The publicly traded company on the NASDAQ, also featured on the S&P 500, has unveiled a novel product offering exposure to already established stocks and ETFs.

Featuring the Magnificent 7, BlackRock funds, and its own stock, this is an addition to the platform’s already rich derivatives portfolio.

TradFi And DeFi Convergence

Coinbase, one of the top 3 spot exchanges by trading volume, has announced its upcoming stock and crypto equity index, The Mag7 and Crypto Equity Index Futures, set to launch on Monday, the 22nd of this month. This financial product will be the first of its kind to offer a hybrid mix of stock exposure and crypto exchange-traded funds (ETFs).

While several industry peers, such as Kraken, Robinhood, Bitget, and others, offer equities in the form of xStocks, no other company has yet started to provide this dual approach. Coinbase Derivatives, which already offers a diverse range of instruments for investors, including energy and metals, is set to introduce the index in just over 2 weeks.

The CEO of the exchange, Brian Armstrong, celebrated the news on X, naming their trading platform “the everything exchange.”

We’re launching the first US futures that give exposure to the top US tech stocks and crypto at the same time.

We’ll launch more products like this as part of the everything exchange.

Coming on September 22. pic.twitter.com/iTLSt7a8kx

— Brian Armstrong (@brian_armstrong) September 2, 2025

Traders will have the benefit of experiencing the Magnificent Seven stocks without having to purchase them directly, along with two of BlackRock’s established ETFs for Bitcoin and Ethereum, all in a single futures product.

Moreover, the combination of assets on the upcoming index, along with the already hefty list of instruments, will expand access and efficiency to investors, opening the doors for new trading strategies.

Index Features

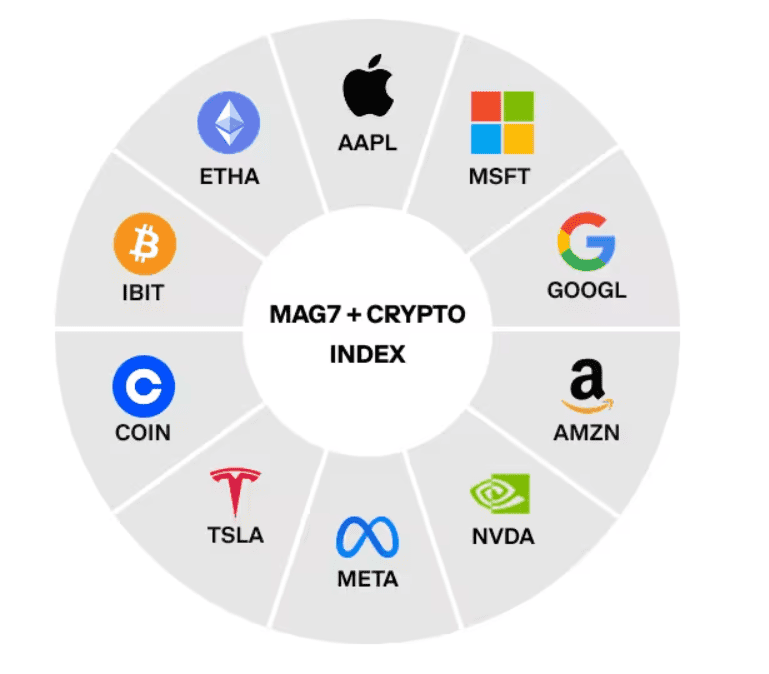

The well-known Mag 7, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), NVIDIA (NVDA), Meta (META), and Tesla (TSLA) will fill the stock portion.

Additionally, the ETFs from the goliath BlackRock will be the iShares Bitcoin Trust ETF (IBIT) and the iShares Ethereum Trust ETF (ETHA). Lastly, the exchange’s stock (COIN) will also be available for purchase.

COIN, with data taken at the time of writing, is currently trading around $303, with a slight 0.32% drop for the past 24 hours, according to Google Finance, but is still up over 22% year-to-date (YTD).

The index will also boast an even-weighting methodology, with each of the 10 available products representing a 10% slice of it. As prices change, the balance can fall below 10%, but there will be quarterly rebalances, which will reset the weightings. The market research firm, MarketVector, will be the official provider for the index.

The Mag7 and Crypto Equity Index Futures will be monthly contracts that are settled in cash, with each contract representing $1x the index, according to information provided by Coinbase so far.

The post Equity Index Coming to Coinbase, Will Feature Mag 7 and Crypto ETFs appeared first on CryptoPotato.

One of the largest crypto exchanges is stepping into the equity market and will include the Magnificent 7 stocks and 2 Blackrock funds in the roster. AA News, Crypto News, Coinbase, Crypto ETF, Stocks

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.