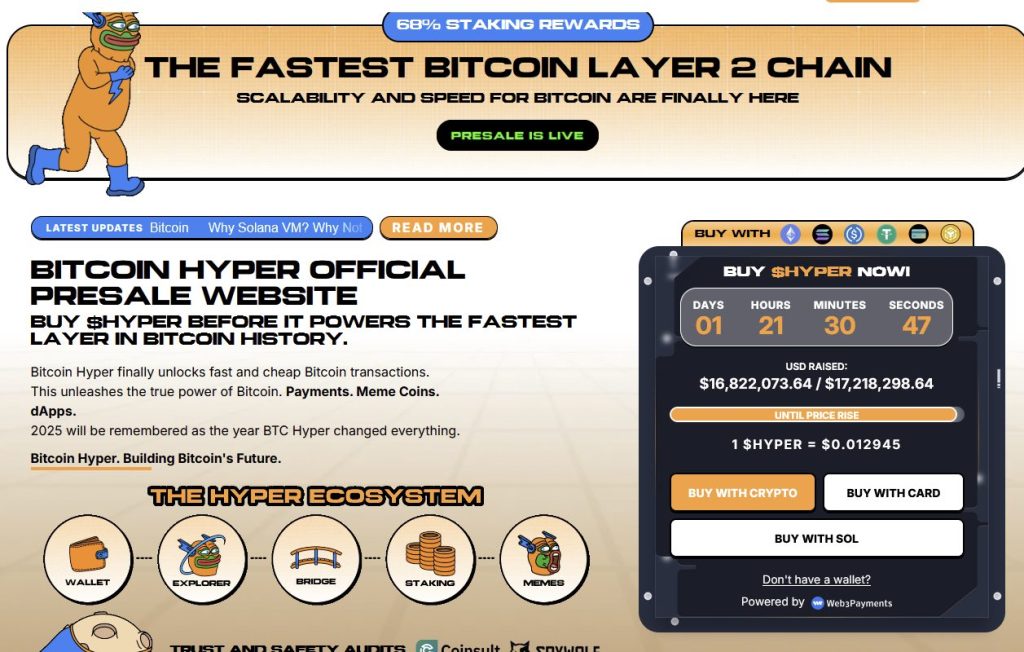

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $16.8 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012945—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Wall Street Money Floods In After Fed Cut – $200,000 Could Be Just Weeks Away appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.