Ethereum is showing a strong chart structure as some market analysts suggest a possible price move to $7,000 by mid-2026.

Meanwhile, the asset is holding key levels after a recent pullback, with trading activity reflecting a phase of consolidation. Analysts point to long-term patterns and investor behavior as reasons for this forecast.

Weekly Chart Forms Bullish Pattern

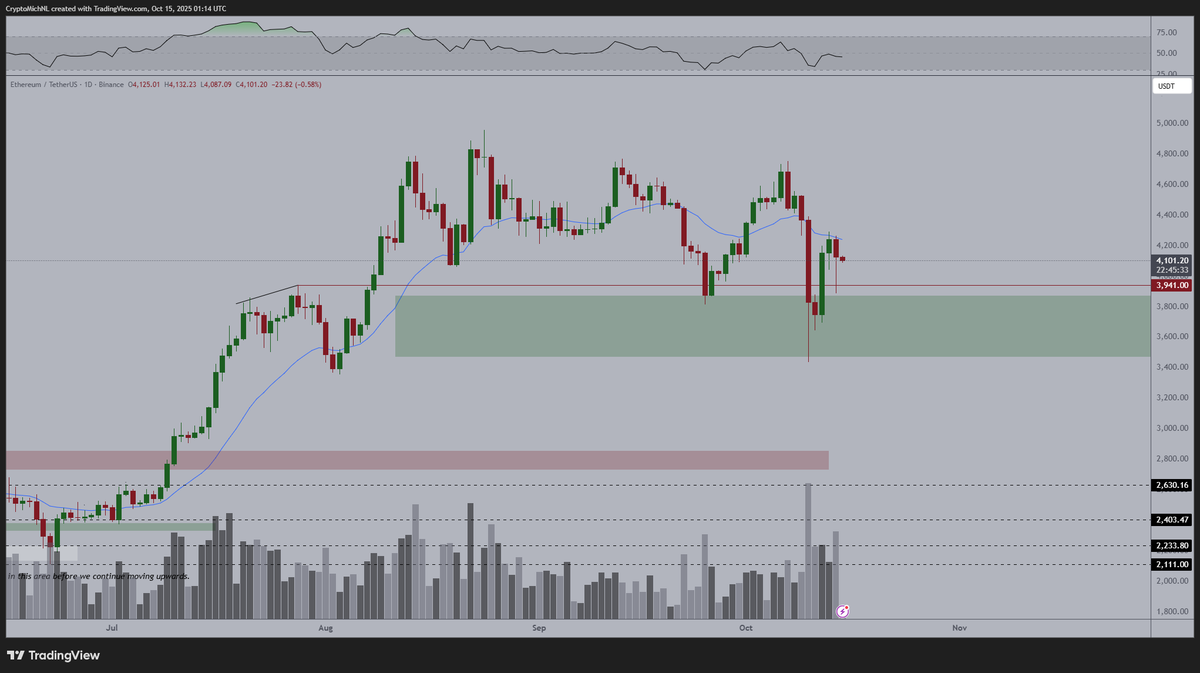

A technical chart shared by analyst Mike Investing shows Ethereum trading inside a flag formation on the weekly timeframe. The setup follows a steady rise in price from late 2024 into early 2025. After reaching above $4,400, ETH corrected slightly and is now trading near $4,100.

$ETH is positioning within an aggressive bullish flag and is about to see a euphoric squeeze.

With $ETH bottomed out and completing its last hard pullback below $4k this year this opportunity is generational.

Bears are in major trouble now.

$7,000 by May 2026.

Mark my words… pic.twitter.com/EDBIFtdY2R

— Mike Investing (@MrMikeInvesting) October 14, 2025

According to the chart, this pullback remains within a bullish structure. The 200-week moving average, currently near $2,447, continues to act as a support line. ETH has stayed above this level, keeping its long-term trend in place. The analyst projects a move to $7,000 by May 2026. He added that any drop below the $3,500–$3,600 zone would put the current setup at risk.

Moreover, analyst Michaël van de Poppe has pointed to a higher low formation in the recent price action. In a post on X, he stated:

“Higher low is created here on $ETH. I think that we’ll see a strong breakout in the coming 1–2 weeks and a new ATH.”

His chart shows ETH rebounding from the $3,600–$3,900 zone, a range that has held as support during past tests. At the time of the latest update, ETH was trading near $4,100 after pulling back from $4,600. Trading volume has started to rise again, which may signal new demand.

The 21-day EMA is now flattening. If the asset closes above it, it could lead to a retest of the recent high. RSI levels remain in the middle range, allowing room for further movement in either direction. The current pattern supports the idea of steady accumulation, as long as the price remains above support.

Exchange Balances Reach Multi-Month Lows

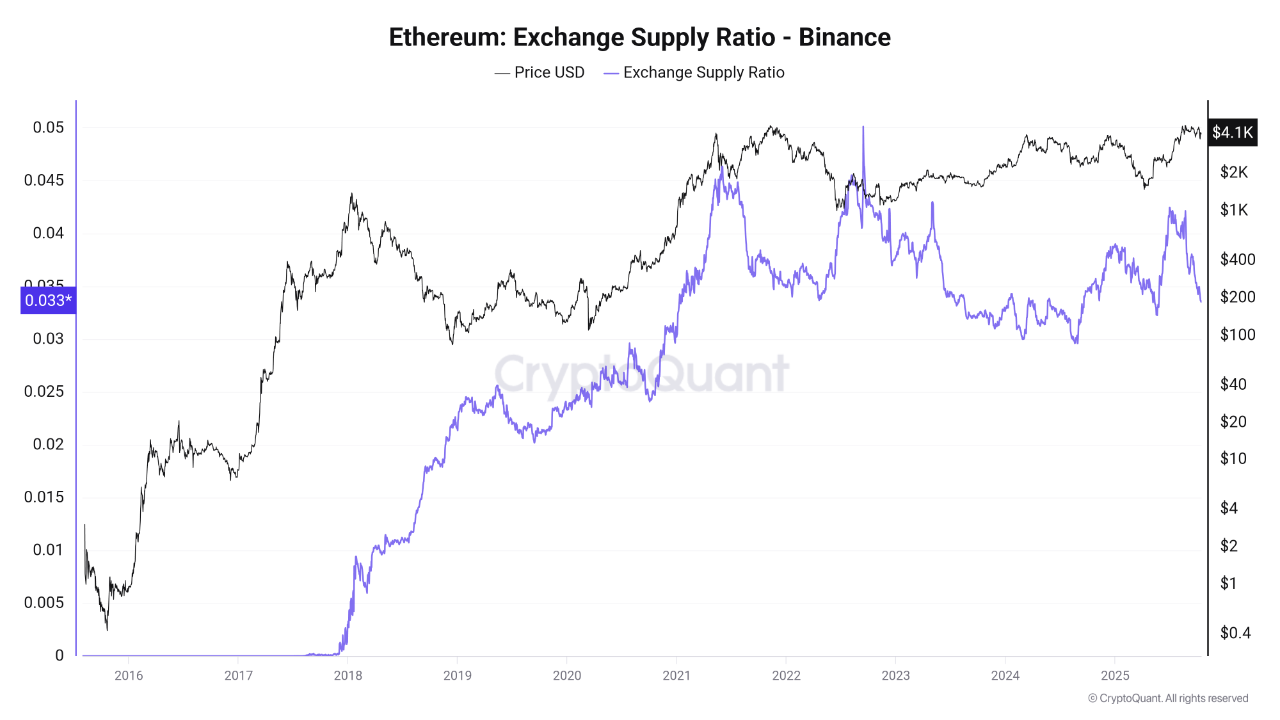

According to data from CryptoQuant analyst Arab Chain, the Ethereum supply on Binance has reached a multi-month low. The supply ratio is now around 0.33. This suggests that more ETH is being moved off exchanges and into self-custody wallets.

Such moves often indicate lower short-term selling activity. In earlier market cycles, similar trends were followed by price increases. Investors appear to be taking a longer-term view, removing coins from exchanges and reducing available supply in the open market.

Whale Activity Rises as Retail Steps Back

Retail is fading $ETH.

Whales are loading up.

I’m following the smart money! pic.twitter.com/iiLb55BXj8

— CryptoGoos (@crypto_goos) October 15, 2025

The post reflects a growing difference in behavior between smaller investors and larger holders. This is backed by recent data. There has been a decrease in retail trading volume, while accumulation of ETH by large wallet holders has been going on simultaneously.

Along with this, the institutional interest in self-storage and staking has continued to increase. The centralized platforms are holding fewer coins, which is contributing to decreasing market liquidity and indicating long-term holding strategies.

The post $7K Ethereum by 2026? Analyst Explains the Bullish Case appeared first on CryptoPotato.

Ethereum holds key support as analysts eye $7K by 2026. Charts show bullish setups, low exchange supply, and rising whale accumulation. Crypto Bits, Crypto News, Ethereum (ETH) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.