CleanCore Solutions has amassed over 710 million Dogecoin, worth approximately $174 million, with more than $20 million in unrealized gains since launching its Official Dogecoin Treasury on September 5, 2025, according to an update on October 7.

The accumulation positions CleanCore at 71% of its milestone target of acquiring 1 billion DOGE within 30 days, supported by its $175 million private placement before deducting fees.

The treasury operates in partnership with the Dogecoin Foundation’s House of Doge, with Bitstamp by Robinhood serving as the designated trading venue.

However, CleanCore’s stock has tumbled 8.44% to $2.06, mirroring a pattern across crypto treasury companies where share prices decline despite growing holdings.

The stock remains up over 60% year-to-date but trades below its treasury net asset value.

Rapid Accumulation Backed by Institutional Investors and Musk’s Attorney

CleanCore crossed 500 million DOGE on September 11 after purchasing $130 million worth of tokens, with CIO Marco Margiotta emphasizing the execution speed and scale.

The firm added another 100 million DOGE on September 16, building on the momentum from its private placement, which drew over 80 institutional investors, including Pantera, GSR, FalconX, and Borderless Capital.

Alex Spiro, Elon Musk’s attorney, became Chairman of CleanCore’s Board as part of the September 2 transaction.

The Bitstamp alliance provides a regulated platform for treasury transactions with plans for yield-bearing opportunities.

Adams emphasized that the approach goes beyond simple net asset value, working with House of Doge to advance the ecosystem through professional treasury governance.

CleanCore’s underlying business strengthened with a record Q4 2025 revenue of $1.1 million, marking its first quarter to exceed $1 million.

Full-year revenue grew 29% to $2.1 million, providing operational cash flow despite the company’s focus on aqueous ozone cleaning technology.

The firm secured a $1.37 million purchase order in June and converted over $600,000 of debt into equity.

Trump Family Ventures Drive Dogecoin Mining Expansion

Earlier this month, Thumzup Media provided DogeHash Technologies with a $2.5 million loan to expand Dogecoin mining capacity, supporting the deployment of more than 500 new ASIC miners, which will bring the total operational rigs to over 4,000 by year-end.

DogeHash shareholders will exchange their holdings for 30.7 million Thumzup shares, with the combined company rebranding as DogeHash Technologies Holdings under the ticker XDOG in Q4.

Donald Trump Jr. holds a 350,000-share Thumzup stake worth nearly $3.3 million, as of his July purchase.

The company raised $50 million in August, with its board authorizing up to $250 million in crypto holdings, including Bitcoin, Dogecoin, Litecoin, Solana, XRP, Ether, and USDC.

Thumzup now holds 19.106 Bitcoin and approximately 7.5 million Dogecoins.

The company is just one of many other Trump family-affiliated crypto investments.

American Bitcoin, co-founded by Eric Trump and backed by Donald Trump Jr., surged 110% at its September debut following a merger with Gryphon Digital Mining, reaching $7.7 billion market value.

The brothers’ combined stake was briefly worth $2.6 billion before closing around $1.5 billion.

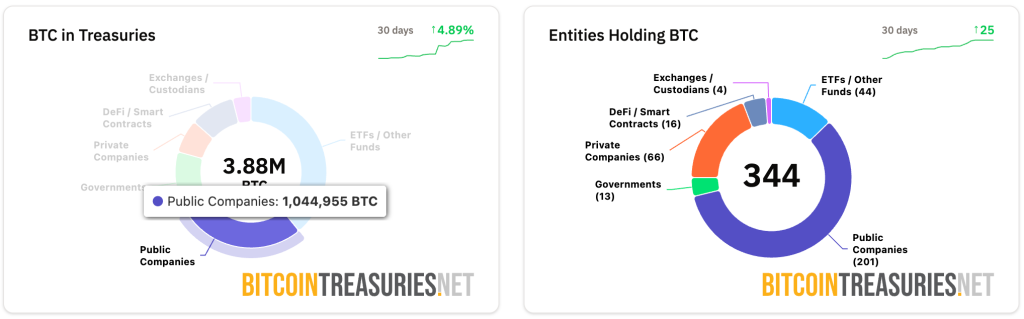

Corporate Dogecoin adoption remains limited compared to Bitcoin, where public treasury companies now hold 1,044,955 BTC worth over $126 billion, representing approximately 5% of the circulating supply.

Strategy leads with 640,031 BTC, valued at more than $77 billion. However, monthly purchases collapsed from 134,000 BTC in November 2024 to just 3,700 BTC in August 2025, as its modified net asset value premium fell from 3.89x to 1.44x.

At least seven crypto treasury firms now trade below their holdings value, raising investor red flags.

In fact, K33 Research reveals 25% of public companies holding Bitcoin trade at market values below their BTC holdings, with critics even saying debt-funded share buybacks signal desperation.

Technical Analysis Points to Range-Bound Trading Near Critical Support

Dogecoin trades at $0.24983, near the ascending trendline support from February lows around $0.15, following a rejection from the $0.25-$0.28 resistance zone that has defined trading for most of 2025.

Multiple failed breakout attempts in May, August, and September created a supply wall at $0.28, while CleanCore’s accumulation at approximately $0.245 aligns with current prices.

DOGE faces binary outcomes, where holding $0.24-$0.25 support could enable another attempt at $0.27-$0.28, with potential reach toward $0.30-$0.32.

Conversely, failure triggers testing of the $0.20-$0.22 zone.

Most probable scenario involves continued range-bound trading between $0.23-$0.28, requiring sustained closes above $0.28 with volume for a genuine breakout toward $0.36.

The post CleanCore Solutions Amasses 710M Dogecoin Worth $174M – Is DOGE About to Explode? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.