ChatGPT’s XRP analysis has revealed XRP plunging -16.7% over nine days to $2.3843, testing key $2.3375 support as Ripple announces $1 billion GTreasury acquisition targeting multi-trillion dollar corporate treasury market, while Nasdaq receives CoinShares XRP ETF filing ahead of October 18 deadline.

ChatGPT’s XRP analysis synthesizes 27+ technical indicators while testing $2.33 breakdown with ETF approval timeline convergence.

Technical Analysis: Complete Bearish Breakdown

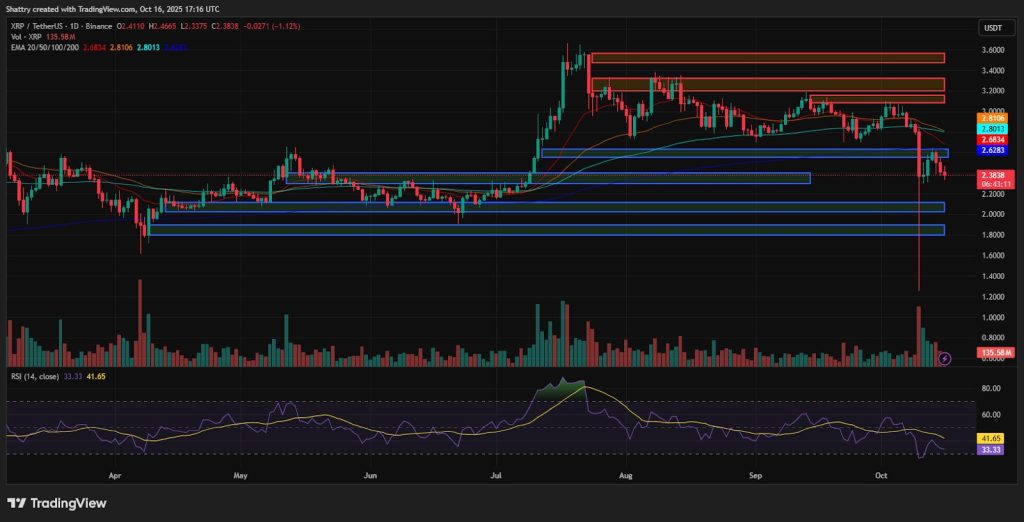

XRP at $2.3843 reflects a -1.10% decline from $2.4110, with a nine-day plunge from $2.8638 representing a -16.7% decline through all key support levels. Volume at 135.62M XRP confirms strong selling pressure.

RSI at 41.65 approaches oversold. Moving averages show a complete bearish structure: 20-day at $2.6854 (+12.6%), 50-day at $2.8106 (+17.9%), 100-day at $2.8013 (+17.5%), 200-day at $2.6146 (+9.7%). All EMAs act as overhead resistance.

The MACD is deeply bearish, currently at -0.0440, with a signal line at -0.1328 and a histogram at -0.0888. ATR at 2.3290 confirms high volatility. Failed recovery attempts validate bearish continuation toward $2.20–$2.00 support zone.

$1B GTreasury Acquisition Meets ETF Filing

Ripple announced its third major 2025 acquisition, purchasing GTreasury for $1 billion to target the corporate treasury market serving Fortune 500 companies.

Community analysis emphasizes “trillions in idle capital will now move through the XRP Ledger.”

Nasdaq received the CoinShares XRP ETF filing ahead of the October 18 decision. Garlinghouse expressed optimism about “potential for XRP ETFs to launch this year.”

Speaking with Cryptonews, Ray Youssef, CEO of NoOnes, observes that “high-beta altcoins like Ethereum leading market recovery bounces,” with “ETH, BNB, XRP, and DOGE [usually] posting double-digit gains” following the recent deleveraging event.

Additionally, African expansion also accelerates through Absa Bank’s partnership in South Africa and crypto custody solutions for leading banks.

Ripple is also progressing toward obtaining an operational license in Luxembourg while strengthening XRP Ledger’s DeFi expansion.

Distribution During Acquisition Strategy

XRP maintains $140.78B market cap (-3.28%) with $234.97B fully diluted valuation. Volume increased +14.25% to $6.3B, producing a 4.44% volume-to-market cap ratio.

XRP’s market dominance of 3.84% positions it as the fourth-largest cryptocurrency.

Holder count reaches 481,020. Circulating supply of 59.91B XRP against 100B maximum indicates 59.91% circulation.

Historical 2025: $3.04 (January), $2.15 (February), $3.18 (July peak), before the current $2.38 correction.

Community debates Ripple’s cash deployment with analysts noting “companies they’re buying should benefit XRP in the long run when partners decide to use it.“

Social Sentiment: ETF Optimism Meets Technical Weakness

LunarCrush shows AltRank at 654 (+269), Galaxy Score at 38 (-9). Engagements at 13.31M (-2.36M) and mentions at 53.98K (+2.09K).

Social dominance surges to 5.3% (+2.5%), sentiment 85% positive (+1%).

Lark Davis notes, “XRP facing two major resistances – previous support now acting as resistance, 0.618 Fib right above it.” Technical discussions emphasize “XRP looks like it wants to revisit $2.”

The community remains divided between acquisition optimism, with some emphasizing “ETFs around the corner, regulatory clarity, institutions coming into market,” and technical analysts warning, “XRP crashes 15% in just 24 hours.“

ChatGPT’s XRP Analysis: Treasury Integration Tests Support

ChatGPT’s XRP analysis reveals XRP at ckey breakdown testing $2.3375. Immediate support at $2.3375, major support at $2.20–$2.30. Breaking these indicates correction toward $2.00.

Resistance at $2.4665, followed by EMA cluster at $2.6146–$2.6854. Recovery requires reclaim above $2.65.

Three-Month XRP Forecast

ETF Approval Catalyst (40% Probability)

October 18 ETF approval with a hold above $2.33 drives recovery toward $2.80–$3.00 (17–26% upside). Requires $2.65 reclaim and GTreasury momentum.

Extended Consolidation (35% Probability)

Breakdown below $2.33 results in $2.00–$2.40 consolidation during acquisition integration and regulatory clarity.

Deeper Correction (25% Probability)

Failure at $2.33 triggers selling toward $2.00–$1.80 (16–26% downside).

ChatGPT’s XRP Analysis: Acquisition Strategy Tests Patience

Next Target: $2.20-$2.00 Within 30 Days, $2.80-$3.00 Within 90 Days

Holding above $2.33 prevents a breakdown toward $2.20.

The October 18 ETF approval could catalyze a recovery toward $2.80, with other catalysts driving the price toward $3.00 or higher.

Failure at $2.33 indicates correction toward $2.00 before institutional adoption and treasury market penetration drive XRP toward $4.00+ targets.

The post ChatGPT’s XRP Analysis: $2.38 Crashes 17% as Ripple Acquires GTreasury for $1B – Will $2.20 Hold? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.