Although the past 24 hours have been characterized by heavy selloffs, Bitcoin is still currently holding above the $100,000 level, trading around $103,700 as of the time of writing. Notably, signs of exhaustion are also beginning to surface for Bitcoin, especially in the past 48 hours.

While long-term indicators suggest a bullish continuation for the Bitcoin price, short-term models indicate a breakdown of bullish strength, particularly as the cryptocurrency approaches the critical $100,000 support zone.

This sentiment is relayed by popular crypto analyst Willy Woo, who shared the good and bad news based on Bitcoin’s current technicals.

Good News: A Bullish Long-Term Signal Still Intact

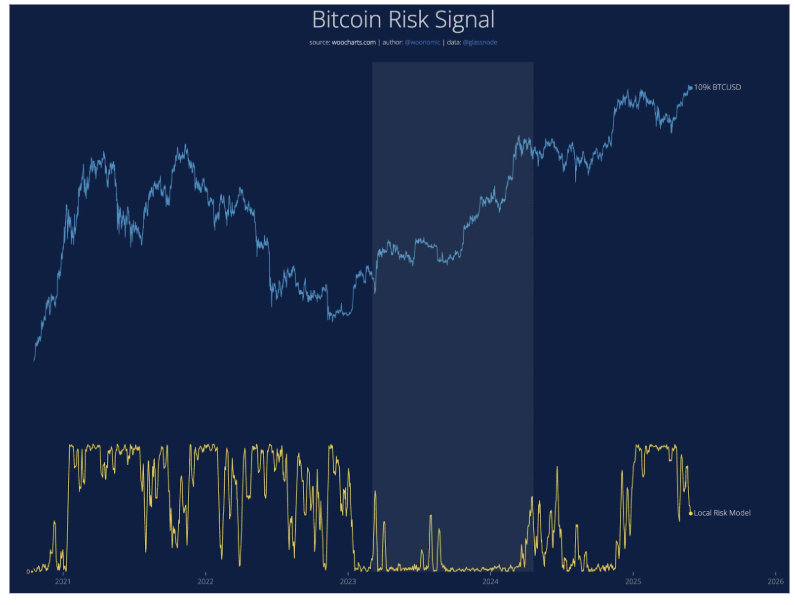

According to Woo, one of the strongest long-term signals, the Bitcoin Risk Signal, is currently trending downwards. This drop indicates that buy-side liquidity is currently dominant in the long-term environment, setting the stage for another strong leg upward.

The lower the risk reading, the safer it is to hold or accumulate Bitcoin, and this signal’s current decline shows a relatively low-risk environment for long-term investors.

Woo noted that this long-term setup is intact, and with Bitcoin trading well above the psychological six-figure mark, the momentum is still in favor of the bulls in the long term.

At the time of writing, the local risk model, as shown in the chart below, is currently in the mid-range, having declined from peak levels in early 2025, and is expected to continue trending downwards. In another analysis, Willy Woo noted the next significant move could push it above $114,000 and trigger liquidations of short positions.

Bad News For Bitcoin Price

Although the long-term picture is still favorable, the short-term models, including the Speculation and SOPR (Spent Output Profit Ratio) metrics, are flashing caution. Using this indicator, Woo noted that the strength of the rally from $75,000 to $112,000 has started to weaken, especially with flat capital inflow in the past three days.

Keeping this in mind, Bitcoin’s price action this week is critical. “If we do not get follow through, then we will be up for another consolidation period,” the analyst said. If spot buying fails to pick up strongly in the coming week, which is the first week of June, especially with U.S. markets reopening after a long weekend, there will be a chance for a bearish pivot.

The good and bad news can be summed up as follows: if buying pressure opens up quickly, Bitcoin could break above $114,000 and head toward the next major liquidity zone between $118,000 and $120,000. Failure to push higher could confirm bearish divergences and set the stage for another round of consolidation.

At the time of writing, Bitcoin is trading at 103,700, down by 1.5% and 3.9% in the past 24 hours and seven days, respectively.

Featured image from Unsplash, chart from TradingView

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.