Bitcoin’s price dropped by close to $6,000 a few hours ago, decreasing from over $91,000 to almost $85,000 on Binance.

The sharp decline happened in less than a few hours, leaving over $650 million worth of liquidated positions – a stark 390% increase as opposed to the previous 24 hours.

As CryptoPotato reported yesterday, the market was attempting a slow recovery, and Bitcoin had somewhat settled around $91,000. Unfortunately, the bears had something completely different in mind.

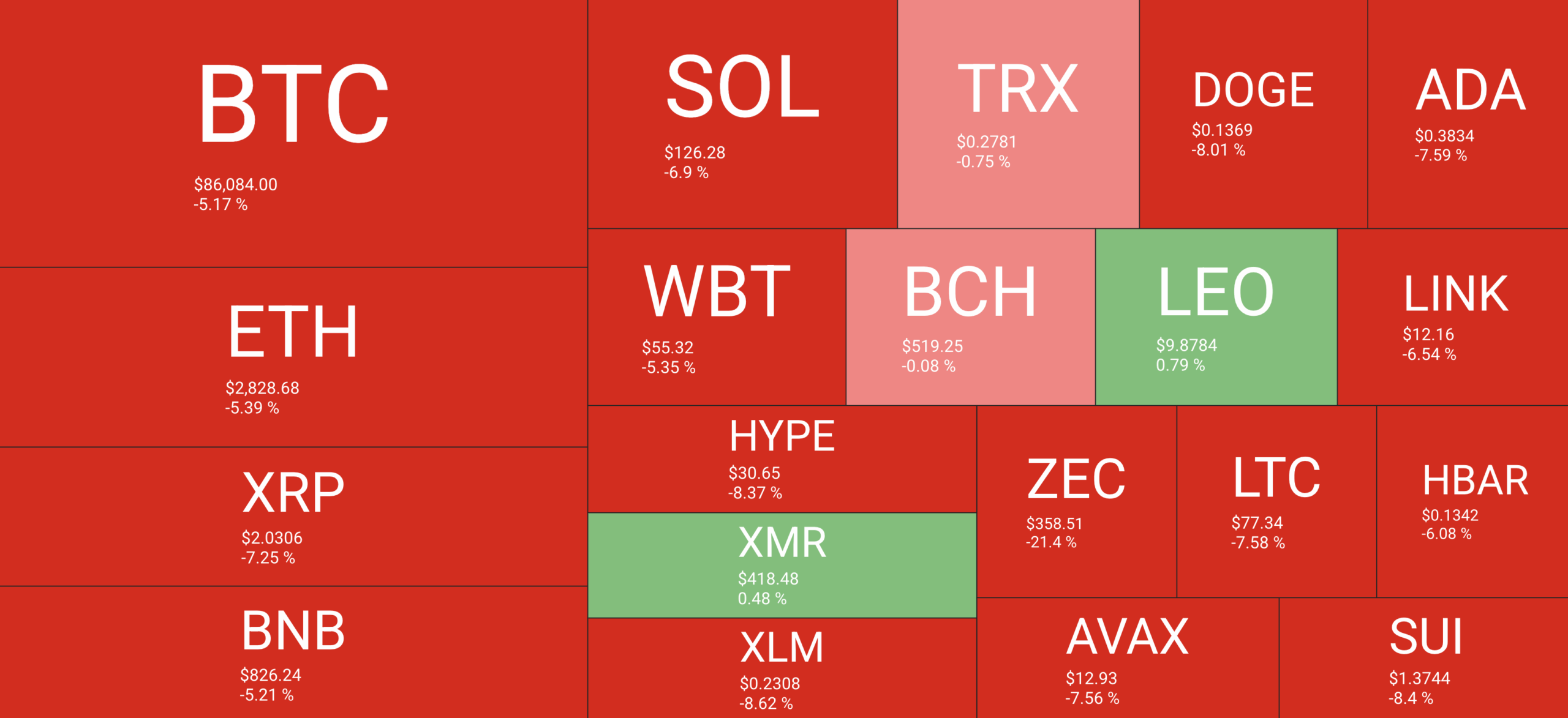

As you can see from the heatmap above, altcoins are also bleeding out. In fact, their losses are, as per usual, larger than BTC’s.

XRP is down by 7.3%, SOL by 7%, HYPE by 8.2%, XLM by 8.7%, and so forth. Even ZEC seems to have lost its resilience and has crashed by a whopping 21.6% over the past 24 hours.

All in all, the total cryptocurrency market capitalization is down to $3 trillion, according to CoinGecko. There is a slight discrepancy in the data and CoinMarketCap shows that it’s already below that mark.

The post Bitcoin Tumbles Toward $85K, Crypto Markets Shed Close to $200 Billion appeared first on CryptoPotato.

Bitcoin’s price lost almost $6K in a couple of hours as broader crypto markets sell off. Crypto News, Top News, Bitcoin (BTC) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.