DraftKings and Flutter Entertainment both stumbled on Tuesday (November 4) after Bank of America (BofA) issued downgrades for the two online betting heavyweights, warning that the gambling industry is under pressure from several directions, including the growing influence of prediction markets.

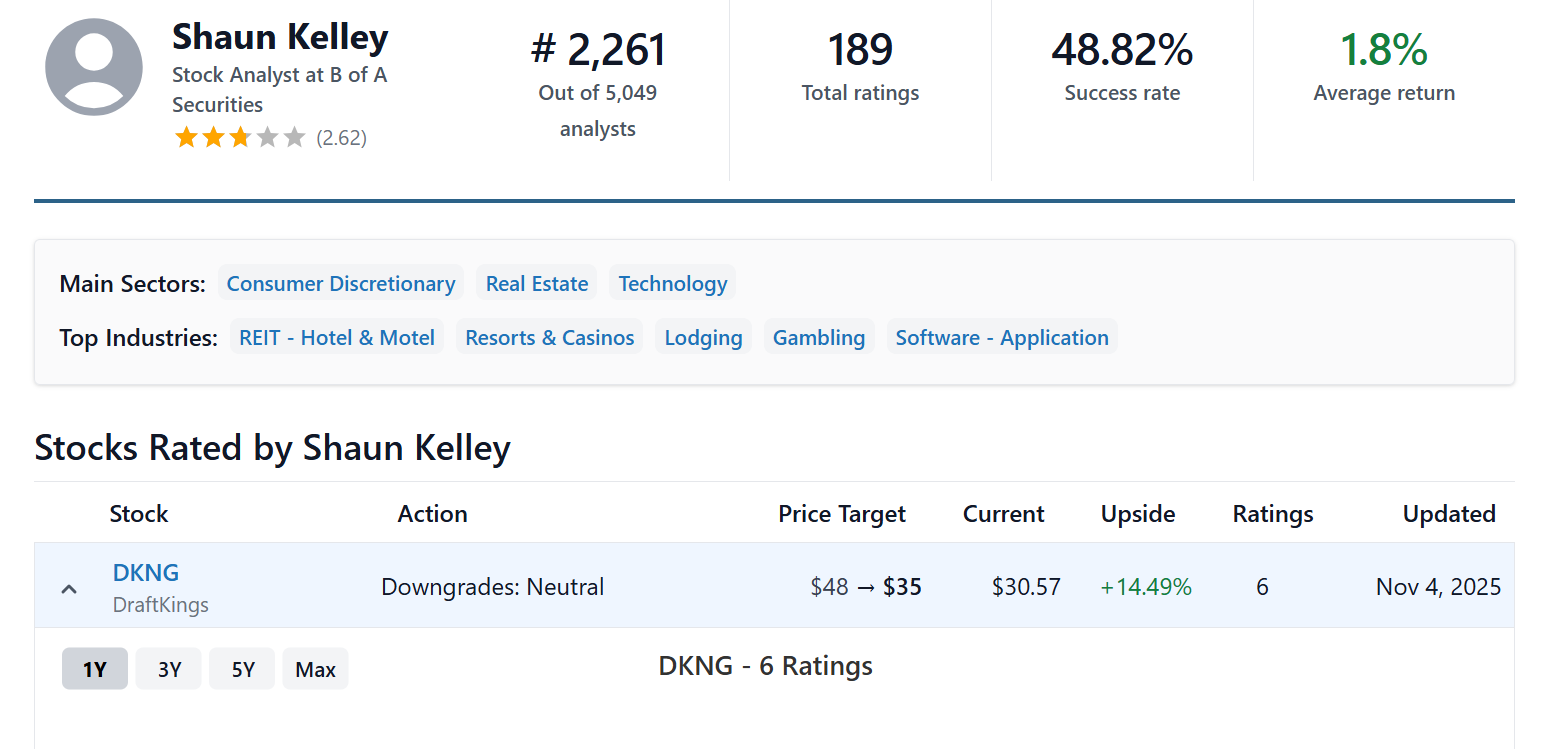

DraftKings dropped about 5% in early trading after BofA lowered its rating from “Buy” to “Neutral.” Analyst Shaun Kelley also cut the price target from $48 to $35, citing a mix of problems such as recent sports outcomes that let bettors win more than usual (and dented profits), DraftKings’ lagging performance in iGaming, and the possibility of higher state-level taxes. Prediction markets, he added, could become a near-term drag as well.

BMO Capital piled on by trimming its own price target to $63 from $65 and lowering its Q3 revenue expectations tied to those same unfavorable September sports results.

Flutter Entertainment didn’t escape the scrutiny either. Bank of America downgraded the stock to “Neutral” from “Buy” and slashed its price target to $250 from $325. The firm pointed out rising concerns around structural hold rates, potential trade-offs that could slow handle growth, the ongoing UK tax review, and what it called the “perennial” threat of US gaming tax changes. Prediction markets, once again, were flagged as an added overhang for the company.

Prediction market growth hampers DraftKings and Flutter, says BofA

“The near-term event path around prediction markets is challenging, with chances of a competitive marketing and price war rising, while OSB operators’ decisions are constrained by regulation and legal maneuvering,” Kelley is cited as saying in Bloomberg.

It’s no shock that DraftKings decided to scoop up prediction-market startup Railbird last month. The move gives the company an early stake in the fast-growing market for sports contracts. In Railbird’s newly released statement, DraftKings highlights the federally regulated setup of the platform and says the acquisition fits into a “broader strategy to enter prediction markets, expanding its addressable opportunity through regulated event contracts.”

Kelley says that while neither DraftKings nor Flutter’s FanDuel has seen any real “cannibalization” from prediction markets yet, he thinks the next stage of their growth could create some turbulence in terms of how these businesses operate.

In his Tuesday note, he warned that “without clear legal resolution, the event path and unit economics of prediction markets could be material overhangs for our space for the next 6-9 months, and possibly for years.” He added that “we see more negative news ahead in terms of announcements and competition, and possible mixed news as legal developments remain fluid.”

ReadWrite has reached out to DraftKings and Flutter for comment.

Featured image: DraftKings / Flutter Entertainment

The post BofA downgrades hit DraftKings and Flutter as prediction market risks grow appeared first on ReadWrite.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.