Ethereum’s most recent price action reflects a temporary slowdown in momentum. After the aggressive decline toward the lower demand region, the market has entered a fluctuation phase, with minor bullish retracements attempting to stabilize the structure. The price is currently compressing within key technical boundaries, suggesting that a decisive move is approaching.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH is moving in a consolidation phase following its sharp drop into the $1,800–$1,850 demand zone. The recent candles show minor bullish retracements, but these moves lack strong impulsive characteristics and appear corrective in nature.

Technically, the asset is confined between the $1.8K static support and the descending channel’s middle boundary, which is acting as dynamic resistance around the $2,500–$2,600 region. As long as Ethereum remains trapped between these two levels, the market structure reflects a fluctuation state rather than a confirmed trend reversal.

A valid breakout above the channel’s midline resistance would be required to shift short-term momentum in favor of buyers. Conversely, a breakdown below the $1,800 support would expose lower demand zones and likely reintroduce strong selling pressure.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the price action reveals the formation of a tightening triangle pattern after the rebound from the $1,800 low. The structure shows converging trendlines, reflecting decreasing volatility and a balance between buyers and sellers.

Ethereum is now trading near the apex of this narrow range, indicating that a breakout is imminent. A bullish breakout above the upper boundary of the triangle could trigger a push toward the $2,300–$2,400 region as the next short-term resistance. On the other hand, a bearish breakdown below the ascending support of the triangle would likely lead to a renewed test of the $1,800 demand zone.

Overall, the market is in compression mode on the lower timeframe, and the next impulsive move will likely determine the short-term direction.

Sentiment Analysis

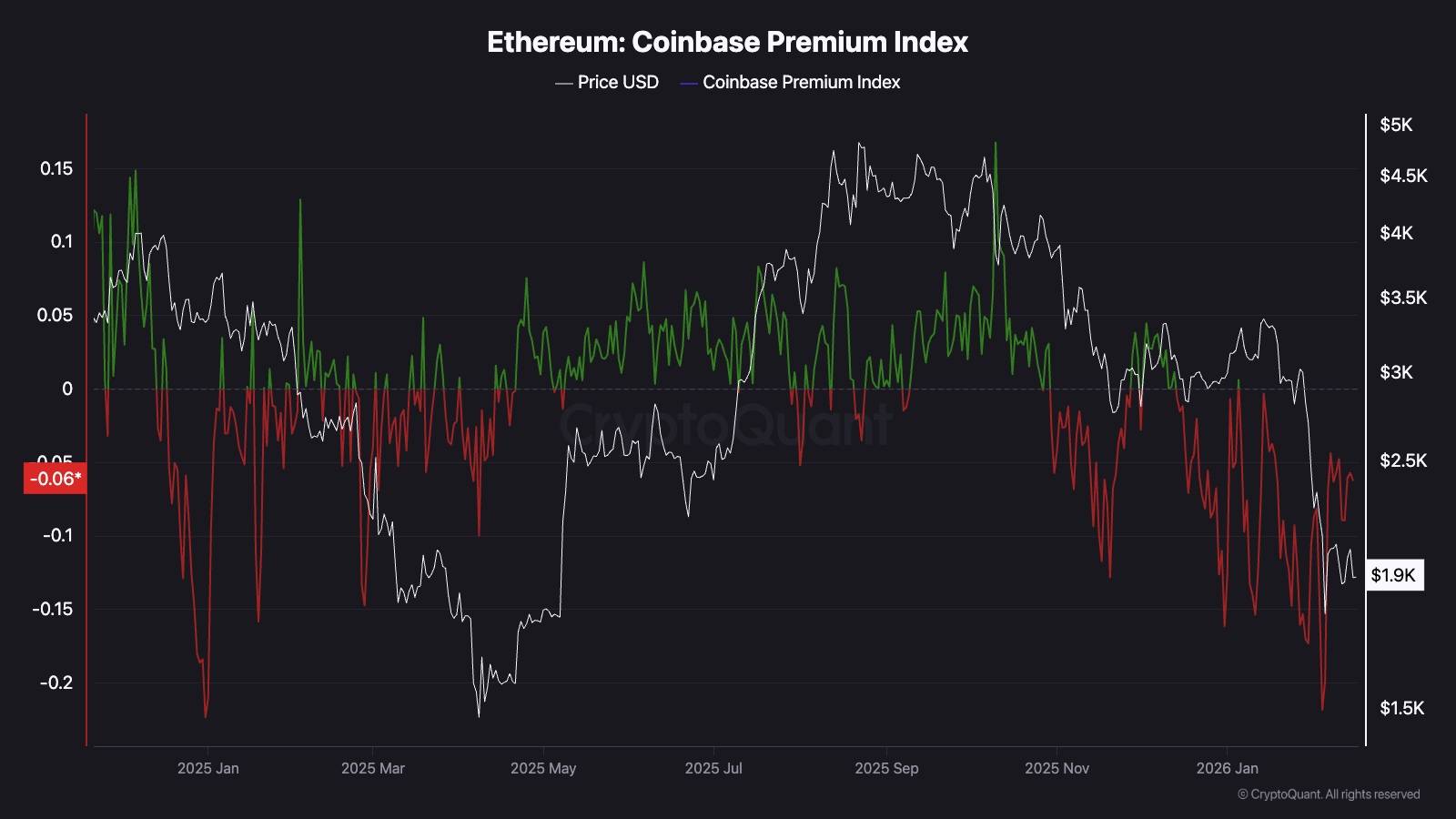

From an on-chain perspective, the Coinbase Premium Index has remained predominantly negative, indicating relatively weak demand from US-based investors and a lack of aggressive spot buying on Coinbase compared to other exchanges. This persistent negative reading aligns with the broader corrective structure observed on the charts.

However, the index has recently experienced a noticeable upward surge. Although it is still below the neutral threshold, the intensity of the rebound suggests that selling pressure from US participants may be easing. If this upward momentum continues and the index crosses into positive territory, turning green, it would signal renewed spot demand from US investors.

Such a shift could act as a catalyst for a bullish rebound, particularly if it coincides with a technical breakout from the current triangle formation. In that scenario, both technical structure and on-chain demand would align in favor of a stronger recovery phase.

The post Ethereum Price Prediction: Is Breakout Imminent as ETH Compresses in Key Technical Pattern? appeared first on CryptoPotato.

Ethereum’s most recent price action reflects a temporary slowdown in momentum. After the aggressive decline toward the lower demand region, the market has entered a fluctuation phase, with minor bullish retracements attempting to stabilize the structure. The price is currently compressing within key technical boundaries, suggesting that a decisive move is approaching. Ethereum Price Analysis: Crypto News, ETH Analysis, Ethereum (ETH) Price

This articles is written by : Nermeen Nabil Khear Abdelmalak

All rights reserved to : USAGOLDMIES . www.usagoldmines.com

You can Enjoy surfing our website categories and read more content in many fields you may like .

Why USAGoldMines ?

USAGoldMines is a comprehensive website offering the latest in financial, crypto, and technical news. With specialized sections for each category, it provides readers with up-to-date market insights, investment trends, and technological advancements, making it a valuable resource for investors and enthusiasts in the fast-paced financial world.