The Conflux ($CFX) token is experiencing explosive growth, with a recent 49.35% price increase in a single day, trading at $0.2253. It now boasts a $1.15 billion market cap and a 24-hour trading volume of $1.73 billion.

Community sentiment reflects this optimism, with 80% of participants expressing a bullish outlook.

Why Conflux ($CFX) Could Hit $0.30: AI, Cross-Chain Utility & China’s Blockchain Darling

$CFX’s growth is not a product of speculation alone but is driven by a series of strategic developments, technical innovation, and extraordinary market confidence that solidifies Conflux’s unique position in the blockchain space.

From a technical perspective, this rally breaks CFX out of a consolidation zone that held prices between $0.12 and $0.15 for several weeks.

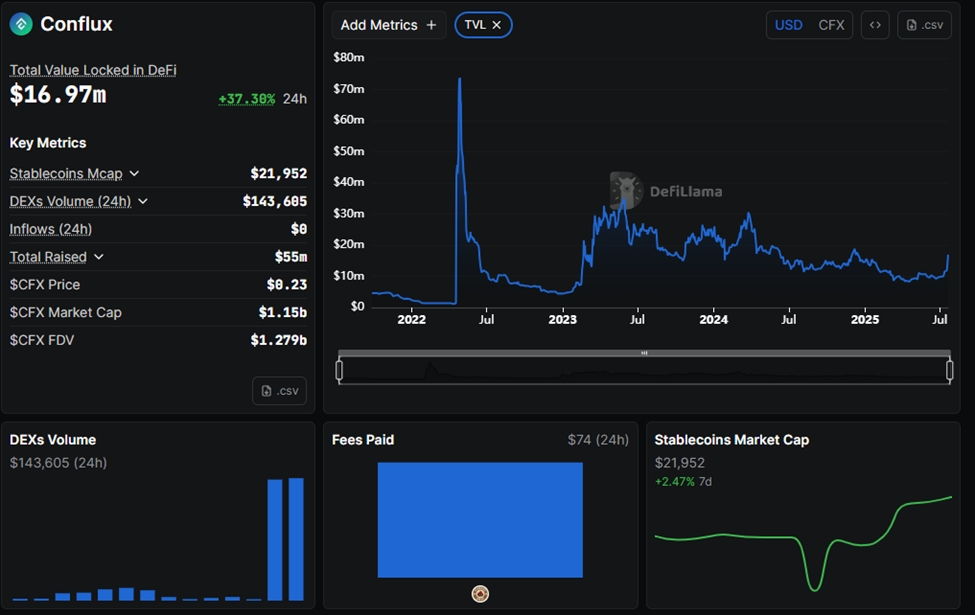

While its DeFi Total Value Locked (TVL) remains modest at $16.97 million and DEX volume is at $143,605, there are early signs that decentralized liquidity is beginning to build.

One of Conflux’s strongest assets lies in its technical design. Its Tree Graph consensus mechanism processes blocks and transactions in parallel, delivering between 300 and 6,000 transactions per second (TPS) without sacrificing decentralization.

This low-latency, high-throughput structure helps Conflux outperform many Layer‑1 blockchains that struggle with congestion and high fees.

The Conflux 3.0 upgrade, slated for August, will push capacity to around 15,000 TPS and allow native on‑chain AI agent invocation, elevating Conflux into a new category of intelligent blockchains.

It also adds improved compatibility with the Ethereum Virtual Machine, making it easier for DeFi apps to migrate and interoperate seamlessly.

These enhancements support real‑world asset tokenization and cross‑border trade. As the only public Layer‑1 blockchain officially permitted to operate in China, Conflux can tap into a vast, often inaccessible market.

A recent announcement on the Shanghai government’s website announced a collaboration with AnchorX and Shenzhen-listed Eastcompeace Technology to issue an offshore yuan stablecoin. Named AxCNH, this stablecoin is intended to streamline cross‑border payments and asset transactions among Belt and Road Initiative countries.

Some market observers also seem to suggest that the upcoming Conflux 3.0 upgrade and stablecoin initiative align with China’s growing interest in expanding its financial infrastructure across BRI partners.

Analysts believe that with these performance boosts and strategic moves, Conflux could extend its momentum, possibly reaching $0.30 in the short term and even higher later on.

$CFX/USDT Shows Parabolic Breakout With Healthy Consolidation and Strong Derivatives Backdrop

$CFX/USDT recently pulled off a big move, climbing from around $0.097 to nearly $0.249 before settling into a sideways pattern.

The price chart shows a strong rally that’s now cooling off just under its recent high, a common pause that usually leads to either a breakout continuation or a short-term dip.

Looking at the Fibonacci retracement from that move, some key areas where price might react can be spotted.

The 23.6% level sits near $0.213, the 38.2% level is around $0.191, and the 50% mark is close to $0.173. So far, CFX has stayed above $0.218, which means that sellers haven’t really shaken up the broader bullish structure yet.

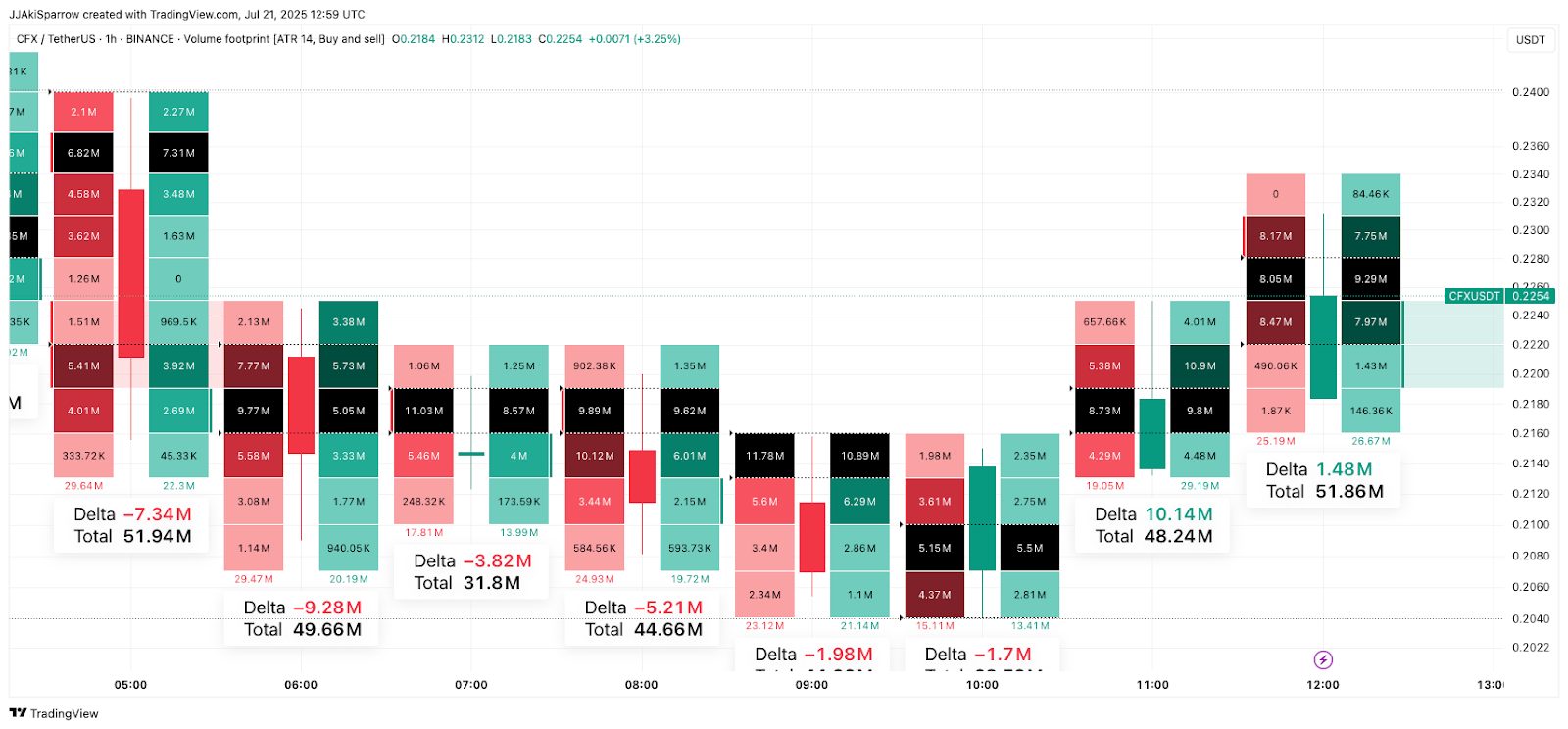

There’s also some interesting data coming from volume footprints.

Earlier trading sessions showed heavy sell pressure, with one hour recording a negative delta of about—9.28 million out of a total volume of 49.66 million. That’s a clear sign that while many were selling, there was strong demand soaking it all up.

Later on, the tone shifted, with positive deltas like +10.14 million in 48.24 million total volume, showing buyers stepping in during the dips.

It all points to a market where demand is still in control, even as some traders lock in profits.

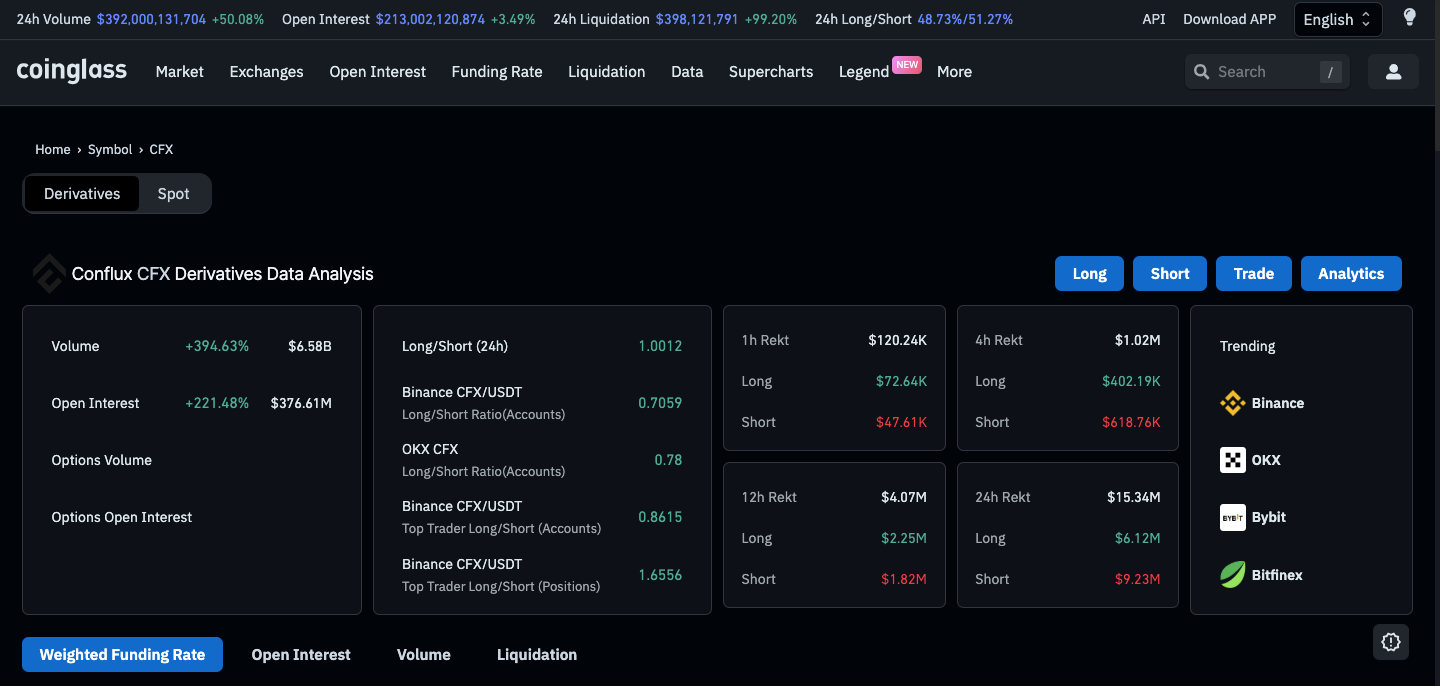

Derivatives data backs that up. Trading volume has spiked almost 395% to $6.58 billion, and open interest has surged over 221% to $376.61 million.

Long/short ratios are leaning heavily toward longs. Binance retail accounts show a ratio of 0.86, while top traders are sitting at 1.65. That’s a strong indicator that big players are positioning for more upside.

Short liquidations over the 4-hour and 24-hour timeframes can be seen, which means a lot of bearish bets are getting squeezed out.

Technically, the breakout is still intact. That said, markets don’t go up in a straight line. What bulls are watching now is whether CFX can hold a close above the $0.231 to $0.240 zone. If it does, that could spark the next leg higher.

On the flip side, if price dips into the $0.213 to $0.191 area, it could give buyers a new entry point.

All things considered, the current setup shows strength. The market is catching its breath after a big run, but all signs, from price action to order flow and positioning, suggest that bulls are still in control.

The post Conflux ($CFX) Surges 49.35% in 24 Hours, Can the Momentum Push Price to $0.30? appeared first on Cryptonews.

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.

: Exploring Conflux Network’s Tree-Graph 3.0 upgrade: This enhancement aims to boost tx speeds to 15K TPS while maintaining security through hybrid consensus. For developers and users, it signals smoother scalability for

: Exploring Conflux Network’s Tree-Graph 3.0 upgrade: This enhancement aims to boost tx speeds to 15K TPS while maintaining security through hybrid consensus. For developers and users, it signals smoother scalability for  Lucas Trader

Lucas Trader  (@lucastrader77)

(@lucastrader77)