ChatGPT o3’s AI model processed 38 live indicators and came up with a Cardano price forecast. ADA is currently trading at $0.5833, and the RSI is plunging to 30.76, which is in oversold territory.

Interestingly, nearly $1 billion worth of ADA was withdrawn from centralized exchanges this year, and Ford Motor Company’s advisory role in a Cardano-based legal data storage project suggests institutional confidence despite technical weakness.

After losing 13% over seven days, ADA faces key support at $0.5812 amid an elevated daily volume of 67.7 million tokens. Whales purchased 310 million ADA in June, providing potential accumulation support as technical indicators reach extreme oversold levels.

The following analysis was conducted using ChatGPT’s o3 AI model. It synthesized 38 real-time technical indicators, on-chain whale movements, enterprise adoption developments, and social sentiment metrics to assess ADA’s 90-day price trajectory across multiple probability scenarios.

The predictions were then reanalyzed and edited together for enhanced readability while maintaining analytical precision.

Technical Pulse: Extreme Oversold Conditions Meet Volume Surge

Cardano’s daily chart reveals a market under severe technical pressure. ADA is trading at $0.5833, having opened at $0.6021 before establishing a range between $0.6071 (high) and $0.5812 (low), a 4.3% intraday spread reflecting heightened volatility.

The RSI at 30.76 places ADA deep in oversold territory, approaching the 30-level threshold that historically precedes relief rallies. Within the last seven days, ADA has lost almost 13%, causing the coin to trade at around $0.60, creating the most oversold reading since May’s capitulation.

MACD indicators paint a bearish picture with the MACD line at -0.0065 trading below the signal line at -0.0311. However, the histogram at -0.0246 shows potential momentum divergence, suggesting selling pressure may be exhausting despite continued downward price action.

Moving averages create formidable overhead resistance across all timeframes. The 20-day EMA at $0.6502 sits 11.5% above the current price, while the 50-day EMA at $0.6838 represents a 17.2% premium.

The 100-day EMA at $0.7063 and the 200-day EMA at $0.7084 cluster near 21% above current levels, creating a resistance wall that confirms the bearish trend structure.

Volume analysis shows 67.7 million ADA traded daily, representing a 19% increase from recent averages and indicating distribution pressure.

However, this elevated volume at oversold levels often precedes capitulation bottoms, particularly when combined with whale accumulation data.

The Relative Volatility Index at 37.57 indicates continued bearish momentum, though approaching levels where reversal patterns historically emerge. ATR readings suggest daily volatility ranges of approximately 4-5%, consistent with the current $0.58–$0.61 consolidation zone.

Historical Price Context: Six-Month Bear Market Trajectory

Cardano’s 2025 performance shows a systematic decline from January’s peak near $1.16. February trading in the $0.85–$0.90 range gave way to March’s $0.80–$0.85 consolidation before accelerating weakness through the spring months.

May witnessed the steepest decline, with ADA bottoming near $0.65 before June’s volatile range between $0.60 and $0.95.

At the start of June 2025, ADA was trading near $0.69, just 58% higher than the previous year, showing the crypto’s underperformance relative to the broader market recovery.

The April low near $0.51 is a key psychological level, with current prices holding approximately 14% above this threshold. This support zone has attracted renewed buying interest, evidenced by recent whale accumulation patterns and exchange outflow data.

Historical analysis shows ADA’s current price represents an 81.32% decline from its September 2021 all-time high of $3.10, placing it among the deepest retracements in major crypto rankings.

Support & Resistance: Critical Battle Zones Define Range

Immediate support clusters around today’s low at $0.5832, reinforced by the psychological $0.58 level where strong buying interest has emerged. The immediate support lies at the $0.60 mark, aligning with a long-standing trendline formed by the lows on November 5, April 9, and June 5.

The next major support zone extends from $0.5500 to $0.5600, representing a confluence of technical levels and potential whale accumulation areas.

Historical support lies in the $0.4200–$0.4400 range, corresponding to 2023’s base-building period.

Resistance emerges immediately at $0.6071 (today’s high), followed by the key $0.6200–$0.6500 zone where the 20-day EMA creates overhead pressure. Sidelined investors looking for buying opportunities could load up on Cardano upon a closing price higher than $0.7315, an inflection point on June 11.

Major resistance lies within the $0.7000–$0.7100 EMA cluster, where the 100-day and 200-day EMAs converge to create a formidable overhead supply. Breaking this level would require a large volume expansion and fundamental catalysts to overcome established selling pressure.

The current range between $0.58 and $0.61 represents a compression zone where directional momentum could emerge rapidly once triggered by volume or news catalysts.

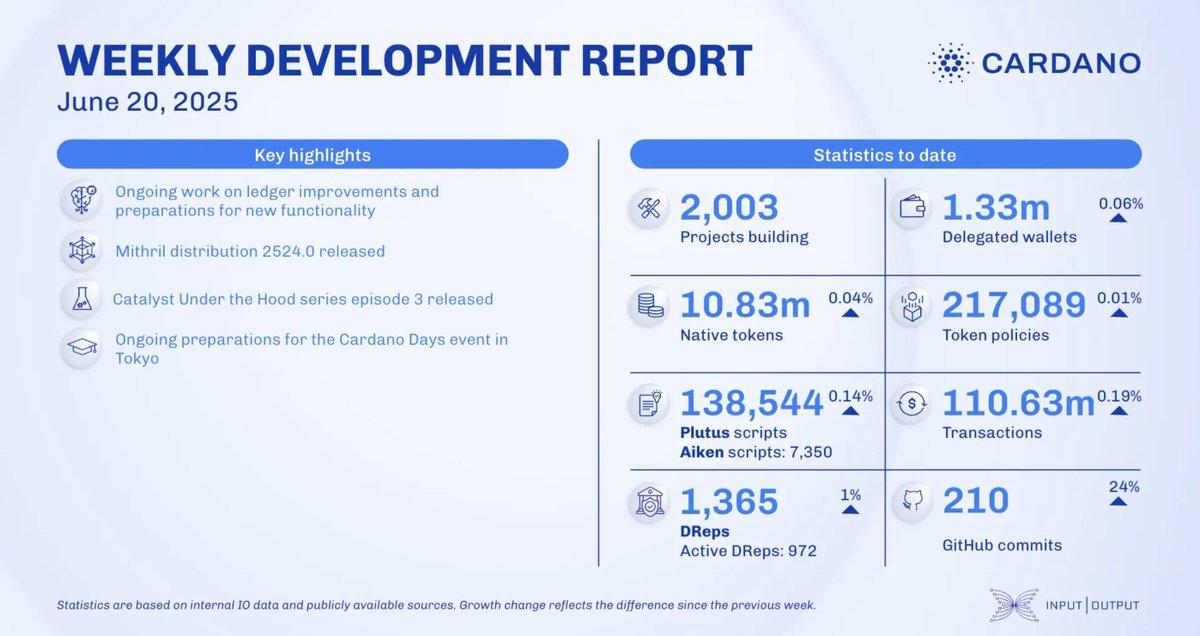

Enterprise Validation: Ford Partnership Revolutionizes Adoption Narrative

Ford Motor Company has joined Iagon and Cloud Court in a pilot proof-of-concept project that leverages the Cardano blockchain for secure legal data storage. This collaboration will accelerate Cardano’s enterprise adoption trajectory.

The initiative addresses three persistent challenges plaguing corporate legal departments, including testimony data scattered across teams, security vulnerabilities from decentralized access control, and operational delays in document preparation and witness coordination.

Under the hybrid model, testimony data remains encrypted on distributed nodes. Still, Cardano smart contracts log permissions and access events, creating an auditable chain of custody that satisfies frameworks such as HIPAA, GDPR, and US protective orders.

The proof-of-concept combines Iagon’s decentralized storage network with Cloud Court’s AI-powered analytics engine and Cardano’s immutable ledger technology.

If Ford ultimately endorses the architecture, other Fortune 500 legal departments could view the pilot as proof that public-network infrastructure can satisfy stringent confidentiality and audit requirements.

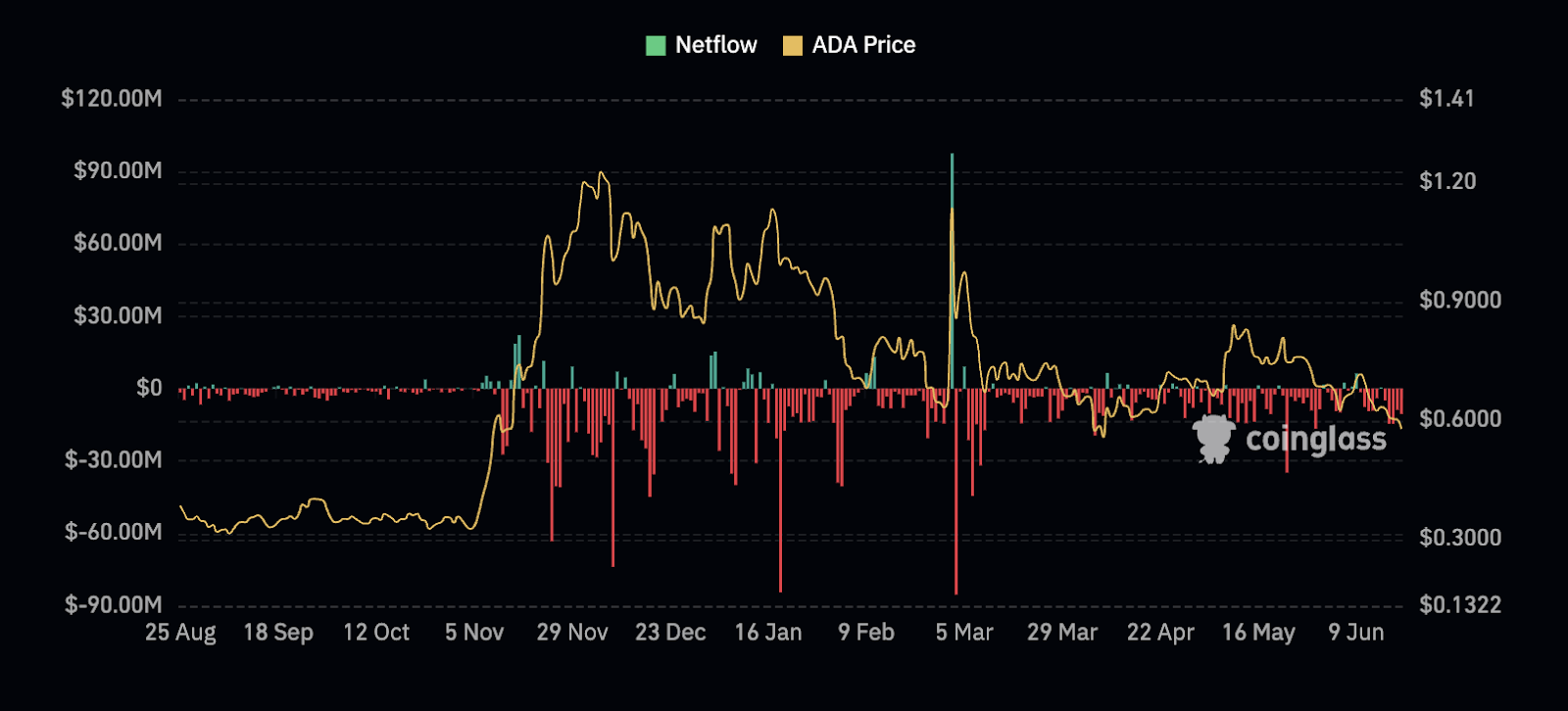

On-Chain Dynamics: Massive Capital Flight from Exchanges

Cardano (ADA) has gained bullish momentum, with nearly $1 billion worth of ADA withdrawn from centralized exchanges this year. Blockchain analytics firm TapTools reported Tuesday that approximately $932 million in ADA has left exchanges since January.

This massive outflow represents approximately 4.6% of ADA’s total market cap moving to self-custody wallets, indicating strong conviction among long-term holders despite recent price weakness.

Exchange outflows typically precede price recovery as reduced sell-side liquidity creates upward pressure when demand returns.

Since June 1, whales with holdings of 100 million to 1 billion ADA tokens have expanded their portfolios to 3.15 billion tokens from 3.02 billion tokens. Similarly, whales with more than 1 billion ADA tokens have a total holding of 1.97 billion ADA, up from 1.79 billion ADA on June 1.

This whale accumulation of 310 million ADA during June’s volatility demonstrates institutional-level confidence, with large holders absorbing selling pressure at depressed price levels.

The number of Cardano whales, addresses holding between 1 million and 10 million ADA, currently sits at 2,384. That’s down from 2,413 nine days ago but slightly up from 2,382 just two days ago.

Over recent days, the slight rebound in whale count suggests accumulation may accelerate as technical oversold conditions attract opportunistic buyers seeking value at multi-month lows.

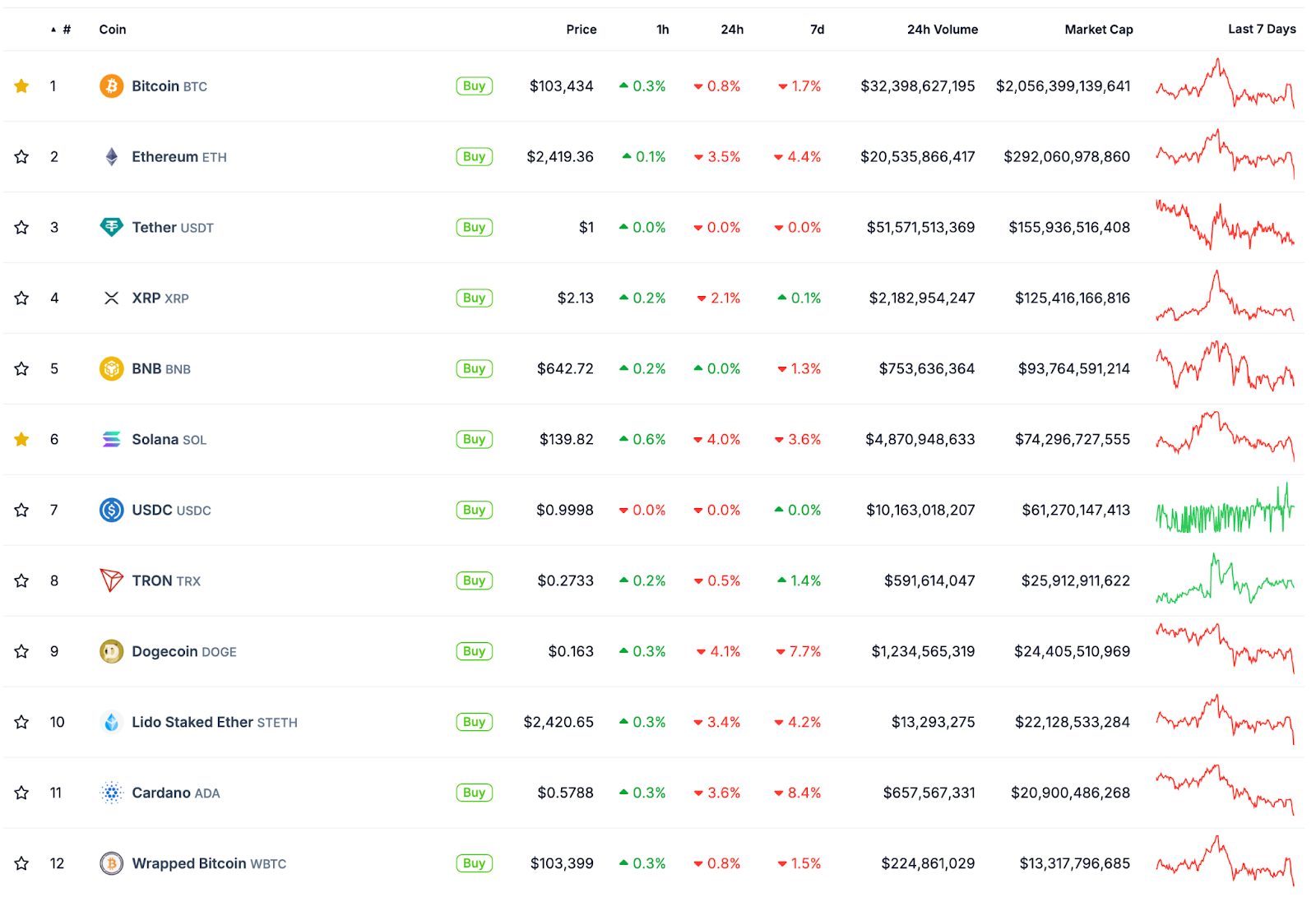

Market Metrics: Fundamental Resilience Amid Technical Weakness

Cardano maintains a market capitalization of $20.41 billion with 24-hour trading volume reaching $564.37 million, representing a volume-to-market cap ratio of 2.75%. The fully diluted valuation reaches $26.04 billion based on the maximum supply of 45 billion ADA tokens.

The current circulating supply stands at 35.36 billion ADA, representing 78.6% of the maximum supply. The remaining tokens are allocated to treasury reserves and staking rewards. This controlled supply inflation provides long-term scarcity dynamics supporting price appreciation potential.

ADA trades at $0.5833, representing an 81.32% decline from its September 2021 all-time high of $3.10.

However, current levels sit 3,235% above the October 2017 all-time low of $0.01735, showing the cryptocurrency’s long-term appreciation trajectory despite recent weakness.

Market dominance remains stable at 0.65% of total cryptocurrency market cap, maintaining Cardano’s position among the top 11 digital assets by valuation despite underperformance relative to Bitcoin and Ethereum.

Social Sentiment: Community Conviction Amid Enterprise Optimism

LunarCrush data reveals Cardano’s AltRank at 174, indicating strong relative social engagement compared to other cryptocurrencies. The Galaxy Score of 55 suggests moderate bullish sentiment, while engagement metrics total 10.78 million interactions across social platforms.

Mentions reach 31.21K with 4.64K creators contributing to discussions, reflecting sustained community interest despite price headwinds. Sentiment is 90% positive, indicating overwhelming optimism among active community participants.

The 2.8% social dominance demonstrates Cardano’s ability to capture attention relative to its market cap, with enterprise partnership news driving increased discussion volume.

Recent social media themes focus on Ford’s collaboration importance, long-term ecosystem development, and accumulation opportunities at current price levels.

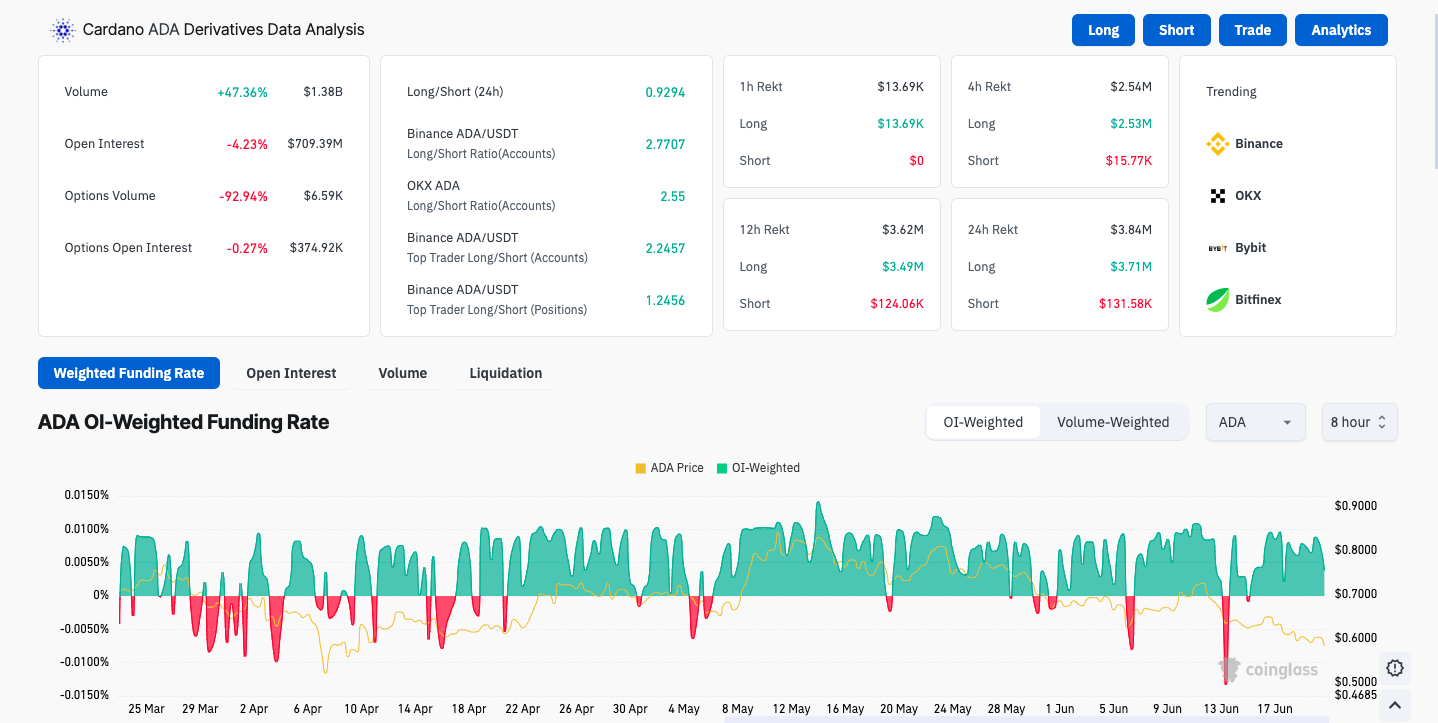

Derivative Markets: Reduced Leverage Signals Capitulation

CoinGlass data indicates a decline of over 4% in Cardano’s Open Interest (OI), reaching $709.39 million in the last 24 hours. The falling OI relates to capital withdrawal from Cardano derivatives, suggesting a drop in traders’ interest.

The OI-weighted funding rate has corrected to 0.0084% from a peak of 0.0108% on June 11, indicating reduced bullish positioning among leveraged traders. The long/short ratio is at 0.9681. A ratio below 1 suggests a greater number of short positions.

Long liquidations have accelerated over the past 24 hours, contributing to selling pressure but also reducing leveraged longs that could create additional downside risk.

This deleveraging process often precedes price stabilization as weak hands are flushed from the market.

Three-Month ADA Price Forecast Scenarios

Oversold Bounce Recovery (Base Case – 45% Probability)

RSI oversold conditions at 29.66 historically precede relief rallies, particularly when supported by whale accumulation and reduced derivative leverage. The target range extends to $0.62–$0.65, representing a 6–11% upside from current levels.

This scenario requires support defense at $0.58 with volume expansion above 80 million ADA daily. Recovery faces initial resistance at the 20-day EMA around $0.65, with a sustained break above this level potentially extending gains toward $0.70.

Success probability increases if Ford partnership developments provide fundamental support and broader altcoin sentiment improves. Risk management requires stop-loss placement below $0.55 to limit downside exposure.

Enterprise-Driven Breakout (Bull Case – 30% Probability)

Successful Ford pilot implementation and additional enterprise partnerships could drive sustained buying interest. Bulls target $0.74–$0.78, representing a 27–34% upside, with a breakout above $0.74 potentially opening the path to $0.80–$0.85.

This scenario requires concrete enterprise adoption progress, broader crypto market recovery, and technical reclaim of multiple EMAs with a daily volume exceeding 100 million ADA.

If that level continues to hold, bulls are eyeing a potential bounce back to $0.74–$0.78, with a breakout above $0.74 possibly opening the door to $0.80.

Fundamental catalysts must include additional Fortune 500 partnerships, successful proof-of-concept completion, and institutional investment flows supporting price appreciation beyond technical resistance levels.

Deeper Correction (Bear Case – 25% Probability)

Failure to hold $0.58 support could trigger algorithmic selling toward $0.55–$0.50. A breakdown below $0.55 would indicate a deeper correction targeting June’s $0.51 low or potentially $0.45–$0.48 based on historical support levels.

This scenario requires broader crypto weakness, negative enterprise developments, or the failure of current whale accumulation to provide price support.

ADA is in a consolidation phase and faces difficulty maintaining support at the $0.620 level.

ADA Price Forecast: Is ADA Oversold?

Cardano’s current position represents a key inflection point where extreme technical oversold conditions meet massive enterprise validation through Ford’s blockchain evaluation.

The confluence of $932 million in exchange outflows, 310 million ADA whale accumulation, and RSI near 30 creates a unique setup rarely seen in major cryptocurrencies.

The current support defense at $0.58–$0.60 remains essential, with any breakdown below $0.55 potentially triggering a deeper correction toward $0.50-$0.51.

However, whale accumulation patterns and reduced derivative leverage suggest selling pressure may be nearing exhaustion.

Recovery requires reclaiming the 20-day EMA near $0.65 with sustained volume expansion, potentially opening the path toward $0.70–$0.75 if enterprise developments provide fundamental support.

The current technical setup creates a risk-reward setup favoring patient accumulation despite near-term volatility risks.

The post ChatGPT o3’s 38-Signal AI ADA Price Forecast Reveals Oversold Bounce Potential Amid Ford Partnership appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

LATEST:

LATEST: