ChatGPT’s XRP analysis has revealed a textbook flag pattern consolidation at $3.20, marked by minimal movement of -0.52%. This comes as the SEC grants Ripple a new Regulation D waiver, effectively removing major fundraising roadblocks.

Meanwhile, Blue Origin’s announcement of XRP payment acceptance positions XRP for a potential breakout toward $3.33 or continued range-bound action above the $3.16 support.

ChatGPT’s XRP analysis synthesizes 18 real-time technical indicators, SEC waiver implications, corporate adoption developments, and institutional positioning metrics to assess XRP’s 90-day trajectory.

Technical Analysis: Perfect Flag Consolidation Formation

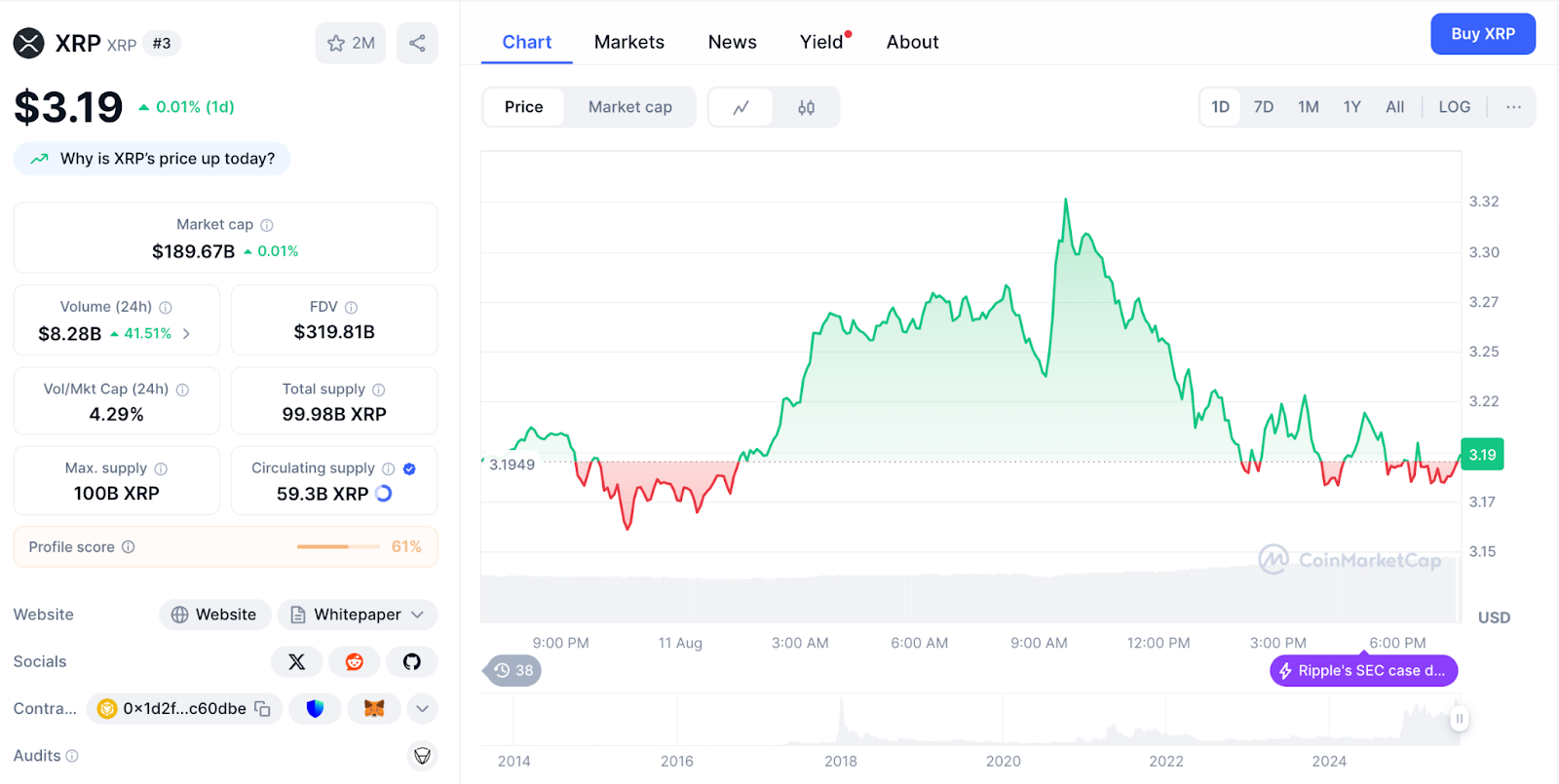

XRP’s current price of $3.20 reflects a minimal 0.52% daily decline from the opening price of $3.22, establishing a tight trading range between $3.24 (high) and $3.18 (low).

This controlled 1.8% intraday range shows classic flag consolidation typical of preparation phases before major directional moves.

The RSI at 49.58 sits in a perfectly neutral territory with substantial room for explosive movement in either direction without extreme conditions.

Moving averages reveal strong positioning with XRP above most major EMAs: 50-day at $3.16 (-1.2%), 100-day at $3.12 (-2.5%), and 200-day at $3.07 (-4.1%), with only the 20-day EMA at $3.21 (+0.5%) providing minor resistance. This structure indicates healthy consolidation within an uptrend.

MACD shows mixed signs at -0.0135 below zero, but a strong positive histogram at 0.0344 suggests building momentum toward a potential bullish crossover.

Volume analysis shows steady activity at 42.33 million XRP during consolidation, indicating sustained institutional interest.

Additionally, ATR at 2.97 suggests a high volatility environment with potential for major moves, especially as regulatory developments accelerate.

Historical Context: Steady Consolidation After Victory Rally

XRP’s August performance demonstrates institutional patience following the SEC case victory, with current consolidation validating market confidence despite typical post-victory profit-taking.

The positioning above $3.16 support maintains elevation from the regulatory breakthrough.

The year-long journey from February’s $1.72 low through extended spring consolidation at $2.18–$2.21 to July’s breakthrough at $3.10 established a strong institutional foundation.

Current consolidation represents healthy digestion of victory gains.

August’s steady action between $2.72–$3.38 shows controlled institutional positioning ahead of the next catalyst wave.

Current pricing maintains a 14.89% discount to the all-time high while securing extraordinary 113,000%+ gains from 2014 lows.

Support & Resistance: Tight Range With Clear Boundaries

Immediate support emerges at today’s low around $3.18, backed by the key 50-day EMA at $3.16.

This combination provides primary defense for a continued bullish structure with additional EMA support layers below.

Key support demonstrates a solid foundation with 100-day EMA at $3.12 (-2.5% buffer) and 200-day EMA at $3.07 (-4.1% buffer).

This multi-layer structure provides institutional-grade downside protection during consolidation phases.

Resistance begins at the 20-day EMA around $3.21, followed by today’s high at $3.24 and major resistance at $3.33–$3.40. Breaking above the current tight range could trigger momentum acceleration toward these higher targets.

The technical setup suggests minimal downside risk given a strong EMA support cluster, while upside breakout from flag consolidation could produce rapid moves toward $3.40–$3.50 based on institutional adoption momentum.

SEC Waiver Victory: Unlimited Private Capital Access

The SEC’s granting of a new Regulation D waiver removes a major fundraising roadblock for Ripple, enabling unlimited private capital raising from accredited investors without regulatory red tape.

The waiver elimination allows Ripple to accelerate growth initiatives, product development, and market expansion without previous regulatory constraints.

The timing following the SEC case resolution creates an optimal environment for institutional capital raising and strategic partnerships.

ChatGPT’s XRP Analysis: Corporate Adoption Momentum

ChatGPT’s XRP analysis reveals accelerating corporate adoption with Blue Origin announcing XRP payment acceptance, representing space industry validation for XRP’s utility infrastructure.

The corporate adoption expansion demonstrates XRP’s practical utility beyond speculative trading, with companies recognizing payment efficiency and cost advantages.

Recent developments, including banking license speculation and institutional infrastructure development, position XRP for mainstream financial integration.

Speaking with Cryptonews, Ray Youssef, CEO of NoOnes, emphasized that “projects like Solana and Ripple have a genuine shot at multiplying their market caps many times over, potentially moving them out of the ‘altcoin’ category and out from Ethereum’s shadow.“

This assessment aligns perfectly with XRP’s current positioning, as the combination of SEC victory, corporate payment adoption, and regulatory normalization creates the exact conditions Ray describes for fundamental value appreciation.

Unlike speculative tokens, XRP’s real-world utility provides the sustainable foundation needed to survive market cycles and achieve institutional-grade status.

Market Fundamentals: Stable Metrics During Consolidation

XRP maintains the third-largest cryptocurrency position with a $189.76 billion market cap, demonstrating institutional stability during the consolidation phase.

The modest 0.2% market cap increase accompanies a healthy 25.41% volume surge to $7.61 billion.

The 4.0% volume-to-market cap ratio indicates moderate trading activity, suggesting institutional positioning rather than speculative activity.

A circulating supply of 59.3 billion XRP represents 59.3% of the maximum 100 billion token supply, with controlled release supporting stability.

Market dominance of 4.74% positions XRP as a major institutional cryptocurrency with a regulatory clarity advantage.

Social Sentiment: Steady Confidence During Consolidation

LunarCrush data reveals stable social performance with XRP’s AltRank at 143, indicating sustained community engagement during consolidation.

AA Galaxy Score of 53 reflects building momentum around institutional developments and corporate adoption.

Engagement metrics show substantial activity with 13.02 million total engagements and 62.8K mentions (+21.98K).

Social dominance of 4.45% demonstrates continued attention during a tight trading range.

In addition, Sentiment shows a robust 80% positive despite consolidation, reflecting community confidence in long-term prospects following regulatory clarity.

Recent themes focus on flag patterns, $4–11 price targets, and institutional adoption acceleration.

Three-Month XRP Price Forecast Scenarios

Flag Breakout Acceleration (50% Probability)

A successful break above $3.24 resistance combined with continued corporate adoption could drive appreciation toward $4.00–$5.00, representing 25–55% upside from current levels.

This scenario requires sustained volume above 60 million daily and institutional partnership momentum.

Extended Flag Consolidation (30% Probability)

Continued institutional positioning could result in extended consolidation between $3.10–$3.30, allowing technical indicators to reset while adoption developments continue.

This scenario provides accumulation opportunities without major risk.

Correction on Macro Headwinds (20% Probability)

Broader market weakness could trigger selling toward $3.07–$3.12 support levels, representing 4–8% downside.

Recovery would depend on institutional buying at EMA support and continued adoption momentum.

ChatGPT’s XRP Analysis: Regulatory Normalization Meets Technical Perfection

ChatGPT’s XRP analysis reveals optimal convergence of regulatory normalization, corporate adoption acceleration, and technical flag consolidation.

Next Price Target: $4.00-$5.00 Within 90 Days

The immediate trajectory requires a decisive break above $3.24 resistance to validate the flag breakout from the consolidation base.

From there, corporate adoption acceleration could propel XRP toward $4.00 psychological milestone, with sustained institutional integration driving toward $5.00+, representing strong appreciation.

However, failure to break $3.24 would indicate extended consolidation to $3.10–$3.16 range as the market digests developments, creating an optimal accumulation opportunity before the next adoption wave drives XRP toward $11+ targets, validating global payment infrastructure dominance with full regulatory and operational normalization.

The post ChatGPT’s XRP Analysis Sees Perfect Flag Setup – SEC News Could Trigger Moonshot appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

Jeff Bezos’ space company Blue Origin to accept

Jeff Bezos’ space company Blue Origin to accept