Bitcoin’s recent shake-off has purged excessive leverage and pushed the price into a major accumulation zone around $100K–$102K.

Although momentum remains weak in the short term, on-chain and order flow data suggest that smart money could be re-entering, capitalizing on retail fear and forced liquidations.

Technical Analysis

By Shayan

The Daily Chart

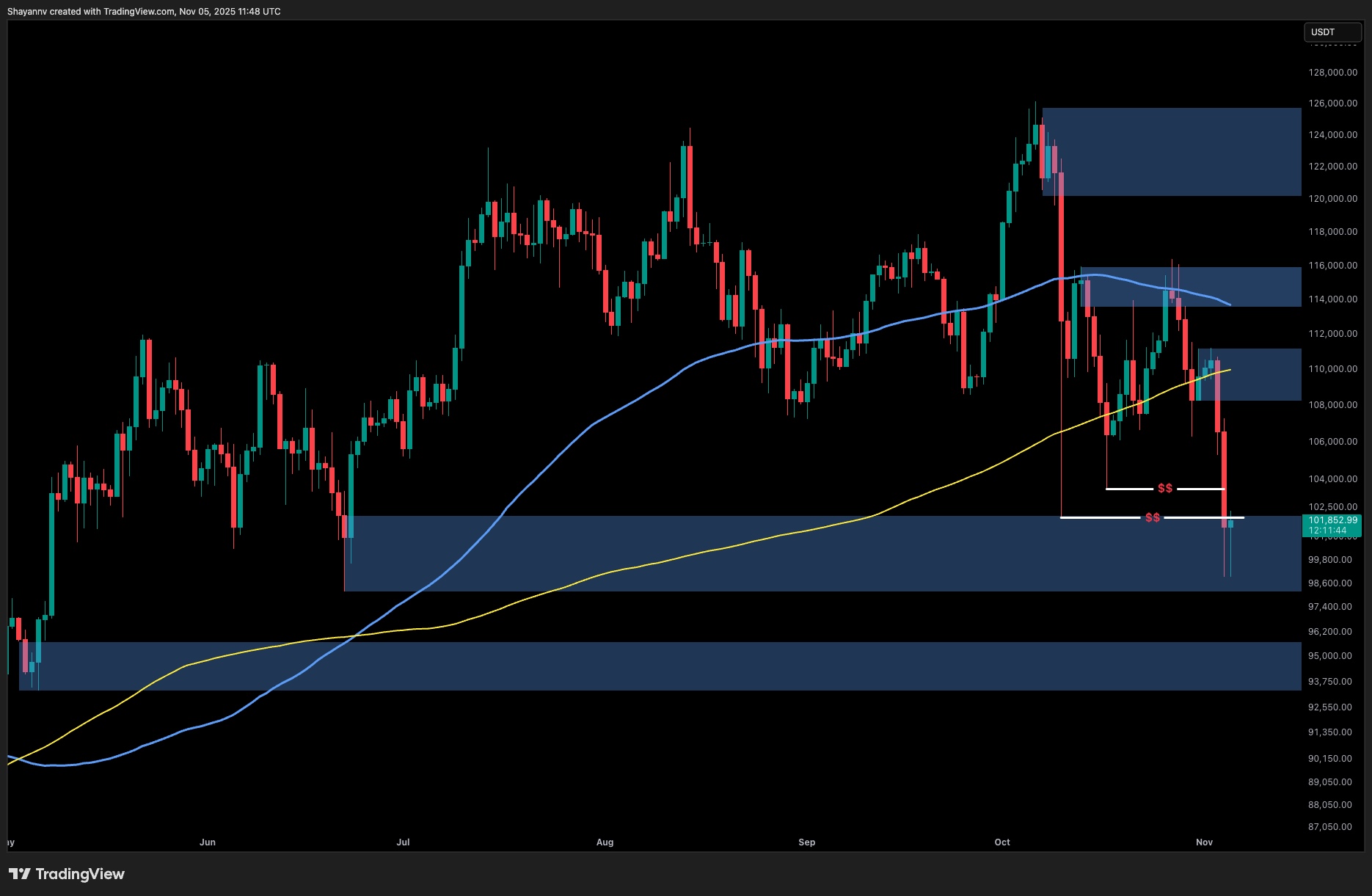

On the daily timeframe, BTC has dropped below both the 100-day and 200-day MAs, confirming a short-term breakdown from its previous equilibrium range. The rejection from the $114K resistance zone and the subsequent cascade toward $101K mark the most aggressive correction since August.

Currently, the asset is sitting atop the $100K–$102K institutional demand block, a zone that historically acts as a major pivot point. This level also aligns with previous higher-timeframe liquidity resting beneath the range lows, an area where smart money often absorbs retail capitulation orders.

If BTC forms a consolidation base here and reclaims the $106K–$108K structure, it could confirm that the recent drop was a liquidity sweep, paving the way for a rebound toward $114K–$116K. Conversely, failure to hold above $100K would expose the $93K–$95K macro demand zone, which remains the next key support for potential accumulation.

The 4-Hour Chart

The 4-hour chart reveals the mechanics of the recent breakdown. After forming an ascending structure throughout late October, Bitcoin rejected from the upper trendline near $116K and broke beneath the rising wedge support, triggering a fast liquidation cascade.

The selloff accelerated after violating the $108K–$109K short-term demand zone, flushing leveraged long positions and trapping late buyers.

Currently, the market is stabilizing just above the $100K demand area, where signs of absorption are emerging. If price can establish a higher low on this timeframe, it may suggest that the correction has reached its exhaustion point and that large players are quietly accumulating amid the panic.

However, a clean retest of $106K as resistance would need to be reclaimed before confirming a sustainable recovery.

On-Chain Analysis

By Shayan

The Bitcoin Spot Average Order Size metric provides valuable insight into current market behavior. Following the major sell-off earlier in 2025, the chart displays a distinct sequence: a surge in whale-sized orders, followed by an expansion in smaller retail orders (red clusters), a pattern that typically reflects retail capitulation. This shift often marks the point where institutional and high-net-worth participants begin accumulating positions, capitalizing on emotional selling to enter the market at discounted prices.

Historically, phases characterized by retail capitulation followed by increasing whale order activity have preceded the final impulsive rally of a broader bullish cycle. The same structure is now re-emerging. Following the recent market plunge, large-order activity (green clusters) has begun to reappear near the $100K region, signaling renewed engagement from deep-pocketed participants.

While confirmation is still required, this behavior aligns with what could be the “final shakeout” phase before a new wave of institutional accumulation sets the stage for the next bullish expansion.

The post Bitcoin Price Analysis: What’s Next for BTC After Slipping Below $100K? appeared first on CryptoPotato.

Bitcoin’s recent shake-off has purged excessive leverage and pushed the price into a major accumulation zone around $100K–$102K. Although momentum remains weak in the short term, on-chain and order flow data suggest that smart money could be re-entering, capitalizing on retail fear and forced liquidations. Technical Analysis By Shayan The Daily Chart On the daily BTC Analysis, BTCEUR, BTCGBP, BTCUSD, BTCUSDT, Crypto News, Bitcoin (BTC) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.